US trade partners brace for tougher tariffs in Trump’s second term

Donald Trump is expected to move quickly and “ruthlessly” in threatening the US’s trading partners with steep tariffs on their imports once he takes office, say former trade officials and advisers.

Trump, a self-described “tariff man”, won a sweeping electoral victory following a campaign in which he lambasted America’s trading partners and vowed to boost US manufacturing.

The president-elect has threatened levies of up to 20 per cent on all imports and 60 per cent on those from China — measures that are more stringent and broader than those deployed during his first term in office.

Analysts say Trump could use executive powers — including the International Emergency Powers Act (IEPA), which allows a US president to respond to emergencies through economic means — to act soon after taking office on January 20.

While his allies have claimed the president-elect will primarily use tariffs as a bargaining tool to force co-operation on other issues, others have warned that the former president should be taken at his word.

“He is very much someone who does what he says he’s going to do,” said Everett Eissenstat, a former Trump trade adviser. “He has been transparent about how he would use tariffs, and he won [the election]. So it’s hard to argue that the American people don’t want that.”

“Our trading partners need to take seriously Trump’s plans to increase tariffs,” agreed Wendy Cutler, vice-president of the Asia Society Policy Institute.

Dmitry Grozoubinski, a former World Trade Organization negotiator, said Trump would “ruthlessly” use his leverage as the president of a country that is often referred to as the world’s “consumer of last resort”.

US consumer spending has been in rude health since shortly after the Covid-19 pandemic struck, and helped drive annualised growth to just short of 3 per cent in the third quarter of this year.

“Confronted with loss of access to the US, the engine of global growth, leaders will either bend the knee and negotiate concessions, or punch back so as to bring at least some leverage of their own to the negotiating table,” said Grozoubinski. “But negotiate they will.”

Adam Posen, president of the Peterson Institute for International Economics, said that if the US could “credibly extract what they want” without having to implement what Trump has threatened, that would be a “good outcome for the US short-term”.

But he warned that once tariffs are put in place, “it’s very hard to take them off”.

“The decisions made in the first couple weeks after the administration comes in on how aggressive to be with the tariffs are likely to be lasting ones,” Posen said.

Foreign officials are preparing for the worst.

Mexico, the US’s top trade partner, has faced threats from Trump of “whatever tariffs are required — 100 per cent, 200 per cent, 1,000 per cent” to prevent imports of Chinese cars.

Trump also warned this week of a blanket 25 per cent tariff on goods from Mexico if President Claudia Sheinbaum does not stop the “onslaught of criminals and drugs” crossing the border into the US.

Those levies could be imposed using executive powers that would override USMCA, the free-trade agreement that the president-elect inked with the US’s southern neighbour and Canada during his first term.

Sheinbaum tried to reassure Mexicans and business leaders on Tuesday that they had nothing to worry about, saying she was “convinced” there was going to be a good relationship with the country that purchases three quarters of its exports.

Some fear Mexico — and investors — are underestimating the risk to USMCA and the likely volatility of the coming years.

“[They are] assuming it won’t get worse, that the scare is over and they’ll do a deal, that the US needs Mexico . . . it won’t be a smooth ride,” said Carlos Ramírez, a political risk consultant at Integralia Consultores. “A lot of things can go wrong.”

Migration experts believe Trump will use tariff threats to try to get Mexico to sign a “third safe country” agreement, which would in effect block asylum seekers who pass through Mexico from the US asylum system.

However, any deal could be complicated by Trump’s plans for a mass deportation programme of migrants living in the US without a visa, the largest group of whom are Mexicans.

Trump has also railed against the EU’s €158bn trade surplus with the US, lashing out at Germany for selling it cars while not buying any in return.

The European Commission, which runs EU trade policy, will offer to import more from the US, with liquefied natural gas one possible concession. Another possible sweetener would be the removal of tariffs on €5.6bn-worth of US exports — implemented during Trump’s first term — as soon as March.

“We are going to talk. The trade relationship is so big and so many people depend on it that we have to look after it,” said an EU official.

But the person said the EU has also prepared a list of possible retaliatory measures, if needed.

While these could be enacted fairly swiftly, it will only act in accordance with World Trade Organization rules, reducing the tariff levels it can impose. Analysts believe Trump is unlikely to be as constrained by global trade rules.

The UK, meanwhile, would be left to play what former one former trade official has described as a “piggy in the middle” role between the US and the EU — especially tricky at a time when the new government was trying to reset trade ties with Brussels.

“Despite the anticipation that a Trump victory would drive greater UK-EU co-operation, [the president-elect] may well see this as a political slight, so the UK will be back to a world of carefully negotiating trade-offs,” said Allie Renison of consultancy SEC Newgate.

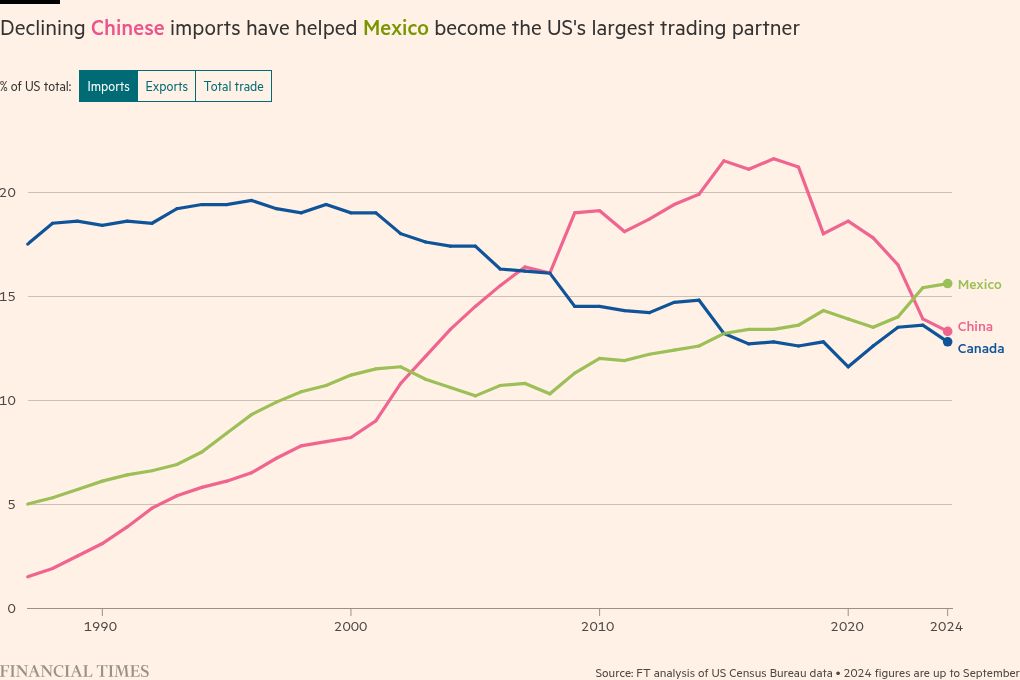

During his first term, Trump primarily targeted trade with China, then the US’s biggest trading partner.

He used Section 301 of the 1974 Trade Act, which authorises the US leadership to take direct measures to enforce the country’s rights under trade agreements, to justify imposing duties on $360bn of Chinese imports.

He also used national security laws to impose tariffs on many countries’ steel and aluminium imports, including China’s.

While Beijing has given few indications of how it will respond, the country’s ballooning exports are expected to stoke tensions with Washington under Trump.

Analysts believe that, should Trump deploy higher tariffs on Chinese imports, Beijing could resort to a sharp depreciation of the renminbi, making its exports more attractive.

Data visualisation by Amy Borrett and Janina Conboye

#trade #partners #brace #tougher #tariffs #Trumps #term