Bayer’s turnaround just got even tougher

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In a crisis, psychologists recommend focusing on factors within our control. Bayer’s chief executive Bill Anderson has duly been focusing on self-help measures such as efficiencies and cost cuts as he seeks to turn the troubled German conglomerate around. Deteriorating market conditions, however, mean he will have to dig even deeper.

Bayer’s original problem is that it is still struggling to recover from its ill-fated $63bn takeover of US crop sciences company Monsanto, which saddled it with a hefty debt load and costly litigation over the weedkiller Roundup. It has promised to deleverage from more than three times net debt to ebitda, to 2.5 times. Declining earnings make this a moving target. A cut to its earnings forecast on Tuesday means what was already a very tricky two-to-three-year turnaround has become even more taxing.

Bayer’s latest troubles largely stem from its crop science business — the second biggest contributor to earnings last year. Here it is battling competition from lower-priced agricultural products, plus problems in Latin America. Growers in Argentina, for example, are planting less corn after the proliferation of a certain insect hit harvests last year and amid drought fears. It also has regulatory issues, including a delayed approval for soya bean herbicide Dicamba.

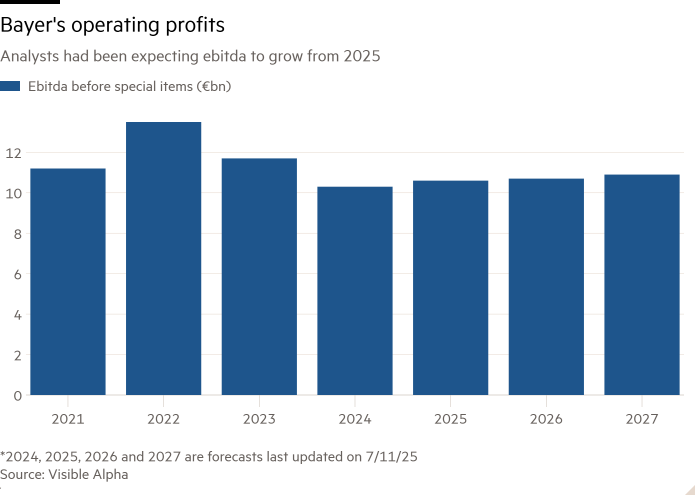

The main worry is 2025. Even before Tuesday’s update, the consensus forecast for 2024 ebitda before special items, at €10.3bn, was already below Bayer’s lowered guidance of €10.4bn to €10.7bn. But analysts had expected earnings to start growing again from next year, according to forecasts on Visible Alpha. Shares in Bayer dropped to a two-decade low in response, taking their decline to more than 37 per cent so far this year.

True, Anderson could point to some progress on his turnaround plan, unveiled in March. This involves slashing jobs — about 5,500 since the start of the year — and speeding up decision making. Bayer is also seeing some success with newer drugs such as cancer medicine Nubeqa. It needs these to offset rising generic competition for its best-selling anti-clotting medication Xarelto, which generated sales of more than €4bn last year. The group has managed to make some progress in reducing debt, which was down 4.7 per cent quarter on quarter to €35bn.

These problems do not directly result from the Monsanto takeover agreed back in 2016 — a deal so catastrophically bad that it is now the stuff of corporate legend. But it is hard to avoid the conclusion that the Monsanto purchase has overburdened Bayer’s balance sheet, put management under pressure and left shareholders rightly doubtful that Anderson can turn things around without something more radical — such as a break-up.

#Bayers #turnaround #tougher