Vodafone may yet be worth hanging on for

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Telecoms and governments go together like smartphones and teenagers. Just ask Vodafone. It is in the middle of a tricky turnaround plan, but the signal is being distorted by interventions from politicians and regulators in Germany and the UK. Not all of them are helpful.

Take the changes to Germany’s cable television laws. Fees for TV services can no longer be bundled with rent at housing associations, and many tenants are opting to switch provider. That was writ large on Vodafone’s earnings on Tuesday, since Germany makes up 42 per cent of its preferred measure of ebitda. Overall that came to €5.4bn in the first half — roughly flat year on year. The shares fell 6 per cent.

The German law, effective from July, had at least been well signalled, and Vodafone chief Margherita Della Valle isn’t changing her forecasts of how the company will perform this year. She’s also selling some underperforming assets and raising money; €4.1bn from the sale of Vodafone Spain, €1.3bn from the sale of a stake in Vantage Towers.

Costs and debt are falling in the process. Debt has shrunk about 12 per cent to €31.8bn over the past twelve months, on similar operating profits.

And, thanks to a newly pragmatic stance by the UK’s Competition and Markets Authority, its long-plotted merger with rival Three looks closer to actually happening.

This decision, which has more modest strings attached, will mark a bigger step-up in Vodafone’s turnaround. The company is counting on savings from pooling capital expenditure and IT networks, marketing, logistics and the like, which it reckons should have a present value of £7bn.

The CMA’s volte face appears to recognise reality: that a tie-up, rather than depriving consumers of competition and ramping up tariffs, will mean a greater ability to invest. For now, Three and Vodafone’s returns are both sharply below their cost of capital. Consumers, the theory goes, should also benefit as money goes into ensuring quality (fewer failed calls and wider availability of 5G) rather than parallel infrastructure. Three main operators will still compete — plus a robust band of resellers such as Tesco Mobile, Sky and Lebara, which together account for almost a fifth of the market.

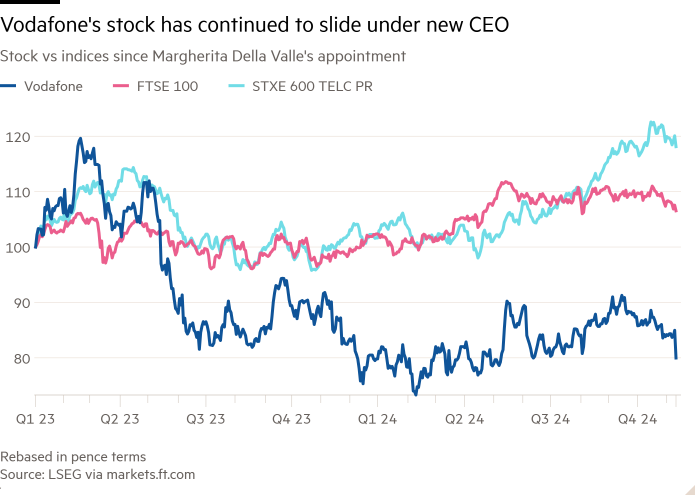

The CMA’s latest stance should send a positive signal to shareholders. The trouble is that they have been here before and the hold-and-wait pattern has yet to pay off: witness the current unpicking of the empire-building years. Still, if Della Valle can deliver on the merger promises, Vodafone will prove worth hanging on for.

#Vodafone #worth #hanging