Political shift weakens business schools’ appeal to overseas students

The international diversity that has long been a selling point for European business schools is now under threat as political shifts and stricter immigration policies take hold across the continent.

With business masters programme classes often comprising as much as 90 per cent foreign students, this global appeal — offering the opportunity to study alongside international classmates — has set European schools apart from their North American and Asian counterparts.

But recent crackdowns on international students in some countries are raising concerns about the global competitiveness of European business education, especially as alternatives such as India and China gain traction.

The UK has been hit particularly hard, with universities and business schools struggling due to a sharp decline in international postgraduate students, an important revenue source. A survey by the Chartered Association of Business Schools (Cabs) in August found that 90 per cent of UK deans reported a drop in non-EU postgraduate applications compared with last year, with 70 per cent calling the decline “significant”.

Andre Spicer, dean of Bayes Business School in London, points to this year’s ban on postgraduate students bringing family members and the rise in the salary threshold for skilled worker visas, from £26,200 to £38,700. These changes have made it more expensive for companies to hire foreign graduates, prompting firms such as HSBC, Deloitte and KPMG to rescind job offers.

“The ban on bringing families makes it really difficult to attract MBA students,” Spicer says, noting that the higher salary threshold has had a similar “dampening effect” on demand for masters programmes.

Spicer also notes the improving quality of business education in countries such as China and India, giving nationals more reasons to stay local rather than look abroad. Plus, he adds, “some of our students were concerned about the far-right riots during the summer”.

But, in spite of these concerns, many students still see the UK as an attractive destination.

Betul Inci, a Turkish executive MBA candidate at Bayes, was drawn to the global appeal of the UK capital. “London is a global business hub and I am studying with people from a diverse mix of nationalities, learning from different perspectives,” she says.

Inci enrolled in the executive MBA programme at Bayes in March, while continuing her role as director of design and project management at Istanbul-based furniture maker Parla. To secure a UK student visa, she needed an offer from a licensed institution, proof of English proficiency and funds to cover the £55,700 tuition fees and living expenses.

European Business Schools Ranking

This is an early article from the ranking report, out on Monday December 2

Tougher UK immigration rules reflect a broader trend in Europe. The Dutch government is pushing forward with plans to limit university teaching in English, citing overcrowded lecture halls and a housing crunch. Bachelors programmes in English are set to be cut to one-third of all courses.

At the same time, Norway has introduced tuition fees for international students outside the European Economic Area and Switzerland — a notable shift for a country that previously offered free education to all.

France, too, introduced reforms last year aimed at tightening deportations and setting migration quotas, though some elements were later struck down by the courts.

Vincenzo Vinzi, dean of Essec Business School near Paris, notes the mixed effects: “Restrictions on asylum procedures have raised concerns among some applicants, but simplified visa processes and post-graduation work opportunities have had a positive impact on student enrolment.”

A recent French rule change has made it simpler for family members of foreign nationals to secure residence rights and find work, while graduates can stay in France for up to 24 months after completing their studies to seek employment.

Nonetheless, Essec has expanded its international partnerships and opened a recruitment office in Latin America to diversify its student base. This approach is mirrored across European schools, according to Eric Cornuel, president of the European Foundation for Management Development in Brussels.

He notes that schools are also investing in digital learning platforms and establishing campuses abroad to navigate the shifting political environment. The UK’s University of Southampton, for instance, plans to open a campus in India next year, investing £30mn over the next decade to enrol 5,500 students in that period.

Andrew Crisp, a higher education consultant, says: “Business education is being impacted by government agendas . . . For some institutions, the answer will be to go to where the students are.”

Despite the tougher rhetoric across Europe, some deans remain optimistic. Joachim Lutz, dean of Mannheim Business School in south-west Germany, says: “German immigration policies have not negatively influenced the international demand for our programmes.”

Europe’s largest economy is tightening its immigration rules, partly in response to growing far-right sentiment, introducing legislation aimed at speeding up deportations and reinstating border checks.

But international students still benefit from generous post-study work visas, allowing 18 months to find employment. Such policies are attractive to students such as Ferdinandus Sianipar, who moved from Indonesia to pursue his full-time MBA at WHU — Otto Beisheim School of Management, in Vallendar, last year.

“Knowing that the path to permanent residence is accessible gave me the confidence to pursue my MBA here,” Sianipar says.

European schools are facing a tougher political climate, but the continent’s strengths — such as favourable post-graduation work opportunities and cultural diversity — remain a strong draw.

Europe could benefit from Canada and Australia visa caps

The global race to attract international business students is heating up, and European schools could gain an edge as stricter immigration policies in Australia and Canada potentially make those countries less appealing.

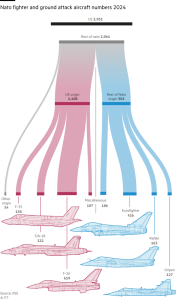

In August, Australia announced a one-third cut in international student visas, capping them at 270,000 for 2025. While the government says this will ease housing pressures, the education sector fears financial losses and a damaged reputation.

“Prospective students who would traditionally consider Australia will now have to consider options in multiple countries,” says Ly Tran, a professor at Deakin University in Melbourne, suggesting Europe could benefit.

Canada is also tightening its stance, extending a two-year cap on student visas to include masters and doctoral students, and reducing numbers by another 10 per cent to 437,000 for 2025 and 2026.

Joseph Milner, vice-dean of MBA programmes of the Rotman School of Management at University of Toronto, notes that it is not the cap itself but the perception that Canada is less welcoming that could deter applicants. “That is where we might see a change in the numbers,” he says. “We are concerned about that.”

Rotman is responding by promoting Canada as a safe destination and offering support to guide students through the visa process.

#Political #shift #weakens #business #schools #appeal #overseas #students