why troubles in France and Germany are transforming EU bond markets

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is head of European rates research at Barclays

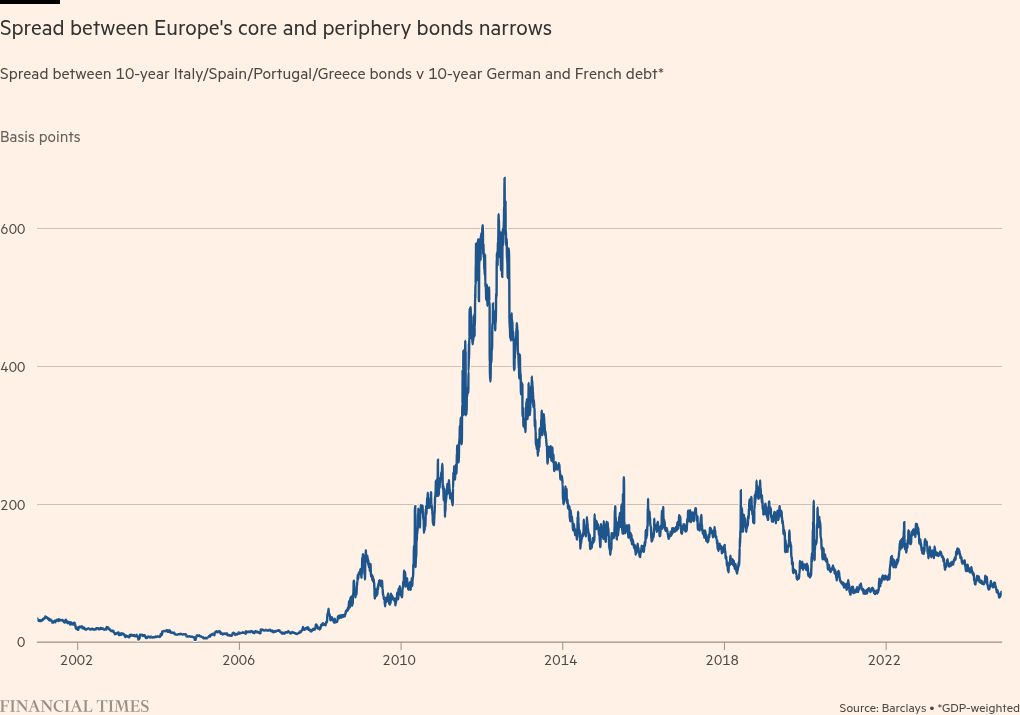

An upheaval is under way in Europe’s sovereign bond markets. The spread between the yield on bonds of the so-called periphery countries — namely Greece, Italy and Spain — has been compressing relative to the core countries, namely France and Germany.

In plain English, this means the premium investors demand to lend to countries once deemed “riskier” is falling away. Investors are embracing peripheral bonds with open arms, whereas the debt of core countries appears to have been knocked off its perch. The bottom line is that the basic core-periphery distinction is out of date.

This was defined during the European debt crisis more than a decade ago, based on countries’ economic and fiscal prowess. It has since become a key part of the market’s lingo. Why is it changing now? I see three main reasons.

One is the Next Generation EU programme, which was launched by the European Commission following the Covid pandemic. Cheap grants and loans available to countries through the programme have created strong incentives for governments to maintain cordial relations with the commission.

This is not to say that political faultlines have completely disappeared and the euro area has become one big happy family. Yet, streams of funds flowing from the NGEU programme are helping to prevent frictions in the common currency region from rupturing. Talk of “Grexit” and “Italexit,” for example, has become a thing of the past.

Furthermore, the presence of the European Central Bank’s Transmission Protection Instrument, which aims to counter any disorderly market dynamics by purchasing European sovereign bonds, provides solace that a policy deterrent to fragmentation is in place even if the situation to use it has not presented itself yet.

You could take that argument further. If risks of fragmentation are markedly diminished compared with the years following the European debt crisis and before the launch of the NGEU, then core-country bonds can no longer claim to represent the ultimate, AAA-rated, haven asset denominated in euros. And without that distinction, today’s European sovereign bond market should continue to look more and more like it looked before the financial crisis, with structurally tighter cross-country spreads.

From the perspective of economic prowess too, the difference between regions has diminished since the pandemic. Germany’s growth model, for example, was widely regarded as the engine of the euro area. But it has suffered one setback after another in recent years. It is questionable whether politicians have the will to address a daunting array of structural economic challenges, including the slowdown of China’s economy, the effects of fierce competition for electric vehicles, and the loss of access to cheap Russian gas. Simply put, Germany is transitioning from a high-growth, low-borrowing economy into a low-growth, higher-borrowing economy. It is no wonder that Bunds have lost their specialness.

Finally, what has perhaps taken the market most by surprise is how the periphery countries have been relative havens of political stability for the past few years. Even in Italy, where the political merry-go-round has seen a plethora of governments since 1945, the right-wing coalition led by Giorgia Meloni has kept political noise to a minimum since its inception in October 2022.

In sharp contrast, a stormy political summer in France has been followed by the end of Germany’s dysfunctional coalition. That has created new nervousness among investors as to the future path of travel. In fact, France’s political logjam and the resulting widening in French bond yields versus peers contained a vital lesson — the market is unlikely to focus on a country’s debt and deficit dynamics unless politicians give it a reason to do so. This is why Italian and Spanish bonds have performed better in the absence of political turmoil, whereas economic challenges have weighed on similar bonds of France and Germany.

The question is whether this regime shift has run its course. Despite a sustained narrowing in the spread between core and periphery bond markets in recent months, the core’s structural challenges and domestic political wranglings are likely to keep markets and investors concerned about their prospects.

Meanwhile, periphery countries look likely to keep closing gaps in yields, thanks to concerted efforts from policymakers to tighten deficits, and also support from the ECB’s policy-easing cycle and the NGEU. Investors will do well to watch this train.

#troubles #France #Germany #transforming #bond #markets