Jumbo loans show risk returning to UK mortgage market

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Loosening credit conditions aren’t just about rate cuts. Nationwide, the UK’s biggest building society, is offering newbie homeowners loans up to six times their salary on a 95 per cent loan-to-value ratio. At the top end, that enables a couple on a joint £50,000 income to borrow £300,000, versus £225,000 on a standard mortgage. It comes barely a month after peers Lloyds and Halifax went up to 5.5 times income for first-time buyers.

Already, borrowers are — tentatively — less cautious. Net mortgage borrowing came in at £2.9bn in August, up from £2.8bn in July, said the Bank of England, with an extra couple of thousand new approvals taking the tally up to 64,900. Risk is on the rise but this isn’t quite history repeating.

True, the Bank of England two years ago dismantled an affordability guardrail erected after the financial crisis. But the more consequential brakes remain in place: lenders cannot have more than 15 per cent of their residential loan book applied to loans with an LTI of 4.5 times or more.

The view from the porch is, near-term, rather rosier too. Employment levels look steady and house prices are nudging higher, mitigating the prospects of returned keys.

As befits a big mutual lender, Nationwide is careful which borrowers are able to avail themselves of the new loans. Affordability is scrutinised, taking account of student debt, personal liabilities and the like. The self-employed need not apply.

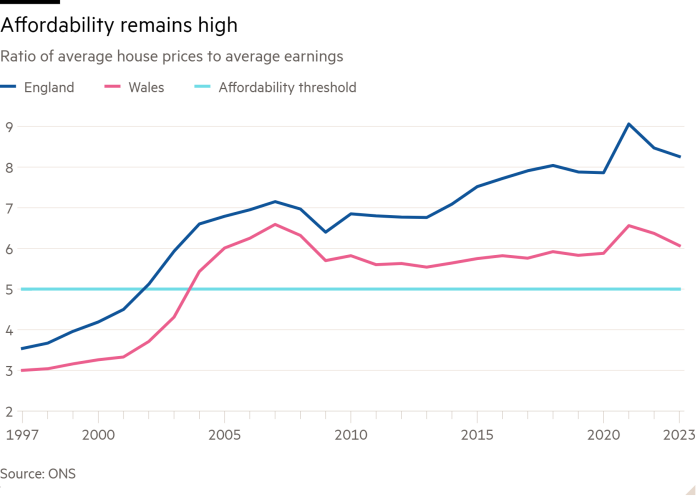

But first-time buyers, who may have been in school when the financial crisis unspooled, could still get into a pickle — with broader market ramifications. Affordability remains stretched at 8.3 times income last year in England, on government figures, albeit down from the 9 times peak in Covid-ravaged 2021.

Low interest rates this time around is more likely to mean around 3-3.5 per cent — below the 4 per cent level that typically acts as a psychological trigger for buyers — than the era of recent memory.

They may well be paying back their loans over a longer period than the traditional 25 years: in the last quarter of 2023, almost half of all new home loans were for 30 years or more.

That reduces monthly payments but means 40 per cent of these new mortgage borrowers will still be in hock past the current state pension age.

Lenders, at least the big players, rely on their own tighter guardrails. But the new mortgages should still prompt wariness. Escalating competition means at least some of their peers may be tempted to exercise a little less restraint.

#Jumbo #loans #show #risk #returning #mortgage #market