Land Securities’ latest shopping centre bet is not an obvious bargain

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For investors in property companies, the first round of dealmaking after a downturn provides a reality check. All too often, greater liquidity exposes over-optimistic valuations. The acquisition of one of the UK’s biggest shopping centres announced on Tuesday by Land Securities, the FTSE 100 property company, provides some comfort. The £490mn price tag, the largest for this type of acquisition since 2017, is not obviously a bargain.

Indeed, the acquisition of a majority stake in the Liverpool One shopping centre required an unusual structure to meet Landsec’s 7.5 per cent yield requirement. Initially, it will pay just £455mn, with an extra £35mn deferred payment falling due in two years’ time. By then, Landsec expects rents to have risen by enough to meet the 7.5 per cent target.

Rarity value justifies the gymnastics. Landsec says it is one of fewer than 10 retail properties that meet its acquisition criteria. The company, which now owns seven of the top 30 shopping centres in the UK, wants retail sites that can benefit from retailers’ growing focus on fewer but bigger stores. The top 1 per cent of UK retail locations now capture the same spend as the bottom 90 per cent, according to data provider CACI.

Getting this far has been painful. Since 2017, Landsec’s retail values are down 60 per cent and rents are down 30 per cent. But at least retail property companies do not have to worry about more supply coming on stream. With values of existing sites being half their replacement costs, no new construction is likely soon. It is a different story for offices, where Landsec’s office portfolio has experienced a less steep value decline of 20 per cent.

Landsec reckons retailers’ shift towards bigger stores will not be derailed by the higher tax and wage costs recently imposed by the government. This will only accelerate the closure of marginal stores, it argues.

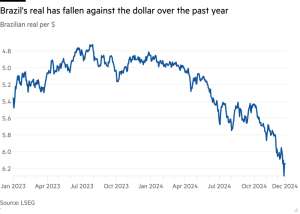

Nonetheless, the case for buying Landsec shares is affected by the macroeconomic gloom. The discount to net assets is a yawning 34 per cent and the shares offer a relatively high earnings yield of more than 7 per cent, says Peel Hunt’s Matthew Saperia. Despite Landsec recently hailing the bottoming out of high-quality asset valuations, investors have appeared unimpressed.

Boss Mark Allan grumbles that investors view the business as a five-year swap with a property company attached. The shares are down 16 per cent since mid-September, when gilt yields started climbing. Expect interest rate expectations to continue to colour shareholders’ attitudes. But so too will evidence from future deals over whether property values have indeed stabilised.

#Land #Securities #latest #shopping #centre #bet #obvious #bargain