A new plan for finding climate cash

This article is an on-site version of our Moral Money newsletter. Premium subscribers can sign up here to get the newsletter delivered three times a week. Standard subscribers can upgrade to Premium here, or explore all FT newsletters.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

Hello again from COP29 in Baku. UN climate summits are always tense affairs, but this one has already had more than its fair share of open discord.

That’s thanks in part to Ilham Aliyev, president of host nation Azerbaijan, who used a speech to island nations on Wednesday to deliver a blistering criticism of France, accusing it of “killings of innocent people” in its territory of New Caledonia. France has historically close relations with Armenia, with which Azerbaijan has a long-running conflict. France’s environment minister Agnès Pannier-Runacher cancelled her plans to attend COP29, condemning Aliyev’s remarks as “unworthy of a COP presidency”.

Separately, Argentina has recalled its negotiating team from the conference — a day after its rightwing President Javier Milei spoke with US president-elect Donald Trump. That has sparked renewed concern that Trump’s dislike of international climate collaboration could prove contagious.

Even without all this geopolitical upheaval, the negotiations at COP29 on a new global climate finance goal would have been hugely difficult. The first few days of discussions don’t seem to have brought parties much closer to consensus. But a timely new paper released yesterday gave some important ideas on what a good outcome could look like, as I explain below. — Simon Mundy

COP29 in brief

-

Countries that “do not support the phase-out/transition away from fossil energy” must not be allowed to host future COPs, argues an open letter with 22 signatories, including former UN head Ban Ki-moon and former UN climate head Christiana Figueres.

-

At least 1,773 lobbyists for the fossil fuel sector have been granted access to COP29, according to an analysis by the non-profit coalition Kick Big Polluters Out.

-

New taxes — including levies on billionaires, frequent flyers, cryptocurrency miners and plastic producers — could yield hundreds of billions of dollars a year for climate finance, says a new report from a body backed by governments including Barbados, France and Kenya.

Where the money might come from

The past couple of days of negotiations at COP29 have been pretty discouraging. The draft text for an agreement on the crucial new global finance goal (which you can find here) has mushroomed from 9 to 33 pages and is cluttered with dozens of options, reflecting a serious variance of opinion between wealthy and developing nations.

But yesterday brought the publication of a major report from an important international expert group that may well influence the discussion among negotiators in the coming days. If so, it could lift the chances of a deal that would generate a badly needed paradigm shift in international climate finance.

The Independent High-Level Expert Group on Climate Finance (IHLEG), established by the COP26 and COP27 presidencies, is a 32-member body co-chaired by economists Amar Bhattacharya, Vera Songwe and Nicholas Stern.

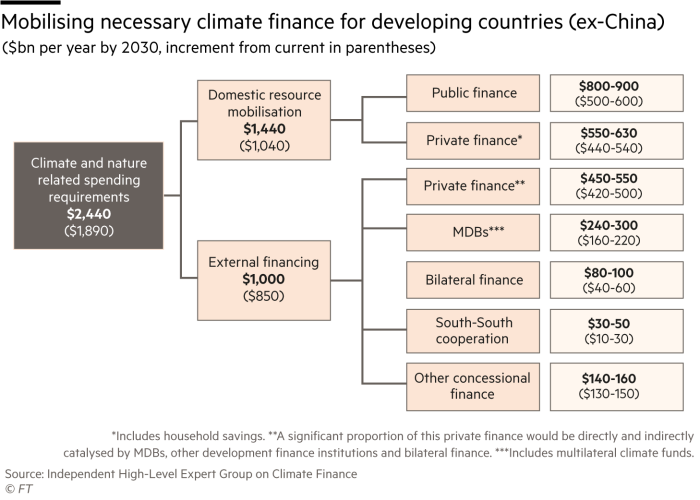

Its new report backs up developing nations’ calls for a dramatic increase in international climate finance. Developing economies excluding China, it estimates, will require $2.4tn in climate-related finance per year by 2030, if the world is to achieve the targets set out in the Paris agreement. That’s more than a fourfold increase from the current level of about $550bn.

A key bone of contention in Baku has been the call from the EU and other rich countries for a new climate goal containing an investment target for all sources of finance, in addition to a pledge for contributions from developed nations. This has been resisted by developing economies, which worry that such a move would weaken the emphasis on the requirement for rich countries to provide climate finance — a responsibility that was placed on 25 developed economies under the UN climate convention back in 1992.

But the IHLEG report implies that developing nations should avoid focusing too narrowly on direct financial support from rich-world governments.

Developed nations’ earlier pledge to mobilise $100bn a year in climate finance for developing countries was met, two years late, in 2022. In that year, they provided $41bn through bilateral public finance, according to the OECD. A further $50.6bn was channelled through multilateral financial institutions. And another $21.9bn of private-sector finance was deemed to have been “mobilised” by governments through catalytic investments or other means.

The IHLEG report calls for a significant increase in climate finance from developed-nation governments. Bilateral finance should double to about $90bn a year by 2030, it says. Multilateral institutions should triple their climate finance provision to about $260bn a year, through more aggressive use of their balance sheets and additional capital contributions. The report also calls for a deployment of $150bn a year in other forms of concessional capital, including the reallocation of special drawing rights at the IMF, and new taxes on high-emitting sectors.

But all that adds up to only $500bn a year — less than a quarter of the total finance needed. Another $500bn would need to come from international private-sector sources, the IHLEG report said. Crucially, it added, developing countries (excluding China) will need to mobilise three-fifths of the necessary finance domestically from both public and private sources — notably through tax reform, redirecting fossil fuel subsidies and carbon pricing regimes.

This finding might seem at first glance to reduce the pressure on rich nations. But, as noted above, the report still calls on them to undertake a massive expansion of financial support, through both bilateral and multilateral means, and do a far better job of catalysing private investment. Moreover, if less developed countries are to deploy domestic capital at the level required, multilateral institutions and rich-world governments can play a big role in helping them build the capacity to do so.

The challenge for developing-nation negotiators at COP29 is to find a deal that will maximise their prospects of mobilising climate finance from all domestic and international sources — without letting their rich-world counterparts off the hook. (Simon Mundy)

Quote of the day

Mia Mottley, prime minister of Barbados, is hoping to hold a meeting with US president-elect Donald Trump to discuss climate change:

Let us find a common purpose in saving the planet and saving livelihoods. We are human beings and we have the capacity to meet face to face, in spite of our differences.

Beyond COP: As Trump’s Washington turns on ESG, can investors adapt?

Donald Trump’s imminent return to the White House will raise a plethora of new risks for investors pursuing environmental, social and governance (ESG) strategies.

In an interview this week, Republican congressman Bill Huizenga told me that dismantling ESG-friendly policies will be a priority in the new year, now that his party has full control of the legislature.

“We are going to have the ability to move pretty quickly — as the speed of Congress goes,” he said. In September, the House passed legislation entitled “Prioritising Economic Growth Over Woke Policies”. Among other things, the bill would ban shareholder proposals if they are deemed “environmental, social or political” in nature. Thus far, it has failed to gain traction in the Democrat-controlled Senate.

Huizenga noted this legislation passed the House with three Democrats voting for it. “I can’t imagine that we are going to lose people,” he said. This September vote showed that “we already have a path forward that was bipartisan”, he added.

Yet for some investors, the path forward for ESG is more nuanced than US Republicans would like to believe. Although enthusiasm for divestment is waning, that’s in part because divesting from oil and gas companies creates a buying opportunity “for those indifferent to the ESG case”, Goldman Sachs said in a November 13 report.

Already before the election the bank said there was “a notable shift in ESG flows from divestment [or] net zero funds toward transition funds focused on incremental green investments”.

Transition strategies and funds dedicated to improving big fossil fuel emitters were emerging as a growing category for ESG funds, Goldman Sachs said. These types of environmental improvement funds hit $50bn of assets under management in July, up from $15bn at the end of 2020.

For many investors, ESG is less a matter of shareholder proposals and divestment than a tool to identify corporate risks and opportunities that do not appear in financial statements.

In a report this week, analysts at Jefferies highlighted instances where “social” criteria boosted investment portfolios. In the information technology sector, companies with the highest proportion of women on their boards between 2021 and 2023 outperformed those with the lowest proportion of female directors by 35 per cent.

For investors who see ESG analysis as a tool to make money, this approach may prove resilient in the face of dramatic political change. (Patrick Temple-West)

Smart reads

Trails of destruction The Philippines is reeling from five major storms in three weeks, which have killed at least 160 people and displaced 9mn. Another typhoon is expected in the next few days.

Competitive advantage An end to electric vehicle subsidies under the incoming Trump administration could provide a boost to Elon Musk’s Tesla.

Prepare for impact The global community working to tackle the climate crisis is well prepared to handle the effects of Donald Trump’s return to power, argues Laurence Tubiana, an architect of the Paris agreement.

Recommended newsletters for you

FT Asset Management — The inside story on the movers and shakers behind a multitrillion-dollar industry. Sign up here

Energy Source — Essential energy news, analysis and insider intelligence. Sign up here

#plan #finding #climate #cash