Private credit’s latest contraption

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning, this is Sujeet Indap filling in for Rob today. Did you hear that there is a US jobs report coming today? Anyway, while you wait on pins and needles, read on for the latest in private credit financial engineering. Email me with your dream (or nightmare) lending product: [email protected].

There goes the neighbourhood

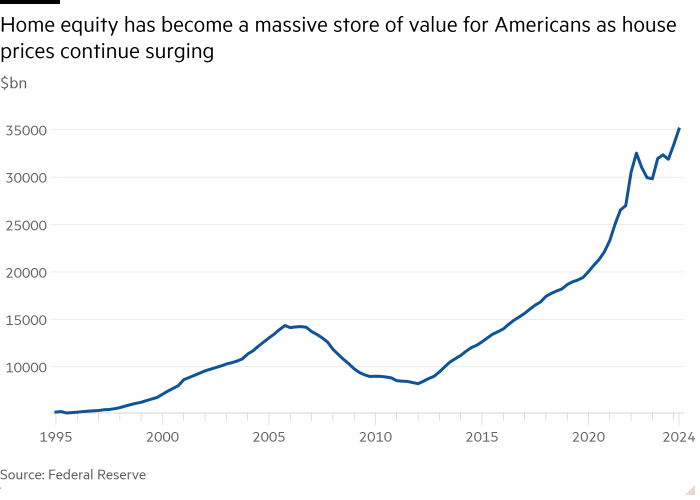

There is $35tn trapped in US residential home equity. And it deserves a far more sophisticated capital market, says Thomas Sponholtz.

A few weeks ago, I got a press release from the venerable Carlyle Group announcing the latest cutting-edge contraption in the private credit frenzy. But this particular deal being announced stood out to me. Carlyle said it was partnering with specialised finance upstart Unison, whose founder and chief executive, Sponholtz, is a former Barclays Global Investors executive.

Sponholtz had long believed there was room for innovation in home lending, specifically in how Americans could monetise home equity. Home equity loans, home equity lines of credit and reverse mortgages were all debt products that, one way or another, had to be paid back with interest by homeowners.

But what if homeowners get liquidity by avoiding a fixed obligation and instead monetise the upside of their property? And so Sponholtz’s company, Unison, created what it called an “equity sharing agreement” where the homeowner effectively sells stock in their house in exchange for upfront cash.

But the equity-sharing agreement was just the beginning. Carlyle and Unison have now conjured their next frontier idea: homeowners also deserve a convertible bond.

House rules

So far the original equity product has about 17,000 customers and its total portfolio of homes is worth $7bn in aggregate.

Not surprisingly, Unison’s immediate cash does not come cheap. The company will buy as much as a 15 per cent interest in homes, spending between $30,000 and $500,000 per home. The homeowner will pay for an appraisal and Unison will invest at a 5 per cent discount to that appraised value. There is also a 3.9 per cent transaction fee.

And finally at the time of sale, which must happen by year 30, Unison is owed four times the proportion it put in. To put some numbers on it, imagine a deal where the firm buys 10 per cent of a house worth $1mn.

In a decade, let’s say the house is worth $1.5mn. Unison gets its $100,000 back as well as 40 per cent of the gain, or $200,000. The house jumping 50 per cent in value over 10 years reflects an annualised rate of return of 4.1 per cent. Unison’s $100,000 investment turning into $300,000 reflects a return of 11.6 per cent

(Importantly, the equity gains for the homeowner from paying down their initial mortgage are kept by the homeowner and their own equity returns are, of course, determined by the size of their initial down payment at time of purchase).

Unison says its returns have been 21 per cent annualised.

Sponholtz told the Financial Times he had grappled for years with trying to figure out how to take on equity exposure to residential owner-occupied housing but that there was no straightforward security or proxy. Housing was important not just because its gross market size, but also because it was a “dirty hedge” against inflation, the main risk in fixed-income investing, he said.

“Home prices go up with inflation . . . you have a really interesting investment that neutralises the negative convexity,” Sponholtz said, referring to mortgage prepayments that surge when interest rates fall and fall when rates rise.

Enter private credit and Carlyle. Unison had some success bundling its equity-sharing agreements into structured products — it recently got a credit rating on the tranches created. But the pure equity product by definition comes with erratic cash flows that made it tricky to securitise.

And so Unison wondered if it could merge housing debt and housing equity into a single product. It has, as a result, created the “equity-sharing loan” that resembles a corporate convertible bond with its fixed obligation attached to a call option.

This is how it works: a homeowner takes out a second mortgage in order to get immediate cash — but the interest rate charged on the second mortgage is lower than the market price. In exchange, Unison gets 1.5 times its proportion in the future appreciation of the house (note that this is less than the four times it is owed in the straight equity product described above).

In an example on its website, Unison said it would shave off almost 2 percentage points from a straight loan interest rate (charging 5.2 per cent annually instead of 7 per cent) in the cash “coupon” it is owed. At the end of the 10-year loan, Unison would, however, get its 1.5x appreciation share as well as the capitalised sum total of the 1.8 per cent initial cash interest rate savings (that’s the 7 per cent minus 5.2 per cent).

Carlyle estimates the all-in cost of capital of the equity sharing loan of 10 per cent to 11 per cent: 6 per cent cash interest, 2 per cent of the cash deferred “payment-in-kind” interest and 2 to 3 percentage points of kicker from the equity sharing slice.

Unison said its typical customer has a Fico score over 700 and that typical use of proceeds are home improvements or paying down credit card debt. The company says its equity-sharing product is far cheaper than getting an unsecured loan from the likes of SoFi.

Carlyle has agreed to purchase up to $300mn in such loans from Unison, which it can then place with its insurance clients.

“We are taking high-quality assets and making them attractive, bringing private markets to bear to finance the real economy,” said Akhil Bansal, head of credit strategic solutions at Carlyle.

Sponholtz says Unison has several more products in the works, including providing financing to help with initial down payments (reminiscent of this recent Wall Street Journal story about friends buying houses together during the pandemic).

Consumer finance is a tricky balance between innovation and exploitation. Lending people money, extracting user fees and using leverage to turbocharge it all is extremely lucrative (just Google “subprime billionaires” to see for yourself).

Residential housing is equally fraught given its centrality in the lives of individuals and families. Just last month, Invitation Homes, the single- family home roll-up created by Blackstone, entered into a $48mn proposed settlement with the US Federal Trade Commission over charging renters hidden junk fees.

A more advanced financing is supposed to grease the gears of capital formation and ultimately housing construction. Unison and Carlyle believe their mousetrap will do so, and America needs them to be right.

One good read

My colleague Andrew Jack examines New York City’s most serious current scourge: rats.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

#Private #credits #latest #contraption