How Trump’s policy could boost the LNG supply wave

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

President-elect Donald Trump famously wants to make America great again. But at least one of his policy ideas has the potential to give European industry a leg up too.

Trump has vowed to encourage upstream production — to a “drill, baby, drill” refrain. He is also expected to lift a Joe Biden-era moratorium on licensing new liquefied natural gas export facilities.

These measures would have an incremental, rather than revolutionary impact. US natural gas production has risen to record levels of about 125bn cubic feet a day, up nearly half over the past decade. While rolling back royalties, compliance and costs might give drillers an extra incentive, the uplift would be capped by the downward pressure on oil and gas prices.

The “temporary pause” on new authorisations for LNG terminals, meanwhile, affected earlier-stage projects. A reversal would not have an immediate impact, although it undoubtedly strengthens the prospects for more LNG supply in the medium term. WoodMackenzie has estimated almost 90mn tonnes per annum (mtpa) of US projects were awaiting for export approval.

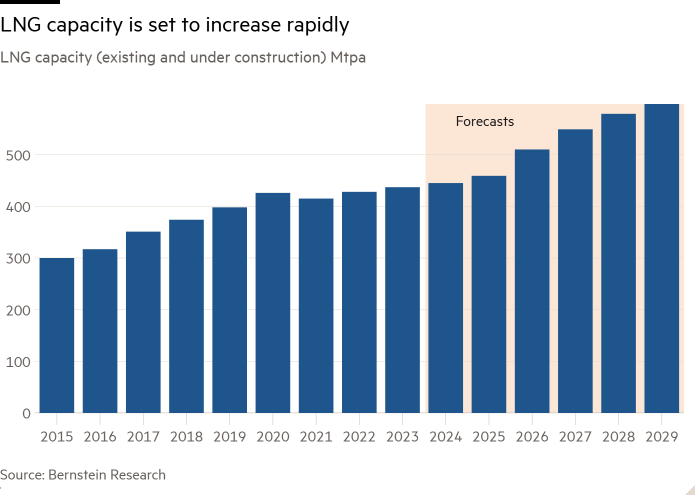

All of this matters because it comes in the context of an LNG market which is already preparing for a glut. Projects with 130 mtpa of capacity are scheduled to come on stream between 2025 and 2027 — equivalent to 33 per cent of existing LNG capacity, according to Bernstein analysis.

That is lower than estimated because projects suffer delays and complications. But it still far outstrips demand growth expected in the period. As this flood of supercooled fuel hits European shores, it is a fair bet it will drive prices down.

Market forces, then, are conspiring to bring cheaper gas to Europe, at least for some time. Geopolitics raises further questions. Trump’s campaign included a vow to bring Russia’s war with Ukraine to a speedy conclusion. The president-elect’s ability to do this remains questionable. It would have momentous implications, of which energy — given Russia’s huge gas reserves — is but one.

For the next year or so, the market will remain subject to bouts of volatility — particularly if Europeans were to experience a seasonal cold snap. LNG supply is still reasonably tight given delays and outages, but European gas demand remains well below pre-crisis levels. Looking beyond that, however, the supply is still coming — and in greater quantities.

For tariff-facing European industries, especially those in energy-intensive sectors such as chemicals and steelmaking, the prospect of a midterm decline in energy prices would come as some relief.

#Trumps #policy #boost #LNG #supply #wave