Stellantis is skidding into unknown territory

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When stuck in traffic, it is best to avoid erratic stop-start driving. That is a lesson Stellantis is learning the hard way.

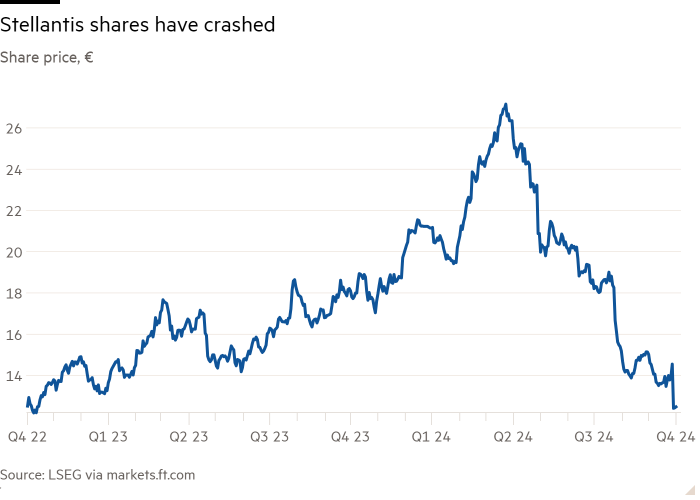

The European carmaker is suffering from the ills affecting the entire auto sector. Sluggish vehicle sales, competition from Chinese operators and the uncertain trajectory of the transition to electric vehicles have resulted in a slew of warnings, from the likes of Mercedes, BMW and Volkswagen. On top of that, Stellantis has managed to fall into a US pothole that is largely of its own making, which was behind this week’s massive profit warning.

Its problem is that, in the favourable post-Covid landscape — in which demand for vehicles outstripped supply — it pressed the accelerator much too hard. It raised prices and cut less profitable models, leading to record North American operating margins of more than 16 per cent in 2022, according to S&P Capital IQ, almost double General Motors’ in the same period.

That strategy crashed into a wall. Consumers cut its market share from 13 per cent to 8 per cent since Covid, according to Harald Hendrikse from Citigroup, resulting in a massive build-up in wholesaler inventories. Efforts to clear this, by cutting prices and lowering production, explain much of Stellantis’s profit warning. It will barely break even in North America, its biggest profit pool, in the second half of the year. Free cash flow, which was expected to be positive, will swing to a €5bn to €10bn loss.

That leaves Stellantis lacking any pitch to investors. Capital returns must now be under review. Worse still, it looks like the group’s sector-leading profitability — which briefly made it a market darling — was simply unsustainable. As many a consumer business has found, focusing on costs at the expense of sales is a recipe for fleeting success and lasting distress.

Stellantis’s road back will be long and winding. Rebuilding market share is a laborious process involving new models and brand investment. The alternative — cutting brands and capacity — is painful. Unsurprisingly, rumours about a merger with France’s Renault (which Stellantis denied in February) have resurfaced in the Italian press.

Investors may also be concerned about the size of the problem that the company managed to accumulate before it slammed on the brakes. Trust in the group’s highly regarded boss, Carlos Tavares, has been hit. With his contract expiring in 2026, Stellantis has begun its search for his successor.

With Stellantis, on about three times forward earnings, trading roughly in line with European rivals such as VW and Renault, it is not clear why anyone would climb aboard its recovery trip now.

#Stellantis #skidding #unknown #territory