Rachel Reeves might come to rue her ‘read my lips’ moment

Stay informed with free updates

Simply sign up to the UK tax myFT Digest — delivered directly to your inbox.

Rachel Reeves took her biggest gamble since becoming chancellor last week. It had nothing to do with annoying wealthy agricultural land owners or pensioners with inheritance tax increases and the withdrawal of universal winter fuel payments. Instead, it was emulating George HW Bush and his infamous 1988 Republican convention pledge: “Read my lips. No new taxes.”

The October 30 Budget with £40bn of tax rises was a “once-in-a-parliament reset”, Reeves said on the day Donald Trump was declared president-elect. “We will never need to do another Budget like this again.”

“We are not going to be coming back with more tax increases or, indeed, with more borrowing,” the chancellor added. In words that are less likely to be remembered, she also said that this might not be a cast-iron guarantee because, “with uncertainties about what is happening in the global economy, I am not going to write five years’ worth of Budgets now”.

Regardless of the important caveat, just as Bush’s pledge came back to haunt him, Reeves now runs the risk of regretting being so categoric about the public finances.

There is no doubt that the chancellor has taken quite a lot of risk out of the nation’s books by acknowledging the need for many existing costs of the state to be recognised. I hope and expect the Treasury has also padded the figures a little to allow some wriggle room.

Things can also go right for Reeves over the next few years. There is a decent chance government borrowing costs will fall back without lower growth, reversing trends seen since 2021. Productivity growth might well return to something closer to the UK’s postwar average. And the employment growth of the 2010s could come back. In each case, there would be a significant windfall for the public finances.

Public sector productivity can improve with encouraging signs emerging in the NHS this week. The chancellor’s growth strategy of stability, higher public investment and an emphasis on sweeping away planning and other constraints to doing business can bear fruit. All these things can happen.

That said, it is easier to write down the reasons Reeves might find she is, indeed, forced to come back to parliament seeking higher taxes to fund a larger state.

Spending on health and social security has been rising as a share of total government expenditure for 70 years, offset by squeezing defence, housing and local government services. The pips are squeaking in these latter areas with no let up in pressures on the NHS, pensions or social care.

With the baby-boomer generation retiring, this is the first decade in which the British state really feels the financial costs of population ageing. It is not going away and ensures that even if more taxpayer money buys more services, it is spread over more elderly recipients so individuals do not feel the state is offering them a better deal.

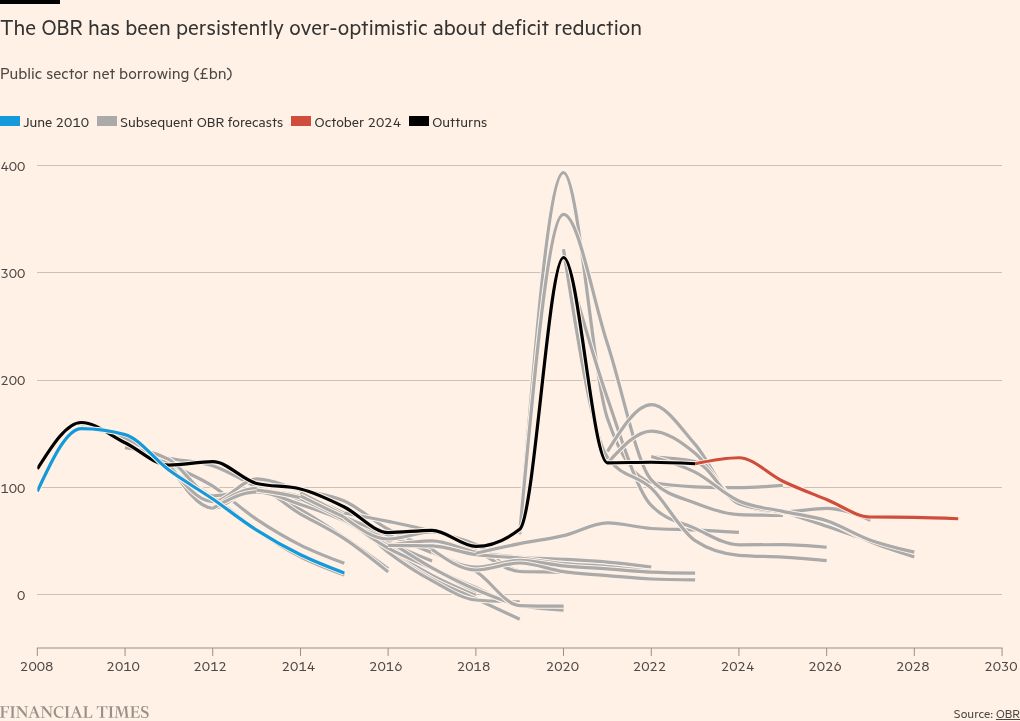

It also is worth repeating that although many politicians rage at the independent Office for Budget Responsibility for its miserable forecasts that constrain their ability to invest for growth, the largest persistent errors with the fiscal watchdog’s predictions have come from over-optimism on productivity growth and public borrowing.

For Bush senior, the consequences of “read my lips” were devastating. Having accepted the need for higher taxes in 1990, the words undermined his 1992 election prospects. Multiple apologies counted for little.

In an uncertain world, promises are dangerous. While much of the controversy surrounding the Budget and Labour’s economic choices has been vastly exaggerated, Reeves has boxed herself in and will find it difficult to respond to well-known risks. She has always needed to be a competent chancellor. She also now needs to be lucky.

#Rachel #Reeves #rue #read #lips #moment