The ‘Tesla-financial complex’ roars back to life

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

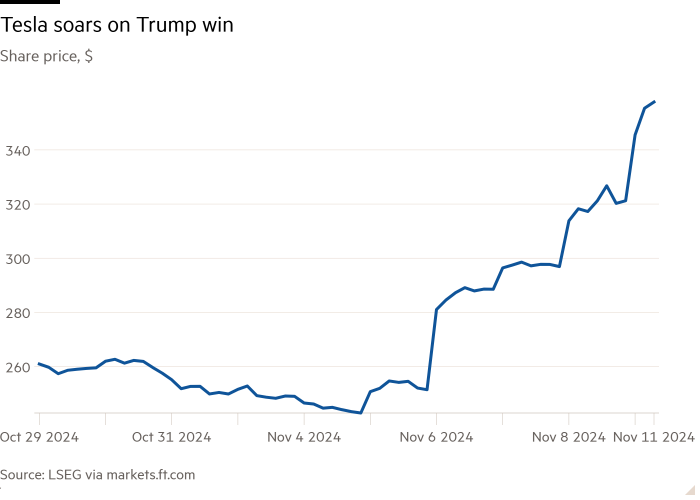

Investors who were betting against Tesla have had a rough few days, Bloomberg writes:

Hedge funds that had short positions against Tesla between election day and Friday’s close took an on-paper hit of at least $5.2 billion, according to Bloomberg calculations based on data compiled by S3 Partners.

[ . . . ]

Since the Nov. 5 election, Tesla shares have gained close to 30%, representing well over $200 billion in additional market value. By Friday, the company’s valuation exceeded $1 trillion. Against that backdrop, hedge funds that had previously built short bets have since rushed to reverse course.

With Elon Musk having months ago tied his fortunes to Donald Trump, the hedgies’ bold strategy did not pay off. In the days since the Republicans’ win, rampant buying of Tesla call options has triggered a classic “gamma squeeze”, according to analysts, with brokers on the other side of the trade forced to buy yet more of the underlying shares to cover their positions.

The numbers involved are “huge” says Rocky Fishman at Asym500. The notional trading value of Tesla options has averaged $145bn a day since the election, according to Fishman’s figures. Last Friday, notional trading volumes hit a stonking $245bn.

That compares with $55bn a day for Nvidia, the second most active single-stock option market, and $310bn a day for the rest of the US single-stock market combined.

Fishman cautions that he doesn’t have a break-down of which of the $310bn is S&P 500 constituents versus non-constituents. “There are meaningful non-constituent contributors to the total,” he told us on Monday, “including bitcoin-related stocks (Coinbase, MicroStrategy), ADRs (Taiwan Semiconductor, Alibaba, MercadoLibre), and election-related stocks (Trump Media).”

But however you cut it, the ‘Tesla-financial complex’ that Robin covered in 2021 looks like it’s back. And with a bang.

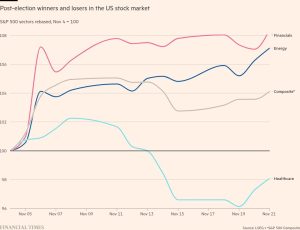

Elsewhere in options-land, S&P 500 implied volatility and put skew have been “absolutely decimated” following Trump’s election victory.

So says Nomura’s Charlie McElligott, who in a note out today describes how investors saddled with pesky risk-management limitations were forced to hedge for a scenario (delayed and disputed election results) that never materialised. Their downside puts have subsequently “turned into a smouldering pile of ash”.

McElligott notes that index call option skew (the difference in implied volatility between out of the money call options versus at the money call options) is now “screaming steeper in violent fashion” as investors chase a Trump-fuelled rally that last week propelled the S&P 500 to its best week in a year. The cross-asset volatility risk premium we wrote about last week has vanished:

[High-res version]

Funds that adjust their equity exposure depending on the prevailing level of market turbulence have thus increased their positions to the highest in over a month, according to Deutsche Bank. Discretionary investor positioning has climbed close to the top of its historical range.

Ignoring markets’ tendency to mean revert, everything is basically awesome and the only way is up, up, up!

#Teslafinancial #complex #roars #life