UK’s long-awaited Budget Day arrives

This article is an on-site version of our The Week Ahead newsletter. Subscribers can sign up here to get the newsletter delivered every Sunday. Explore all of our newsletters here

Hello and welcome to the working week.

Are you a worker? If you are a British taxpayer, you are going to find out the answer to this question — or at least chancellor Rachel Reeves’ definition — because we are hurtling towards the fiscal event known as Budget Day.

The reason why the definition of workers is important is because the Labour government pledged at the recent general election not to make such people pay more in taxes, despite its plans for £20bn of additional annual investment spending. That just leaves the rich — though increasing taxes on them may backfire, according to Financial Times economics commentator Chris Giles.

What we do know — because she told FT readers — is that Reeves is going to use her speech to parliament on Wednesday to announce a change to the UK fiscal rules to help fund her investment plans with increased government borrowing. Much has been trailed already about what will and won’t be part of the spending plans, but chancellors also like to keep something in reserve. Does Reeves have a vote-winning trick up her sleeve? Click here for the FT Budget coverage.

Not to be outdone, and despite their drubbing at July’s general election, the UK opposition Conservatives will announce their new leader on Saturday. Party members have had the final say, voting on the two candidates picked by Tory MPs: Kemi Badenoch, the bookmakers’ favourite going into this contest, and Robert Jenrick. You can read their profiles here.

At this point I must apologise to The Week Ahead’s readers outside the UK. Most FT headlines this week are likely to come from beyond the small island from where I write this — French President Emmanuel Macron’s visit to former colony Morocco, for instance — but much of it is undiaried. The pendulum will swing back next week with the US presidential election.

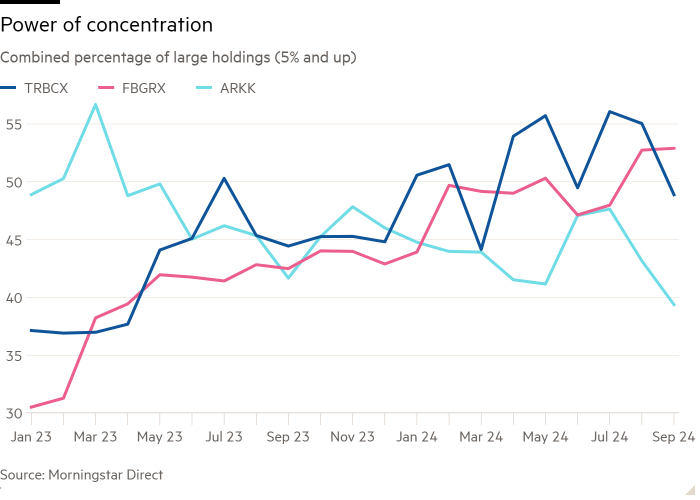

Back to this week, which is another busy one for earnings, dominated by Big Tech grappling with AI, Big Oil grappling with moving to a low carbon future and Big Pharma trying to move beyond drug law suits. Big Tech has been the big market mover. The four companies reporting this week — Apple, Meta, Microsoft and Amazon — alongside Nvidia, which reports next month, have contributed about 46 per cent of the year-to-date gains for the S&P 500. And as the FT noted this week, it is forcing US funds to dump shares to avoid breaching tax rules.

The thin run of economic data this week is saved by the first third-quarter GDP estimates from the US and EU, both watched eagerly but with the former having an additional political slant since the US presidential elections will be less than a week away when the figures come out.

The Bank of Japan’s Monetary Policy Committee meets, announcing its interest rate decision on Thursday. The expectation is that the next move will be up. The question is how soon. Expectations as recently as last month had been for further rate rises before the end of this year. But since then the yen has lost about 5 per cent against the US dollar as investors bet on a slower pace of change.

One more thing . . .

Thank you to all of you continuing to share your favourite music in memory of the UK’s National Album Day this month — my Spotify liked list is now bulging at the seams. In particular, thank you to the reader who recommended the new album by Justin Adams and Mauro Durante, which has been filling my ears this week, and also happened to be reviewed by the FT’s David Honigmann.

Key economic and company reports

Here is a more complete list of what to expect in terms of company reports and economic data this week.

Monday

-

New Zealand: Labour Day. Financial markets closed

-

US: the 2024 Microelectronics Commons Annual Meeting and National Semiconductor Technology Center Symposium begins in Washington, featuring three days of speeches from industry business leaders, academics and government, including the Department of Defense and the Department of Commerce

-

Results: Brown & Brown Q3, Cadence Design Systems Q3, Ford Motor Company Q3, ON Semiconductor Q3, Philips Q3, SBA Communications Q3

Tuesday

-

Turkey: Republic Day. Financial markets closed

-

UK: British Retail Consortium Shop Price Index

-

Results: Adidas 9M, Alphabet Q3, Anglo American H2 sustainability performance update, BP Q3, Caesars Entertainment Q3, Chipotle Mexican Grill Q3, Corning Q3, Clariant Q3, Electronic Arts Q2, Ferrovial 9M, HelloFresh Q3, HSBC Q3, Lufthansa Q3, McDonald’s Q3, Mondelez International Q3, NEC Q2, Novartis Q3, OMV Q3, PayPal Q3, Pearson 9M trading update, PetroChina Q3, Pfizer Q3, Phillips 66 Q3, Reddit Q3, Royal Caribbean Q3, RWS FY trading statement, Santander 9M, Shimano Q3, Snap Q3, Stanley Black & Decker Q3, Tenet Healthcare Q3, Visa Q4, YouGov FY

Wednesday

-

EU: preliminary Q3 GDP estimate

-

Germany: preliminary Q3 GDP estimate. Also, September labour market figures and October consumer price index (CPI) and harmonised index of consumer prices (HICP) inflation rate data

-

UK: 2019-24 consumer credit/debit card spending data

-

US: preliminary Q3 GDP estimate

-

Results: Airbus 9M, Amgen Q3, Aston Martin Lagonda Q3, AXA 9M, Bank of Ireland interim management statement, Booking Holdings Q3, Caterpillar Q3, CDW Q3, Computacenter Q3 trading update, eBay Q3, Eli Lilly Q3, Etsy Q3, Garmin Q3, Glencore Q3 production report, GSK Q3, Hess Q3, Hitachi Q2, Kraft Heinz Q3, Meta Q3, MetLife Q3, MGM Resorts International Q3, Microsoft Q1, Next Q3 trading statement, Smurfit Westrock Q3, Standard Chartered Q3, Starbucks Q4, Ubisoft Entertainment HY, UBS Q3, Volkswagen Q3

Thursday

-

Bank of England deputy governor Sarah Breeden gives the keynote speech at the Hong Kong Monetary Authority and Bank for International Settlements joint conference ‘Opportunities and challenges of emerging technologies in the financial ecosystem’

-

Santander International Banking Conference at the Spanish bank’s Madrid headquarters. Speakers include De Nederlandsche Bank president Klaas Knot, European financial services commissioner Mairead McGuinness and European Investment Bank president Nadia Calviño

-

EU: European Central Bank economic bulletin

-

EU: October Eurozone inflation rate data

-

Germany: September retail sales figures

-

Japan: interest rate announcement

-

Singapore: Deepavali. Financial markets closed

-

Results: Allstate Q3, Amazon.com Q3, Anheuser-Busch InBev Q3, Apple Q4, BNP Paribas Q3, Bristol Myers Squibb Q3, Cigna Q3, Comcast Q3, ConocoPhillips Q3, Fujitsu HY, Haleon Q3 trading statement, ING Q3, Intel Q3, International Paper Q3, Juniper Networks Q3, Mastercard Q3, Merck & Co Q3, Panasonic Q2, Prudential Financial Q3, Repsol Q3, Samsung Electronics Q3, Shell Q3, Smith & Nephew Q3 trading report, Société Générale Q3, STMicroelectronics Q3, Stellantis Q3 shipments and revenues, Sumitomo Q2, TotalEnergies Q3, Uber Q3

Friday

-

Kellanova special meeting for shareholders of the food manufacturing multinational to vote on the proposed acquisition of the company by Mars. If approved, then Kellanova expects the merger will be completed in the first half of 2025

-

Canada, China, Japan, UK, US: S&P Global manufacturing purchasing managers’ index (PMI) data

-

India: Diwali-Laxmi Pujan. Financial markets closed

-

UK: Nationwide October House Price Index

-

US: October employment report

-

Results: AES Q3, Chevron Q3, ExxonMobil Q3, Ingersoll Rand Q3, KDDI HY, Macquarie HY, Mitsubishi HY, Mitsui & Co HY, Nomura Q2, T Rowe Price Q3

World events

Finally, here is a rundown of other events and milestones this week.

Monday

-

Iceland: 2024 Session of the Nordic Council, an inter-parliamentary body representing Denmark, Faroe Islands, Greenland, Finland, Aland, Iceland, Norway and Sweden, begins in Reykjavík. This year’s theme is “Peace and Security in the Arctic”

-

Morocco: French President Emmanuel Macron begins a three-day state visit to the former colony, marking a step towards easing three years of strained relations between the two countries

Tuesday

-

China: Finnish president Alexander Stubb due to meet his Chinese counterpart Xi Jinping in Beijing as part of a state visit. Discussion is expected to include the Ukraine war

-

UK: funeral of former Scottish first minister Alex Salmond, who died of a heart attack during a conference in North Macedonia earlier this month. Private proceedings for family and close friends will be held in his home village of Strichen. Read his FT obituary here

Wednesday

-

Botswana: general election

-

Congo: 50th anniversary of Ali vs Foreman Rumble in the Jungle boxing match Ali’s victory was a monumental upset, cementing his status as one of the greatest boxers of all time, as this FT piece from 2016 explains

-

UK: Budget Day

Thursday

-

India: Diwali, or Deepavali, the Hindu festival of lights begins, running until tomorrow evening local time. The festival is celebrated across the world. Los Angeles-based food writer Radhi Devlukia-Shetty shares how she does this in an interview for the FT’s House & Home section

-

Germany: Reformation Day

Friday

-

All Saints Day, preceding All Souls Day tomorrow, in which Christians are encouraged to remember loved ones who have died. Commemorated in numerous countries, particularly in Europe and the Americas. In Mexico, it is celebrated as Day of the Dead, with traditions including building home altars

Saturday

Sunday

-

Italy: G7 Sustainable Urban Development ministers meeting

-

Moldova: run-off election to decide the country’s next president

-

US: Clocks go back one hour, marking the end of daylight saving

What are your priorities for the next seven days? Email me at [email protected], or, if you are reading this from your inbox, hit reply.

Recommended newsletters for you

Inside Politics — What you need to know in UK politics. Sign up here

US Election countdown — Money and politics in the race for the White House. Sign up here

#UKs #longawaited #Budget #Day #arrives