The OBR should trust markets on the cost of quantitative tightening

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tomasz Wieladek is chief European economist at T Rowe Price and a CEPR Research Fellow.

Ahead of the UK’s budget on 30 October, there is an intense debate about which taxes to raise and which spending to cut to fill the (claimed) £22bn ‘black hole’ in public finances.

The room for manoeuvre is limited. Chancellor Rachel Reeves has already said that she will adopt target public sector net financial liabilities instead of public debt — opening up £50bn in ‘headroom’. How much of it she can afford to use is an open question. Markets will be watching closely for signals — as a result, the Office for Budget Responsibility’s forecasts on future gilt issuance will be more important than in previous budgets.

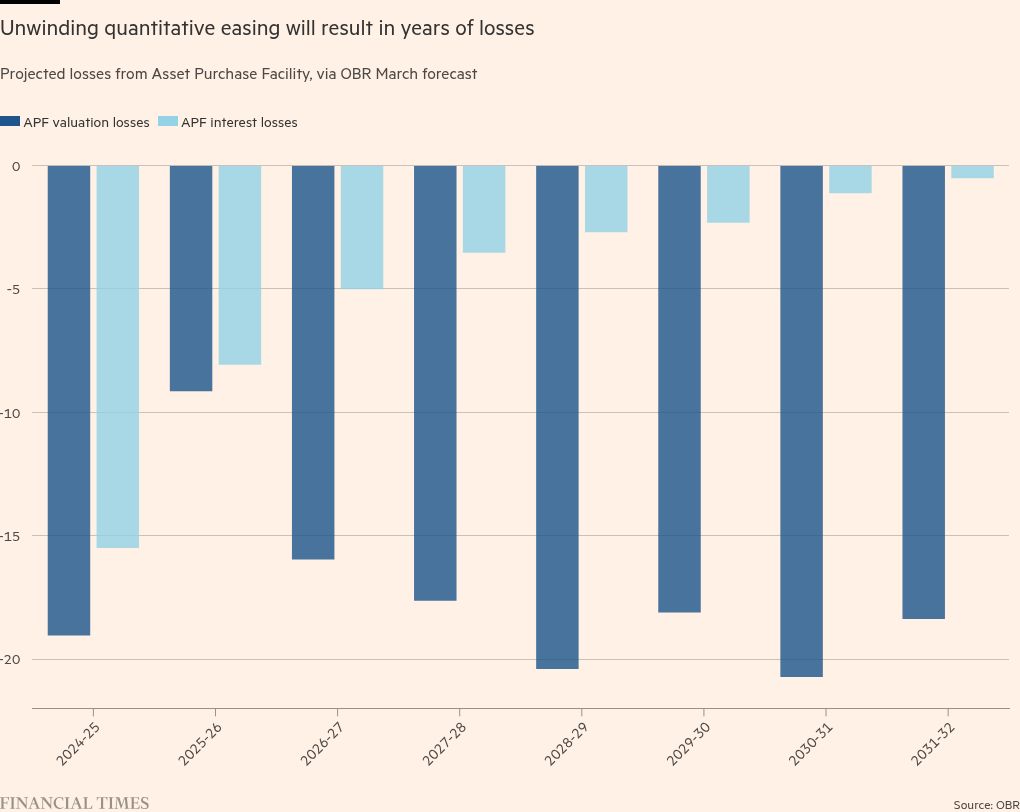

We’ve noted previously that a significant uncertainty in the OBR’s fiscal forecasts surrounds the treatment of Bank of England balance sheet losses. Losses occur because, under quantitative easing, the Bank of England is actively selling bonds at much lower valuations than it bought them, and the Treasury is indemnifying the Bank against those losses.

A second important source of losses is the loss from the interest rate swap on the Bank of England’s balance sheet. The gilts in the Asset Purchase Facility yield roughly 2 per cent fixed interest. But this is financed with floating rate reserves paying 5 per cent. The Bank of England therefore currently makes a roughly 3 per cent annual interest rate loss on its £655bn balance sheet.

As a result, the OBR’s assumptions about the future scale of active sales under QT determines several billion of notional future pressures. As Louis wrote last month, different assumptions could cause a headroom swing of around £15.5bn.

To recap, discussion has centred on three main paths ahead, depending on the OBR’s chosen heuristic:

— The OBR averages the active sales rate over the first three years of QT and projects an average of £36.3bn per year going forward (arguably the “base case” based on precedent)

— The OBR assumes £13bn, the active envelope set for the current year, is carried forward ( much smaller losses)

— The OBR assumes the envelope will be £100bn a year from here on out (much larger losses)

What if there were a different, better way? Basing forecasting assumptions on market assumptions (gathered via the Bank’s market participants survey) could lead the OBR to forecast APF indemnity losses which are on average £7.14bn per annum smaller than the likely current approach (an average of active sales over the first three years of QT). This is one third of the current black hole, so not a small chunk of change.

The expectations theory of the yield curve suggests that the timing of asset sales shouldn’t matter for the eventual size of losses. In a rational-expectation, full-information world, losses from selling gilts today should be equal to accrued interest rate swap losses had the gilt not been sold. But there are other theories, such as the preferred habitat or market segmentation approach, where excess gilt supply, and hence the timing of sales, does matter for yields. As I argue here, this is probably the world that we are in today.

We can see why the OBR would be cautious to adopt this approach. Making forecast assumptions based on market participants QT forecasts is arguably an endorsement of the forecasts. By using them explicitly, the OBR could constrain the Bank’s room for maneuver, because any upside deviation would have a clear fiscal impact. This may even exert pressure on the Bank to deliver on market expectations, and result in a form of fiscal dominance.

But while these concerns are valid in theory, they are less likely to be a significant issue in practice. After all, the OBR is already using the market path for Bank rate in calculating Bank of England balance sheet losses. To my knowledge, no one has argued that this constrains the path of monetary policy in any significant way.

The Bank also hasn’t taken the losses from the rate path into account in its policy deliberations and communications. In the face of pressure over the drag from QT, the Monetary Policy Committee hasn’t (yet) blinked. This suggests that the risk of fiscal dominance via the OBR using market participants’ QT forecasts is small. Furthermore, this would never be a one-way street: just like with market expectations, the Bank can shape market participants’ expectations of QT. Indeed, this is what already happens to a degree in practice.

Of course, the right approach isn’t one that minimises these losses in the forecast. Rather, it’s one that gives the fairest and most accurate picture going forwards.

So — do market participants provide good forecasts of QT? After all, we’re all a bit new to this, and there are open questions around the likely landing zone.

The answer is simple: yes, because market participants are paid to get these forecasts right — after all, they affect portfolio allocation decisions. Recent experience from the US shows that market participants over there did a good job in forecasting Fed QT. During the Fed’s 2017 QT experience, market participants kept forecasting a Fed balance sheet size of around $3.5trn, which is almost exactly when the Fed stopped QT. We should trust that their British equivalents can do the same:

The OBR has a responsibility to provide the best forecasts it possibly can. This is why it already relies on market pricing of financial variables in its forecasts, because these summarise the future well, based on all available information today. This shouldn’t be surprising — there are huge sums at stake in market pricing.

Adding market participants’ QT forecasts to this mix should be the next step. This is a better approach than arbitrary rules of thumb. That this would reduce expected QT losses by so much is a happy bonus. Given the intense debate today, every little fiscal space helps.

Further reading:

— Rachel Reeves’ new rules

#OBR #trust #markets #cost #quantitative #tightening