Britain’s debt rule is not fit for purpose

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The perfect fiscal rule does not exist. Governments need leeway to support their economic goals. But they also need restraints, to prevent a debt spiral. Britain’s chancellor Rachel Reeves is admirably trying to square the circle, as her first Budget approaches on October 30.

The UK’s main target, to have debt as a share of gross domestic product falling in five years, is far too rigid. It can encourage cuts to capital expenditure just to meet it. Raising investment is, however, critical to beating Britain’s low-growth funk. Sensibly, Reeves has committed to balancing day-to-day costs within five years. That allows for more borrowing to invest. But it is not prudent to rely on more debt alone to pay for creaking infrastructure. Tough spending and tax decisions are needed too. Above all, any additional capital spending should be growth-enhancing. That aside, Reeves has little headroom against the existing debt rule anyway.

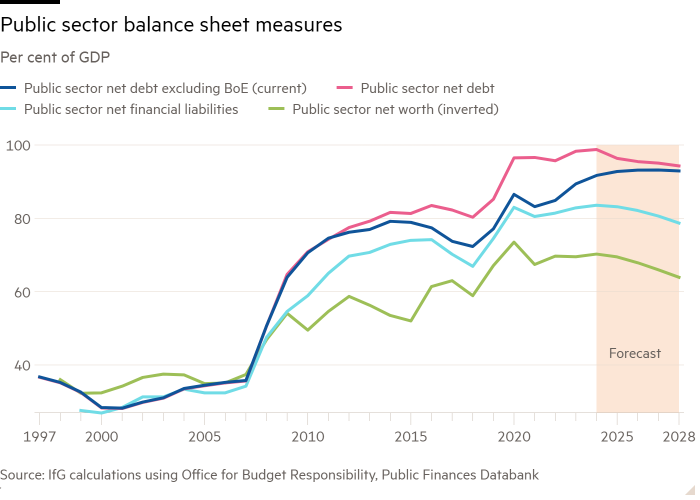

How might she create more space? The chancellor has said she wants investment to account for benefits as well as costs. Productive spending adds value to the economy, which the current focus on debt liabilities ignores. The Office for Budget Responsibility might, then, shift its emphasis to something like public sector net financial liabilities, which includes illiquid financial assets such as equity investments and student loans. Another metric, public sector net worth, also includes non-financial assets such as roads and rail.

Monitoring these measures could help to prioritise quality capital spending. But actually targeting them would be problematic. Creditors are concerned about debt serviceability. Infrastructure, for instance, cannot easily be liquidated to meet obligations. Valuing assets is fraught with measurement difficulties, too. Using these less established measures could create over £50bn in extra headroom, but that may spook gilt markets, which seem willing to stomach only £10bn-20bn more in borrowing. If the chancellor punts on this route, she must show restraint.

New balance sheet targets could also be a breach of Labour’s manifesto commitment to have “debt” falling in five years. If that means sticking to the existing debt rule, Reeves would have little room. Indeed, with the party’s ill-advised promise not to touch around 75 per cent of the tax base, only cosmetic interim options for raising investment space in this Budget might remain. That includes tweaking the definition of debt, by excluding the Bank of England’s losses from asset sales and policy banks, like the National Wealth Fund.

Britain is better off moving to a more holistic analysis of debt sustainability. This would spotlight conventional metrics — such as the debt ratio, interest payments, and maturities — which monitor fiscal capacity. But it would be supplemented by assessing balance sheet measures and better scoring of the growth impact from government reforms and investment, which often take more than five years to bear fruit. Creditors want to know whether borrowing will create future tax revenue streams, not just assets.

The OBR could then allow the debt ratio to be rising over five years if it reckoned that measures today could lower its trajectory over an extended horizon. The promise to balance the current, day-to-day budget (which includes interest costs) will continue to act as a check; lowering its timeframe from five years could convey more seriousness.

But groundwork is required first. OBR resources need beefing up, markets need time to digest changes and, crucially, the government must get better at appraising investment projects. These are also reasons why rushing to new target measures may not be the best course of action. Caught between promises on tax, the desire to show discipline, and the need to make space for investment, the chancellor may then resort to tweaking the debt definition at this Budget. This is not ideal. But if Reeves can also start shifting the country away from its outmoded focus on arbitrary targets and towards a more flexible fiscal framework, Britain’s economic future will look a lot more promising.

#Britains #debt #rule #fit #purpose