Japan is on the cusp of an energy storage boom

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Japan’s drivers have been wary of making the switch to electric vehicles. Its EV market share is about a 10th of China’s, and EVs account for less than 1 per cent of all cars in use. But sluggish EV sales do not necessarily spell bad news for battery makers. The rise of solar power could give them a new source of growth.

Solar power has become the largest source of clean energy in Japan this year. Interest among households has been strong, with more than 3mn residential solar systems installed last year. Demand for a similar number of residential batteries should follow soon. Government measures, including Tokyo requiring all new homes built by large-scale homebuilders from 2025 to have solar panels, are expected to turbocharge sales starting next year.

An even bigger boost is expected from virtual power plants, another area of government focus, that will provide further incentive to install residential batteries. Virtual power plants bring together a large number of interconnected home batteries which are linked through a cloud platform and controlled remotely. That allows operators to sell surplus energy from each of the home batteries during power demand spikes, which generates revenue for homeowners participating in the programme. Starting in fiscal 2026, the trade of this type of electricity stored in residential storage batteries will be facilitated in a dedicated market.

Tesla has a head start here. It started building virtual power plant in Japan with its Powerwall batteries in 2021. It is positioned to benefit from a push into local retail chains, by selling its home battery system through Yamada Denki, Japan’s largest electronics store chain, in a partnership with the chain’s operator Yamada Holdings. Yamada has about 1,000 stores nationwide that already sell residential solar systems. Tesla’s battery will be priced at $13,700, which includes installation costs, making it competitive with local rivals such as Panasonic.

During normal times, household power outages in Japan are extremely rare. But it is not unusual for earthquakes and other disasters to cause widespread outages. The Powerwall home battery, for example, stores 13.5 kilowatt-hours of electricity, which is nearly equivalent to the daily power consumption of an average household. Local companies Toshiba, Itochu and Hitachi are among those betting on energy storage systems for growth.

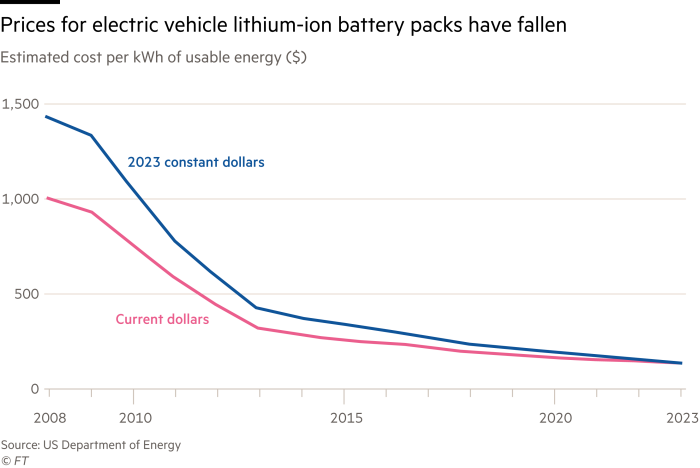

There is much potential in this relatively overlooked sector: the global battery energy storage market will reach as much as $150bn by 2030, estimates McKinsey. Falling prices of battery cells should help wider adoption of home batteries. As EV sales growth slows this year, energy storage will become increasingly important to the top lines of EV and battery makers.

#Japan #cusp #energy #storage #boom