Why a ‘rural lifestyle’ group rules the retail roost

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tractor Supply bills itself as a “rural lifestyle retailer”. The Tennessee-based company became a stock market darling during the pandemic as more Americans moved away from cities and took up hobby farming. Post-Covid, even as other pandemic trends like Pelotons lost their appeal, the homesteading lifestyle has stuck. It turns out millennials really like growing their own chickens, vegetables, and fruits.

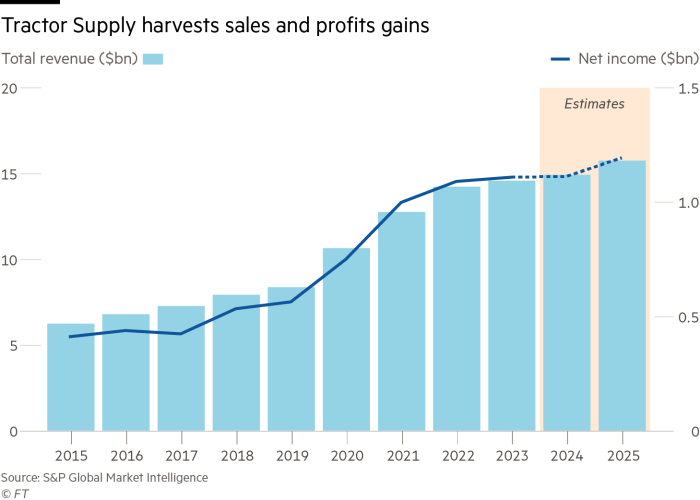

All this has been a boon for Tractor Supply. The company, which sells everything from chicken coops to cattle gates and tractor parts, pulled in a record $14.5bn in revenue across its 2,216 stores last year. That compares with the $8.3bn it took in 2019 and works out to a 15 per cent compound annual growth rate for the period.

Wall Street has noticed. Tractor Supply’s share price has nearly tripled since March 2020 to give the company a market valuation of over $30bn. That is despite the controversy over the company’s decision to end its diversity, equity, and inclusion (DEI) initiatives and climate goals following pressure from conservative activists.

Climbing to the top of the retail pecking order is one thing. Staying there is tough. Tractor Supply’s revenue is expected to grow just 2.4 per cent this year. Tough comparatives are to blame. The numbers also do not look too shabby considering big box retailers like Target and Lowes are expected to report flat or lower sales this year.

Still, with Tractor Supply shares trading at nearly 27 times forward earnings, compared with its three-year average of around 22 times, the stock will struggle to keep rising from here in the near term.

For investors who take the long view, Tractor Supply remains a decent bet. Unlike large commercial farms, which have been hit by falling crop prices, the company’s core customers — hobby farmers, small ranchers, suburban and rural homeowners — are little affected by ups and downs of the agricultural commodities supercycle.

The company’s specialised focus — providing small-scale farmer everything they need to raise their chickens or heirloom tomatoes — gives it a formidable economic moat. You can’t buy 40lbs bales of chopped hay or live chicks and ducklings on Amazon or Temu. An emphasis on selling its own private label brands offers another advantage. Its ebitda margin of about 13 per cent is more than twice that of Walmart’s.

There is room for further improvement. Tractor Supply should make more of its one-stop shop business model and expand more aggressively into adjacent product categories like gardening and plants. It can and should take market share from the likes of Home Depot and Lowes.

#rural #lifestyle #group #rules #retail #roost