Bilateral trades hint at global carbon market agreement

Stay informed with free updates

Simply sign up to the Climate change myFT Digest — delivered directly to your inbox.

A breakthrough in the long-running deadlock over rules governing a global carbon market is tipped to be a key outcome of COP29 in Baku.

The existing unregulated trade in carbon credits between companies — the so-called voluntary market, which is worth around $1.5bn a year — has been beset with accounting and integrity scandals in recent years.

But a formalised carbon trading system between countries could help to raise some of the climate finance that developed countries have pledged to deliver. This would be an important win for the COP29 organisers.

If agreed, it would allow governments to claim other countries’ emission cuts towards their own climate targets by trading instruments that represent one tonne of carbon dioxide removed or saved from the atmosphere.

This means countries could cut emissions “in co-operation with others”, making the global race to decarbonise “more effective and faster”, says Dirk Forrister, chief executive of the International Emissions Trading Association, a Switzerland-based lobby group.

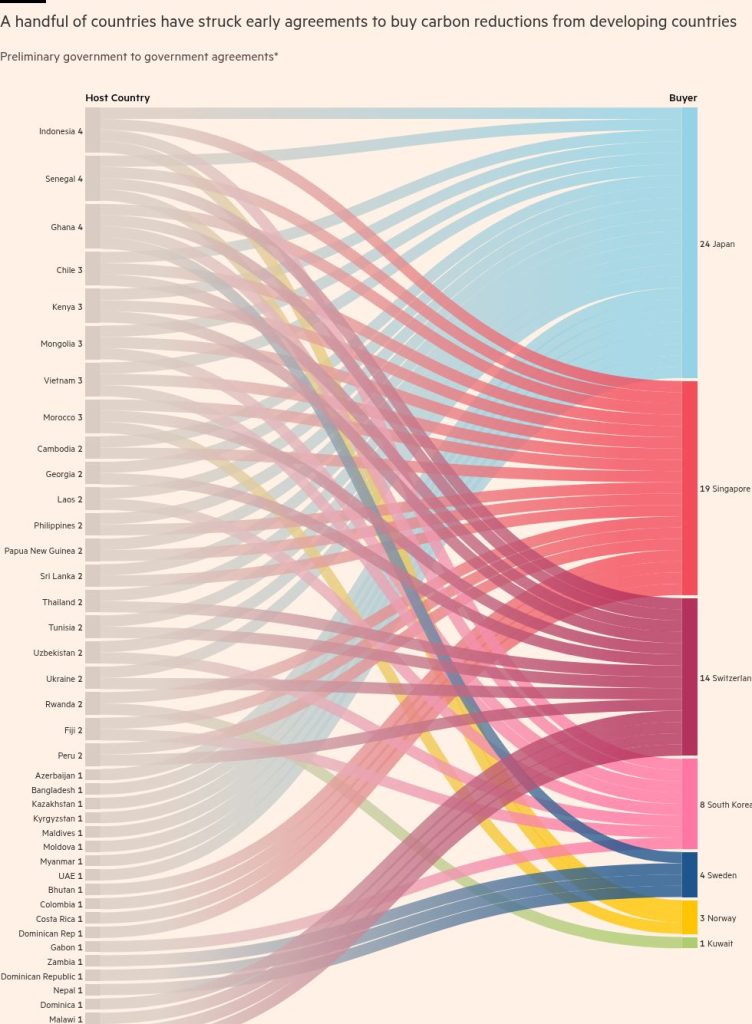

Singapore, Switzerland, South Korea and Japan are among the countries that have already negotiated initial agreements or frameworks that will allow them to buy carbon reductions from developing countries — for example, from tree planting or the sale of cookstoves that use cleaner fuel.

Once this market is given a formal go-ahead, dozens of such deals could be finalised — ending a cycle of failures to resolve debates around UN accounting and reporting guardrails.

People familiar with negotiations are confident that a deal will be struck at COP29 on provisions for bilateral trading between countries, as well as for a centralised UN carbon market that companies can take part in.

They credit the positive political momentum from the hosts and technical work, in recent months, to introduce human rights and accounting safeguards that have reassured experts from the EU and elsewhere.

However, these people say there is still a risk that a final deal could be scuppered, again, if negotiators choose to hold carbon “hostage” to other key issues due to be discussed at COP29. “This is the UN process. It’s a game of moving chairs,” says one.

Even if a deal is struck, it could be slow to translate into a carbon-trading boom. Buying instruments meant to represent a tonne of CO₂ reduced comes with reputational risk.

More broadly, critics argue that polluters should not outsource their responsibility to cut emissions to developing countries. “It’s really important this supplements strong domestic abatement by countries,” said Dexter Lee, head of carbon market negotiations in the UK’s at the Department for Energy Security and Net Zero, at a recent industry event.

Some environmentalists also fear that seller countries could come under pressure to store the CO₂ at the cheapest possible cost, leaving them liable if problems arise with storage — for example, if trees burn down.

International carbon trading generates a lot of “hot air” and debate, says Erika Lennon, a senior attorney at US-based non-profit the Center for International Environmental Law, but is “largely a false solution or a dangerous distraction when what we really need to do is take those [domestic] measures to reduce emissions”.

Countries have promised to submit more ambitious decarbonisation goals to the UN by February 2025. If a deal is struck on a global carbon market this month, though, countries that plan to sell carbon reductions in future could be tempted to set less ambitious goals, warns Stéphannie Galdino, an analyst at carbon analytics company Veyt.

To avoid double counting, countries cannot put carbon reductions towards their climate goals if they have been sold abroad as credits. But Forrister argues that countries buying carbon reductions are likely to set more ambitious targets, as they are no longer limited to using emission cuts inside their borders.

As negotiators thrash out final details, the potential for bilateral dealmaking at the summit could help the carbon market inch further into existence. Dubai-based carbon credit developer Vahid Fotuhi, for example, has been trying to drum up interest from buyers in the first 2.5mn credits that his project to restore degraded mangroves in Mozambique could generate in the next few years. His sales pitch is that wetland ecosystems are better at sequestering CO₂ than forests.

The east African country has not yet formally agreed to sell carbon credits to a buyer country, he says. Such an agreement would reassure buyers that carbon removals will not be counted twice. So COP29 is a chance for Mozambique to finalise discussions on a carbon deal with buyer countries, Fotuhi says. If carbon deals are “like a marriage”, Baku is like a “nightclub”.

“Marriages are rarely forged in nightclubs,” he says. “But, as discussions advance and take further shape, they lay foundations for future bilateral discussions.”

Data visualisation by Janina Conboye

#Bilateral #trades #hint #global #carbon #market #agreement