Offshore oil is back. At what cost?

About 150 miles south-east of the US city of New Orleans, Shell’s newest oil platform looms above the choppy waters of the Gulf of Mexico. Dubbed Vito, the structure embodies a new approach to offshore drilling both for the company — and the industry at large.

“Vito represents the future of Shell in the Gulf of Mexico,” says Ireti Omotoso, Shell’s general manager for US growth assets, over the roar of compression equipment.

“She is faster, leaner, creates less emissions and is technologically more advanced than earlier platforms,” he claims. “She does a lot more for less.”

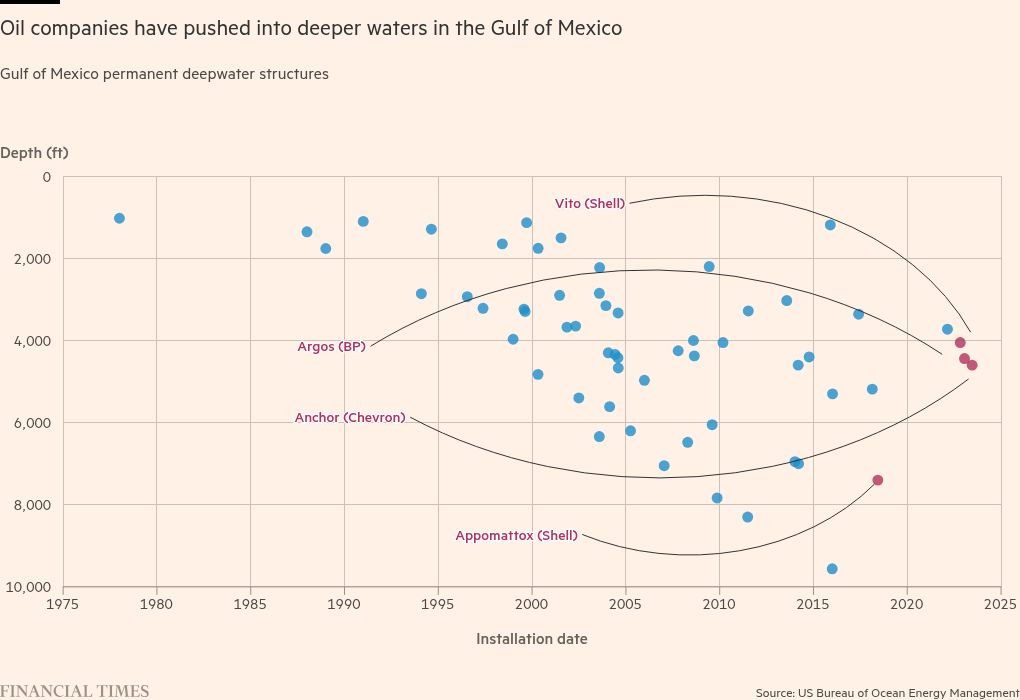

Vito is part of a new generation of facilities being deployed by the industry as it cranks up spending on deepwater drilling in waters 150 metres below the surface, banking on the world remaining thirsty for hydrocarbons for years to come.

The industry’s pitch to investors is that new technologies and efficiency gains can slash the hefty pricetag of deepwater drilling, while dramatically lowering emissions during the extraction process.

The surge in interest in offshore exploration is a reversal of fortune for a source of oil removed from the spotlight in the wake of catastrophic spills, weaker prices and the arrival of the US shale boom.

But plumbing the depths for hydrocarbons is back in vogue. Shale’s once explosive growth has faded and companies are now searching for new sources of oil and gas. Russia’s full-scale invasion of Ukraine caused prices to soar, leaving companies awash with cash at the same time many governments are prioritising energy security over climate targets.

This has encouraged the industry — and its investors — to greenlight new ventures, speed up their exploration of new frontiers in Africa, South America and Asia and drill deeper into the seabed in search of discoveries.

“This comeback looks set to make the 2020s deepwater’s decade,” says Espen Erlingsen, senior partner at consultancy Rystad Energy.

Companies will pour almost $104bn into the space this year, according to estimates from Rystad, up by almost half since 2020 and the highest level since 2016. By 2027, that figure will rise to nearly $140bn. The uptick has fuelled a rush for equipment: last year, the price of hiring drill rigs hit a nine-year high, according to data provider RigLogix.

But the industry faces opposition from environmentalists alarmed at the prospect of locking in billions of barrels of extra production that will continue pumping for years to come.

As world leaders gather at the UN COP29 climate summit in Azerbaijan, green groups say industry is ignoring a key pledge by governments to transition away from fossil fuels.

They accuse Shell and BP of diluting their climate targets and worry that drilling to new depths could trigger another environmental crisis like the 2010 Deepwater Horizon disaster, the worst marine spill in history, which killed 11 people.

Those fears have been exacerbated by the re-election of Donald Trump, who has promised to loosen environmental rules and allow companies to “drill, baby, drill”. But analysts expect his presidency to have little impact on production in the near term. Companies focused on delivering returns to shareholders are reluctant to open the taps too quickly, which would risk oversupplying the market and hurting profitability.

“Big Oil’s attitude shows a lack of imagination beyond oil and gas,” says Mark van Baal, head of activist group Follow This. “At a time when the world must rapidly transition away from hydrocarbons, these companies are betting on decades-long fossil fuel projects and pouring huge amounts of capital into a market that will start declining before the end of the decade.”

Yet, for companies, the potential prize is immense. Off the coast of the South American nation of Guyana a brawl over the largest oil find in a generation is playing out between ExxonMobil and Chevron, the two biggest western oil companies.

Exxon is seeking to block its smaller US rival from buying into the so-called Stabroek Block, through its $53bn acquisition of Hess, which holds a 30 per cent stake in the project. Exxon, which owns 45 per cent, insists it has a right of first refusal and has launched arbitration proceedings.

The project is estimated to generate $170bn in profits between 2024 and 2040 for Exxon and its partners. Guyana will receive $190bn over the same period, according to Wood Mackenzie forecasts.

The discovery — which is rapidly transforming Guyana into the world’s newest petrostate — has spurred new exploration by oil majors and some national oil companies in frontiers from Brazil to Angola.

Last month, France’s TotalEnergies greenlit its $10.5bn GranMorgu project in Suriname, which borders Guyana. Off the coast of Namibia, Portugal’s Galp, along with Shell and Total, have also made huge discoveries.

The renaissance in offshore drilling has big geopolitical implications. For the past 12 years, the shale patch, dominated by the US, has been the biggest source of western oil growth and transformed the US into the world’s top supplier.

But next year, deepwater is predicted to outstrip shale as the biggest source of production growth outside the Opec cartel, giving it a crucial role in western capitals at a time of growing international tension.

“Towards the end of this decade, deepwater will be the key, if not the only, source of non-Opec oil growth,” says Erlingsen.

In the Vito control room, dozens of screens flash showing metrics on production, emissions and efficiency. But, in reality, the platform’s wells are controlled from its real nerve centre, back in New Orleans.

All of its operations can be managed from shore, where engineers use virtual reality headsets to carry out checks and direct changes — keeping the number of people needed on board the platform to a minimum. Drones carry out tank inspections that would previously have fallen to people.

At the same time, equipment has been stripped back to the essentials, with a single production train and no redundant backups. “In the decision making around Vito, it was: take it all back down to bare bones,” says Colette Hirstius, head of Shell’s Gulf of Mexico operations.

At 22,000 tonnes, Vito, which began pumping oil last year, is a third of the weight of Shell’s Appomattox, brought online in 2019. Vito is designed to hold 60 people onboard, versus 180 on its predecessor. But it is powerful enough to pump up to 100,000 barrels of oil equivalent (boe) a day, a capacity equal to about 60 per cent of Appomattox’s.

The industry’s new offshore model means it can operate much more efficiently than it did before. The average cost of developing deepwater fields has almost halved over the past decade from around $14/boe to $8/boe, according to Rystad.

“In days gone by, we would develop lots of big iron [structures],” says Rich Howe, Shell’s executive vice-president for deepwater. “Today I think our increased activity is much more through small, fast, agile, short-cycle time, smaller assets.”

Technological advances are also allowing the industry to tap previously out of reach barrels, in deeper waters and under ultra-high pressures.

More than 130 miles from Vito, Chevron in August started production at its latest platform, Anchor, which is recovering oil from a reservoir six miles below the water surface.

The $5.7bn project is the first in the world designed to withstand 20,000 pounds per square inch of pressure in deep water, about a third more than previously deployed, equivalent to the pressure exerted by 650 medium-sized bulldozers.

“Anchor is a big deal,” says Bruce Niemeyer, Chevron’s president of exploration and production in the Americas. “It is a foundational development in terms of what’s been accomplished here and it opens another tranche of opportunities.”

Shell and BP are planning to introduce similar ultra high pressure technology at neighbouring fields in the Gulf of Mexico, a long-standing test bed for technologies that are later deployed at other locations around the world.

$8/boeAverage cost of developing deepwater fields, down from $14/boe a decade ago

But while companies herald a new era in offshore drilling, the increase in activity — and the plumbing of new depths — has raised concerns in some quarters.

The industry is haunted by the explosion on the Deepwater Horizon drilling rig in BP’s Macondo prospect. Over 87 days, 134mn gallons of oil poured into the northern Gulf — killing up to 800,000 seabirds and almost wiping out the Rice’s whale.

The catastrophe contributed to a period of slower growth in offshore drilling — a factor later compounded by the growth of shale and the 2014 price crash.

“Everybody became super cautious, in particular in the Gulf of Mexico,” says TotalEnergies chief executive Patrick Pouyanné, highlighting the $60bn in different penalties BP was forced to pay.

The industry points out that safety measures have changed considerably since the accident, including sweeping improvements in spill control.

“It’s an event that forever shaped our company and, in fact, reshaped and changed the industry . . . not just in the Gulf of Mexico, but globally,” says Andy Krieger, senior vice-president for BP operations in the region.

“What is fundamentally different and changed is the mitigations in place and the management of that risk and the rigour with which that risk is managed.”

But many experts and environmentalists are wary. “We [the world] came up short when we expanded the development and went deeper and deeper without a lot of forethought about the new risks involved,” says Donald Boesch, professor of marine science at the University of Maryland, who was appointed by President Barack Obama to the National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling.

“Now we’re treading into new territory where there’s even greater risk with respect to the pressure on, and the depth, of the wells themselves.”

Though improvements have been made, many of the commission’s recommendations were never implemented and the failure of the US Congress to embed them in legislation means they can be rolled back.

Leo Lindner, who worked as a mud engineer on Deepwater Horizon and lost several workmates in the tragedy, says the well blowout reflected how industry put “profit before people” and a failing on the part of regulators.

“The oil industry is so absolutely powerful that regulators don’t actually regulate, they facilitate these companies,” he says. “And when regulators constantly defer to the oil companies, then the risks increase.”

But what most worries Linder, who now works for True Transition, a group that helps oil and gas workers find new employment in emerging fields, is that the offshore drilling boom could bring a return of the “hubris and swagger” of oil executives — with devastating consequences.

Opponents of the renewed appetite for offshore drilling are bothered by a broader challenge: by spending billions of dollars on multi-decade projects, companies are locking in oil production at a time when the world urgently needs to transition away from fossil fuels.

The International Energy Agency said in May 2021 that if the world is to keep temperature rises below 1.5C by 2050 then no new fossil fuel exploration should be carried out.

A report last month from the World Meteorological Organization showed emissions hit a record high in 2023, with carbon dioxide concentrations increasing by more than 11 per cent in 20 years — faster than at any time in human history.

“You wonder, if we’re serious about our ambitions to approach net zero by 2050, why are we continuing to put in infrastructure to provide resources that are going to bring us well past the middle of the century [in terms of production],” says the University of Maryland’s Boesch.

But the industry argues that so long as oil is required, new deepwater platforms can produce at a much lower carbon intensity than before.

“Not every barrel is created equal,” says Hirstius, Shell’s Gulf of Mexico boss. “The barrels that we produce from this region have among the lowest greenhouse gas emissions in the world.”

But environmentalists reject the industry’s green pitch, countering that it does not matter how low carbon a company’s production is when most of the emissions come from the burning of the oil.

“In short, it’s a bit of a rubbish argument,” says Mike Coffin, head of oil, gas and mining research at Carbon Tracker, an independent think-tank. “Lower operational emissions is good — particularly if it’s around methane. But just from a CO₂ perspective, the operational emissions are only 15 per cent of the problem. The 85 per cent plus of the problem is the end-use combustion emissions.”

There would be validity to the industry’s argument “if a project somewhere else was then stopped because of this international oil company doing this low operational emissions project — but the reality is that doesn’t happen”.

Carbon Tracker warns that investing in long duration offshore infrastructure increases the risks for investors of stranded assets, which become redundant before their intended economic lifespan due to the energy transition. In turn, this raises the question of whether the industry will pay for the decommissioning costs of platforms and equipment.

Such arguments are rejected by the industry, which says that oil demand will remain strong for decades to come and failure to invest in supply would lead to soaring prices and economic chaos.

Total’s Pouyanné notes that the industry has a decline rate of 4-5 per cent per year, rising to 7-8 per cent for deepwater projects — meaning significant new exploration is needed just to keep production flat.

“People forget that production is diminishing,” he says. “If we don’t invest in new projects . . . [oil prices] would go through the roof and people will complain more. Everybody will be super unhappy.”

He adds: “The criticism is based on the idea that it is black and white — but it is not black and white: we need to continue to invest.”

Graphic illustration and data visualisation by Ian Bott

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

#Offshore #oil #cost