Does Gen Z have it tougher than previous generations?

Every generation claims to have it harder than the previous one — and Gen Z is no exception.

But the latest data suggest that young Britons today are finding it tougher than ever to achieve financial independence, against a backdrop of growing economic insecurity.

Economists say a combination of unaffordable housing, weak wage growth and rising job precarity is threatening young adults’ financial autonomy, with long-term implications for their economic as well as social choices.

While Gen Zers — the cohort born between 1997 and 2012 — in peer nations are also feeling the pinch, those in the UK are confronting specific pressures, as the cost of living crisis follows a decade of weak wage growth and stagnating living standards.

“Greater economic insecurity has real implications for labour market outcomes, fertility rates and family formation,” said Molly Broome, analyst at the Resolution Foundation think-tank. “It makes it really difficult for young people to have a stake in society.”

Lifestyle shift

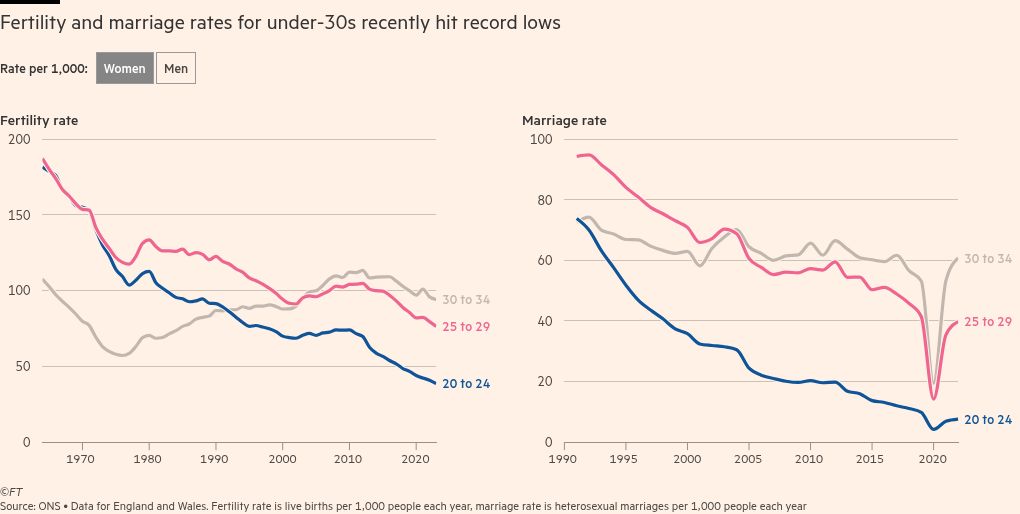

The major milestones of adulthood are already happening later in life. Official data shows that most Britons today will marry in their early 30s — almost a decade later than their grandparents’ generation.

Meanwhile, the average age of first-time home buyers has hit an all-time high of 34, while fertility rates for women in their 20s are at the lowest levels since records began in 1964, according to figures published this week.

Financial pressures can also be detected in changing social patterns, with recent research suggesting that two-thirds of Gen Zers have been forced to turn down social plans because of their economic situation, according to a survey by the Phoenix group of 2,000 adults conducted in May.

More than a quarter spend nothing on luxuries, such as alcohol and cigarettes, a separate survey found.

Toby Murray, senior research officer at the Money and Mental Health Institute, a charity, said some changes reflected the popularity of influencers on TikTok and YouTube, such as self-described “misogynist” Andrew Tate, who entice followers into schemes with a promise to make them successful and wealthy.

“They use the promise of financial independence as the way to get their claws into you because it’s what you’re stressed about and then feed you all the misogyny and ideas that you’re failing because you’re drinking and making bad life choices,” he added.

FT Edit

This article was featured in FT Edit, a daily selection of eight stories to inform, inspire and delight, free to read for 30 days. Explore FT Edit here ➼

There are signs that the growing economic gap between young men and women is filtering through to social views and behaviour. Data shows that on average young women are pulling ahead in terms of education and professional attainment.

Young men are around twice as likely to be teetotal as the average adult following a sharp rise in non-drinking over the past year, according to exclusive data from a 2024 survey of more than 5,000 adults by charity Drinkaware shows. A third of men aged 18 to 24 said they never drink alcohol, compared with just 19 per cent of their female peers.

Young men are also less likely to smoke or vape than women, reversing a long-term trend, and around twice as likely to have voted for the Conservatives or Reform at the last election.

Housing

Young adults are increasingly relying on the Bank of Mum and Dad to pay bills, afford rent and get on the housing ladder, according to recent research.

Almost a third of 25- to 27-year-olds in the UK, the oldest members of Gen Z, still lived in their family home in 2023, official data shows. This is up from a fifth two decades before.

Broome from the Resolution Foundation said the rapid rise in housing costs was one of the main barriers to independence for many young adults, with a large number struggling to rent property, let alone buy.

“Prices have outpaced earnings growth by so much that people are reaching life milestones like home ownership much later in life and financial help from parents is increasingly important,” she said, adding that this could impact wider wealth inequality.

Over the past two decades, the share of under-25s who are homeowners has fallen sharply, declining from 24 per cent of households in 2004 to 10 per cent in 2023.

At the same time, the number of first-time buyers receiving financial assistance has ballooned, rising to an 11-year high of 57 per cent this year.

As the number of young renters has increased, so too has the affordability squeeze, with annual rental inflation hitting 9.2 per cent earlier this year, the highest rate since records began in 2015.

This has had a disproportionate impact on Gen Z, who are twice as likely as younger millennials to be renting and pay on average almost half their income on rent, according to official data.

Employment

Young adults have also been at the sharp end of more than a decade of weak wage growth, rising insecure gig economy employment, and a post-pandemic mental health crisis that has driven record levels of economic inactivity.

This left young adults increasingly depending on their parents to meet everyday costs, with a third of Gen Z and millennials (people born between 1981 and 1996) still relying on them to pay housing costs and utility bills, according to a survey of 18- to 35-year-olds by telecoms company Virgin Media O2.

A sharp rise in the minimum wage next April will help to offset cost pressures for many young adults, with rates for 16- and 17-year-olds set to rise 18 per cent to £7.55 and rates for 18- to 20-year-olds by 16.3 per cent to £10.00, far outpacing a 6.7 per cent increase to the headline rate.

Mental health

Economic insecurity has taken a toll on the mental health of young adults. Official data shows new benefit claims for mental disorders by 16- to 27-year-olds more than doubled over the three years ending June.

Research suggests this reflects a rise in mental illness, not just increased recognition, with two-thirds of people aged 30 and over saying young adults’ mental health is worse than when they were their age, according to a 2023 survey by King’s College London. The majority also think their ability to afford things and future prospects are worse.

Craig Morgan, co-director of ESRC Centre for Mental Health at King’s College London, said an increased willingness to talk about mental health may explain part of the rise, but there was also evidence of a genuine increase in prevalence.

“It’s difficult to know what is driving this but it is likely to be the consequence of a concentration of factors that include the [Covid] pandemic, a sharp increase in economic insecurity and difficulty getting on to the housing ladder,” he added.

#Gen #tougher #previous #generations