Ryanair’s travel agent war left it wounded but not defeated

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Ryanair decides to go to war with a foe, it is used to getting its way. But the European low-cost airline’s long-running battle with online travel agents — or “pirates” as chief executive Michael O’Leary liked to call them — has left it with some unexpected wounds. Unfortunately for competitors, Ryanair’s injuries are unlikely to constrain it for long.

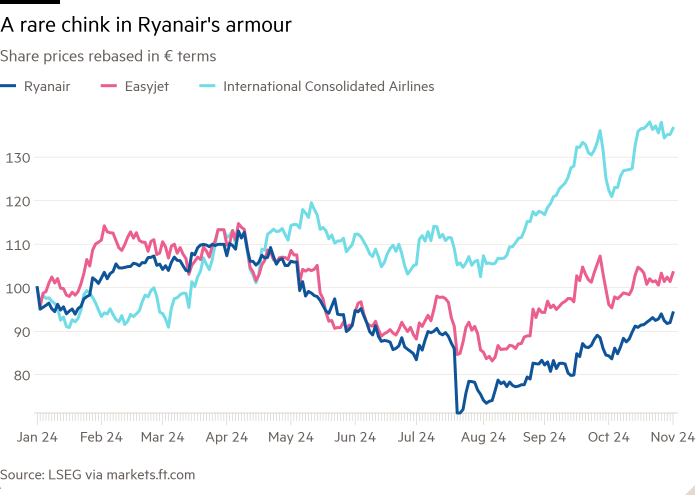

Ryanair’s shares have trailed several of its rivals in the year to date, losing about 6 per cent versus an (albeit unremarkable) 3.5 per cent gain at easyJet, for example.

O’Leary jolted the market in July when he warned that Ryanair’s summer airfares would be “materially lower” than the previous year because consumer spending had deteriorated. This triggered fears of a hard landing from the post-pandemic “revenge travel” boom. Investors were then left scratching their heads when easyJet and others did not echo the gloom.

On Monday, Ryanair confirmed what some analysts had suspected for a while: that its war with online travel agents (OTAs) was at least partly to blame for the 10 per cent year-on-year drop in average fares in the first half of the year to €52. This contributed to an 18 per cent fall in first-half net income to €1.79bn.

OTAs — think sites such as Booking.com, Expedia and Kayak — suddenly stopped selling Ryanair’s flights at the end of 2023. Ryanair was relatively sanguine at the time, believing customers would simply book direct via its website instead. But the OTA customer base was more loyal than expected. Ryanair was forced to slash prices to fill planes.

The airline has other difficulties: it has revised down its expectations for the number of passengers it expects to carry in its next full financial year to 210mn from 215mn, owing to delivery delays at Boeing.

Even so, Ryanair won’t be wounded for long. First, it has struck “approved partnerships” with most of the OTAs. These resolve many of the sources of contention between the two sides — such as providing customers’ details to Ryanair. Crucially, they allow for its flights to be listed again.

Rivals also face delivery delays. Unlike others, Ryanair is not affected by Pratt & Whitney engine problems with its existing aircraft. Capacity constraints across the industry should help sustain airfares in the next few years, while Ryanair is successfully keeping a lid on costs.

Considering that Ryanair’s average post-tax profit per passenger before the pandemic was roughly about €11, net income forecasts for 2026 look too conservative, reckons Bernstein analyst Alex Irving. Current estimates on Visible Alpha suggest profit per passenger of just €9. With the travel agent war largely behind it, that leaves Ryanair plenty of room for lift-off.

#Ryanairs #travel #agent #war #left #wounded #defeated