Insurers offer pension schemes discounts to meet buyout targets

Stay informed with free updates

Simply sign up to the Pensions industry myFT Digest — delivered directly to your inbox.

Insurers are offering pension schemes discounts amounting to tens of millions of pounds to rush through buyout and buy-in deals as they struggle to meet year end targets.

Pensions buyout and buy-in deals — or bulk annuity transactions — where an insurer takes over the responsibility for meeting obligations to pensioners are complex deals which typically take six months or more to negotiate.

But advisers to some of the largest UK pension schemes told the Financial Times that some deals were closing much faster as insurers look to accelerate transactions into the current year.

“Some insurers are approaching year end having not written enough business, so are looking for deals to bring forward,” said John Baines, senior partner with Aon, the professional services firm.

Some schemes had been offered a discount of up to 5 per cent to bring forward a transaction, Baines said, which could “comfortably” shave tens of millions off the buyout premium for a scheme with billions of assets.

Stephen Purves, head of risk settlement with the consultancy XPS, said his firm had seen a handful of such offers made in recent months.

“In late October early November a couple of insurers asked if any clients would be prepared to accelerate a transaction, with some really competitive pricing offered,” said Purves. Discounts were in the range of 3-5 per cent, he added.

Lara Desay, head of Risk Transfer with consultants Hymans Robertsons, said the insurers involved in these approaches typically had targets to meet.

“Some want to write a number of deals by the end of the year or they are targeting a set volume of liabilities,” she said.

Competition in the bulk annuity market has stepped up with the entrance of two new players this year. Royal London, which entered this year, said its pricing strategy was commercially sensitive.

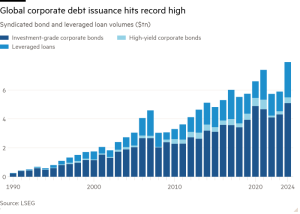

At least one more provider is expected to enter the market in 2025, with the value of bulk annuity deals in 2024 estimated to hit around £45bn-£60bn.

Three of the largest players, PIC, Rothesay and Aviva, said they did not do pricing incentives to meet sales targets but declined to formally comment.

A fourth, L&G, said it did not offer discounts for pension schemes to accelerate bulk annuity transactions.

It added: “Trustees, sponsoring companies and their advisers are always very clear with us on what their timing requirements are, and we work to accommodate them, as well as being transparent that prevailing market conditions at the time of quoting/transaction may impact price.”

Standard Life, which is owned by Phoenix Group, the UK’s largest retirement savings business, told the Financial Times: “We operate in a competitive market and occasionally opportunities do arise for trustees of pension schemes who choose to partner with us, or those who have efficient governance structures in place and can demonstrate flexibility regarding their transaction timescales.

“However, this is not a unique feature of the financial year end and is linked to factors such as asset origination opportunities which enable us to improve our pricing for a pension scheme for a short period.”

#Insurers #offer #pension #schemes #discounts #meet #buyout #targets