The yawning investability gap between US banks and UK peers

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Optimists express confidence that the “special relationship” between the US and UK will survive even Donald Trump’s most anarchic instincts. Perhaps. But our governing values and fortunes are now an ocean apart at least in the short-term, underpinned by an ascendant US libertarianism on the one hand and on the other a more paternalistic UK government.

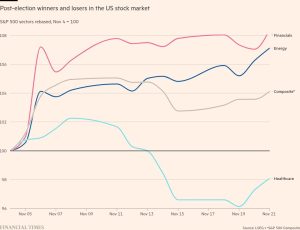

Nowhere is that more evident than in the financial sector. Consider the performance of the countries’ biggest banks over recent weeks. Wall Street has been on a tear. All the big US banks have enjoyed double-digit percentage share price jumps, led by Goldman Sachs, up 15 per cent since the November 5 election.

There are a number of drivers. Promised tax cuts would boost profits. So could a boom in oil drilling. But the biggest win of all will be Trump’s deregulatory agenda. Already in September, the powerful US banking lobby had forced the architects of the so-called Basel III endgame into a humbling dilution of planned rules on capital and liquidity (even using direct appeals to the public via football game advertising slots to amplify their message). The toned-down re-proposal remains reasonably close to the global Basel blueprint and going some way to address the regulatory shortcomings exposed when Silicon Valley Bank and other banks failed last year. But there is now a widespread expectation that these watered-down rules will be junked, too.

In the name of efficiency, Trump has explicitly promised to “slash” regulations of all kinds. For the banks that is likely to mean not only the elimination of new Basel rules, but also an easier regime for the mergers and acquisitions they advise on and less combative regulators.

The contrast with UK banks’ fortunes could not be starker. Already — thanks to their smaller scale and a weaker economy — the valuation of UK banks lagged US peers badly. But some lenders’ shares plunged further last month, after a surprise Court of Appeal decision that judged historic car finance commission payments to be illegal. Close Brothers, a leading operator in the market, has seen its stock almost halve in value since the late October ruling. Shares in Lloyds, Britain’s biggest high street bank and car finance lender, are down more than 10 per cent. (The ratio of Lloyds’ price to the book value of its assets is now just 68 per cent, compared with more than 200 per cent for JPMorgan, the biggest of the US banks.)

The car finance affair has echoes of the misselling of payment protection insurance — a scandal that cost banks more than £50bn in compensation. For motor finance, RBC analysts currently estimate the industry as a whole could be forced to pay out up to £23bn in redress and legal costs.

There were clearly some egregious incentives in place across the car finance industry. Part of the case on which the Court of Appeal ruled related to an undisclosed arrangement whereby car salespeople earned higher commissions if they were able to trick customers into higher interest loans. But the court went far further than that. By ruling other fixed commission arrangements illegal, unless disclosed in detail and knowingly agreed to by a customer, it has set a legal precedent that lawyers and financiers agree could have huge ramifications: suddenly any finance you get through an incentivised intermediary — from mortgages to buy now pay later loans to insurance — could potentially be deemed a breach of fiduciary law.

Cue a frantic phase of lobbying by financiers and a desperate hope that the UK Supreme Court, as the final arbiter of the law, intervenes. At stake, bankers say is the broader reputation of the UK as a predictable place to do business. This may partly explain the enthusiastically pro-City rhetoric in chancellor Rachel Reeves’ Mansion House speech last Thursday, in which she told her delighted audience that financial regulation had “gone too far”. Reforms would include overhauling consumer redress systems “to create a surer climate for investment”, as well as enhancing the growth remits of regulators.

Though she didn’t explicitly mention Trump and the competitive threat posed by his plans for regulatory bonfires, her reform agenda has clearly acquired more urgency. Balancing that with the just treatment of wronged consumers is a huge challenge — but it is not as big as the one facing Britain’s banks as they contemplate the yawning chasm between their own investability and that of their US peers.

#yawning #investability #gap #banks #peers