TSMC profits jump 54% on back of AI chip boom

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Taiwan Semiconductor Manufacturing Company, the world’s largest chipmaker, has further raised its growth outlook on the back of an artificial intelligence boom and a broad-based recovery in other sectors, defying market jitters over the current industry upcycle’s longevity.

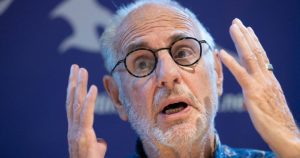

“We continue to observe extremely robust AI-related demand,” CC Wei, chair and chief executive, told investors on Thursday, adding that TSMC expected revenue to grow nearly 30 per cent this year.

The bullish guidance came as the Taiwan-based company reported a 54 per cent year-on-year jump in net profit to NT$325.3bn (US$10.1bn) for the third quarter, exceeding its forecast from three months ago.

It followed a tech sell-off after ASML, the Dutch company that supplies the lithography machines used to make the world’s most advanced chips, reported orders that were half of analysts’ expectations.

TSMC, which dominates production of cutting-edge semiconductors, appears to be isolated from that weakness.

Pointing to almost all the companies that design AI chips being its customers, including so-called hyperscalers such as Amazon and Microsoft, Wei said: “We probably get the deepest and widest look. The demand is real, and I believe it is just the beginning and will continue for many years.”

The company expects the contribution of AI-related chips to revenue to triple to 15 per cent this year compared with 2023.

But TSMC said its strong third-quarter performance — with revenue, gross margins and operating margins all exceeding earlier guidance — was also supported by a recovery in demand across all segments, from smartphones to industrial applications and car chips.

The company remains slightly cautious on investment plans in new capacity. Capital expenditure is “very likely” to be higher in 2025 than this year, probably slightly above $30bn, TSMC said.

But it has only spent $18.5bn as of the end of September, far below its full-year forecast of up to $30bn. A sizeable chunk of spending on advanced capacity — which typically accounts for more than 70 per cent of TSMC’s capex — flows into ASML machines.

Analysts said ASML’s weak third-quarter orders were more likely due to Intel and Samsung, which are both struggling to keep up in chip manufacturing for external customers.

TSMC produces chips for more than 500 companies, including Nvidia’s latest AI processors and Apple’s iPhone chips, a business model that gives it unrivalled scale and balance.

“While ASML delivered a negative update, TSMC continues to go from strength to strength,” said Ben Barringer, technology analyst at Quilter Cheviot. “This is encouraging and has resulted in TSMC raising its guidance, giving the sector confidence again after ASML’s news.”

He stressed that with its stable business outside AI, TSMC was much better positioned than Intel and Samsung. “Should any real downturn hit the sector, it should be in a strong position to weather this and emerge in a good place,” he said.

#TSMC #profits #jump #chip #boom