Beware the tricky business of distressed M&A

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

M&A negotiations are never easy. Dealing with distressed debt hedge funds takes the pain to another level. Numerous companies will increasingly be unable to refinance debt that they borrowed in a low rate environment. As such, their equity values are hovering around zero. But their underlying businesses remain attractive to rivals at the right price.

Those potential buyers are then going to end up negotiating deals with the target’s lenders and bondholders instead of its shareholders. That dynamic is at play right now in the merger between the US satellite TV players, Dish Network and DirecTV. It may soon be the situation if Frontier Airlines again goes after the teetering Spirit Airlines.

These debtholders are contractually owed 100 cents of the dollar of their claims. But instead, they are going to be asked to swallow hard to take haircuts, with the cudgel of an ugly bankruptcy filing in the background. Each buyer and seller knows they are better off together. But creditors are tougher negotiators than shareholders since they are anchored to getting back every dollar that was promised when they made their respective loans.

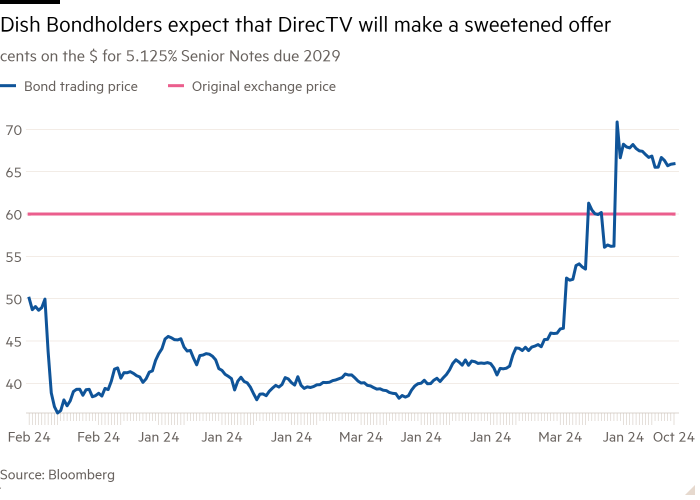

DirecTV has told bondholders holding just under $10bn of Dish bonds that they must accept a $1.6bn discount on their claim, payable in swapped new debt. That impairment and resulting valuation, says the private equity owner of DirecTV, is what they believe solves both the fair value of Dish and the amount of leverage the new combined Dish/DirecTV can shoulder. Dish creditors are baulking and, of course for the private equity firm, every dollar of debt haircut is one more dollar of value transferred for them.

In the case of Spirit Airlines, it has public shareholders and a current market value of $300mn. That is against more than $7bn of total leases and debt. According to news reports, a merger with Frontier could happen through a negotiated bankruptcy filing or out of court. The problem with buying the equity in a regular way is that would require Frontier to make the debt whole when it currently trades at steep discounts to par.

The positive market value put on Spirit merely is a cheap call option on a miracle outcome for shareholders. Far more likely is that Frontier is currently doing the maths on how much of a loss can it force on to Spirit bondholders, who will fear a standalone bankruptcy.

#Beware #tricky #business #distressed