Mike Ashley’s Frasers goes from cheap stores to cheap valuation

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Mike Ashley certainly likes to keep retail investors on their toes. In his latest move, the British sportswear tycoon wants to install himself at the head of Boohoo and right the enfeebled fast-fashion retailer.

This may smack of gall. It is not even a month since UK handbag maker Mulberry spurned his takeover bid, sending Ashley’s Frasers Group packing. Frasers — of which Ashley holds 73 per cent — already owns 36.8 per cent of Mulberry and around 27 per cent of Boohoo.

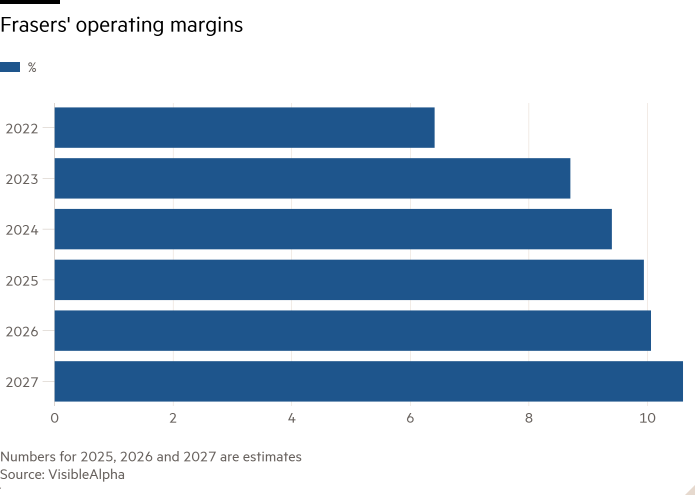

But here’s the thing. Even though Ashley’s scattergun stakebuilding has often thrown analysts and investors (its shopping spree has also extended to exposures to white goods retailer AO World, Asos and Hugo Boss), Frasers has become one of the sector’s top performers. Profit margins and growth are bested only by sector star Next.

The strength of Frasers, formerly Sports Direct, partly reflects an ability to learn from mistakes. A dust-up with the kings of sportswear, Adidas and Nike, saw the two brands withdraw products from Sports Direct stores last decade. The duo blanched at the retailer’s “stack ‘em high, sell ‘em low” policy and walked.

Frasers has since sought to reframe its relationship with brands. Sports Direct now has better displays, making it more appealing to those whose wares it sells. Taking stakes in all manner of brands gives Frasers leverage too: a designer is less likely to flounce off when you also own a chunk of the shares. The nature of these holdings — bikes, make up and electronics sit alongside fashion — also affords diversification.

Frasers has other strings to its bow. Its credit finance arm could deliver a £100mn earnings contribution in the long run, reckons Jefferies.

None of this has come particularly cheap. But net debt stood at a modest £447.6mn at the end of the last financial year, around 0.6 times ebitda. Many of the stakes were accumulated at depressed prices, reflecting retailers’ struggles as shoppers deserted high streets and, in 2020-2021, the pandemic shuttered shops.

For sure Frasers is no slam dunk. Jittery consumers cast a pall over the whole retail sector. Some of its holdings have performed horribly: Boohoo shares are worth almost a tenth of where they were five years ago. China’s Shein is grabbing a chunk of the ecommerce market. Fast fashion is by definition at odds with sustainability trends.

But with shares trading on a forward price/earnings multiple of 8.15 on S&P Capital IQ numbers, almost half that of Next, Frasers looks like a decent buy.

#Mike #Ashleys #Frasers #cheap #stores #cheap #valuation