European gas prices hit peak for year on Norwegian production outage

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

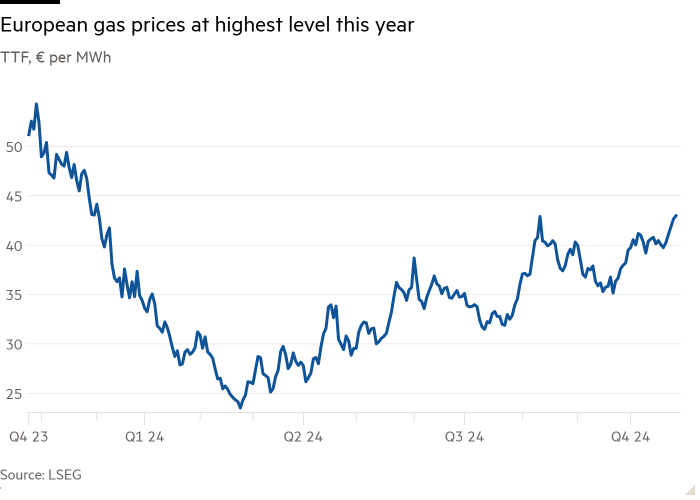

European gas prices have climbed to their highest level of the year, as a production outage in key supplier Norway exacerbates market concerns over tensions in the Middle East.

Europe’s main gas benchmark, the Amsterdam-traded Title Transfer Facility, rose as much as 3.6 per cent to €43.68 per megawatt hour — the highest since December last year.

The increase comes despite the unusually high level of gas in storage facilities in the EU, which are almost full, and underscores the region’s ongoing sensitivity to supply disruptions after largely weaning itself off Russian gas in the wake of the invasion of Ukraine in 2022.

“Market nervousness is taking effect,” said Yuriy Onyshkiv, senior gas analyst at LSEG.

The outage in Norway began on Tuesday, when state energy company Equinor said gas production at one of its platforms had shut down following a smoke alert in an electrical facility. The company said that “the reduction in gas exports resulting from this incident will not have any consequences for the commitments that we have made to our customers”.

Norway has supplanted Russia as the EU’s top gas supplier, providing about 30 per cent of the bloc’s overall imports.

Europe has also replaced Russian pipeline supplies with seaborne liquefied natural gas imports. The latter are sensitive to tensions between Israel and Iran, given 20 per cent of global LNG supplies pass through the Strait of Hormuz.

The continent also needs to compete with Asia for limited LNG supplies, meaning prices in Europe have to rise to incentivise traders to send the cargoes to its shores. The competition is as its fiercest during the colder months, when the demand for heating increases. Gas in storage alone is not sufficient to meet Europe’s winter needs.

Laura Page, LNG insight manager at commodity analytics company Kpler, said traders were also eyeing the future of Russian pipeline gas deliveries to Europe via Ukraine. That route still accounts for about 5 per cent of the EU’s gas supplies, but the agreement between Ukraine and Russia to allow for the transport of gas will finish at the end of December. Traders expect no new deal to be signed.

Despite recent increases, gas prices remain far below the levels of over €300/MWh hit during the crisis that followed the outbreak of war in Ukraine.

#European #gas #prices #hit #peak #year #Norwegian #production #outage