the transformation of British farming

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tens of thousands of British farmers are planning to gather in London on Tuesday to protest changes made to inheritance tax reliefs in the recent Budget, which the sector says will deal a “hammer blow” to family farms.

The reforms to agricultural property relief (APR) and business property relief (BPR) mean farmers and agricultural landowners previously exempt from paying inheritance tax will, from April 2026, be subject to a 20 per cent levy on assets above £1mn.

While the changes to inheritance tax relief have been the key catalyst for the demonstration, they are just one issue in a long list of worries weighing on farmers.

Farmers say the sector is buckling under the pressures of climate change, real cuts to subsidies, high inflation, wafer-thin margins and the prospect of increased competition as the UK strikes post-Brexit trade deals.

What is happening to the number of farming businesses?

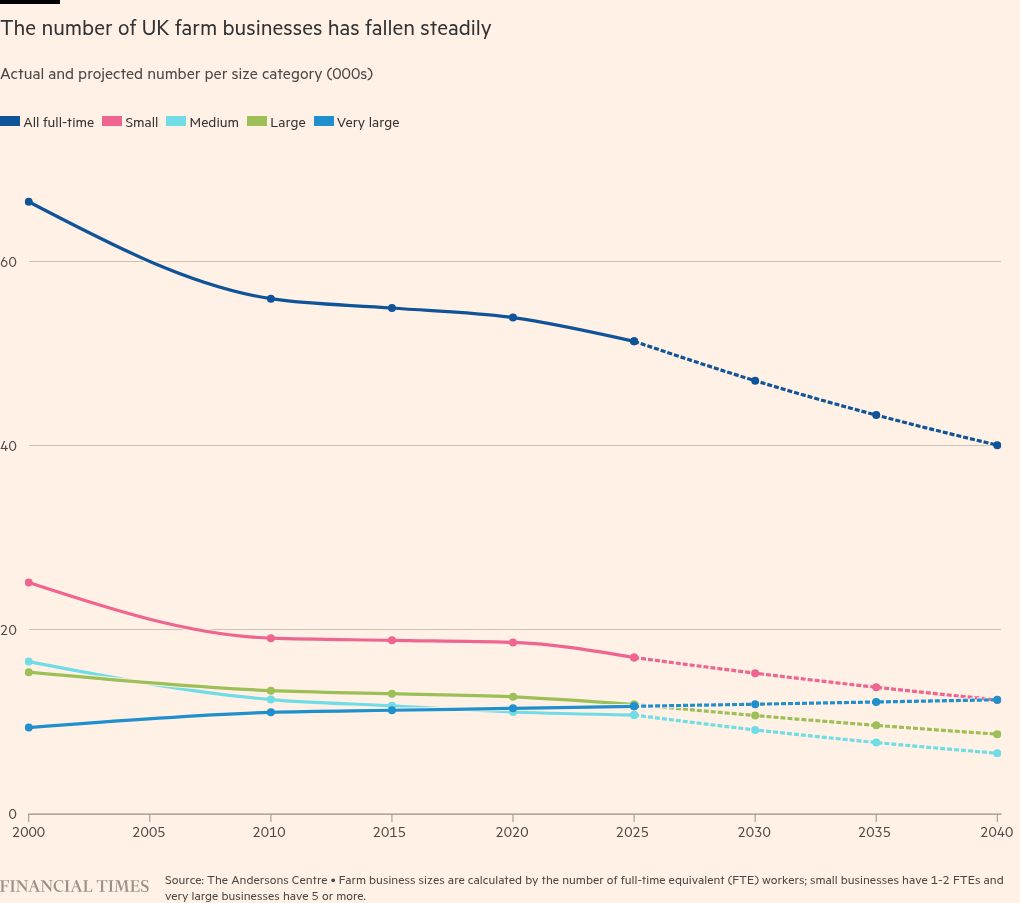

Despite the preferential tax treatment for farmers, which was designed to ensure the continuity of family farms after a farmer’s death, the sector has undergone rapid consolidation.

Fierce competition among retailers has forced down the price paid to farmers for their produce, squeezing their margins, while increasingly volatile weather and the removal of EU subsidies has led to a record number of farm closures in recent years.

The number of farms in the UK is expected to fall 22 per cent by 2040, as small and medium-sized operations that struggle to compete go out of business, according to consultancy the Andersons Centre.

The decline could have serious implications for rural economies, the centre found, which traditionally rely on farming as a source of employment.

How has the relief changed land value?

Farmland values have rocketed as new types of buyers attracted by the APR and BPR exemptions have entered the market.

One of the main reasons for purchasing agricultural has been the inheritance tax relief, according to land agents. Buyers from non-farming backgrounds looking to benefit have driven up demand for land, and with it land prices.

Land values could also normalise if new parcels of land come to the market, according to analysts, as some farmers are forced to sell off land in order to pay death duties.

“A big question now on everyone’s lips is what impact does the reform have on land values?” said Kelly Hewson-Fisher, head of rural research at Savills. “The assumption is that the benefit of investing in land due to the tax reliefs has diminished.”

Why is the number of real farmers buying property falling?

The number of properties acquired by actual farmers has steadily declined in recent decades.

Private and institutional investors and lifestyle buyers — wealthy people who buy rural land for the enjoyment rather than to run commercially — bought half the farms available in 2023, more than twice as much land as farmers, according to land agents Strutt & Parker. Forty per cent of buyers were farmers in 2023, compared with 60 per cent in 2014.

Agents said that while the previous tax regime was one of the main attractions for buying UK farmland, even after the Budget changes it was still more favourable than other asset classes, and still attractive as a hedge against inflation.

What has happened to farmers’ incomes?

Farm income is falling as the government phases out direct farming subsidies. Since the UK left the EU the sector has been transitioning away from the bloc’s Common Agricultural Policy to a new scheme that rewards farmers for improving the natural environment and biodiversity, as well as reducing emissions, rather than providing them with direct payments.

The direct payments were in the process of being phased out between 2021 and 2027, but in the Budget, Labour announced it was accelerating the wind down period, meaning farmers would see their support cut as much as 79 per cent next year.

Farm income has already fallen dramatically year on year,as a result of the cuts to farm subsidies and volatile weather hitting yields. This month, Defra released data on farm finances in the year to February, revealing that all farm types except for pigs and poultry registered a drop in average income.

Cereal farmers have seen their income fall by 73 per cent while dairy farmer income fell 68 per cent compared with the same period the year before.

How many farms will be affected?

One of the critical areas of disagreement between Labour and farmers since the Budget is over how many farms will be affected by the tax changes.

The Treasury says 73 per cent of previous claims for agricultural property relief fell below £1mn, concluding that the vast majority of farms will be unaffected by the new threshold.

But NFU president Tom Bradshaw has argued that focusing only on previous claims fails to give an accurate picture, as many claiming relief below £1mn are likely to be “private houses in the country with a few acres let out for grazing” as opposed to real farm businesses.

The group points instead to official farm business figures, which show that only 34 per cent of farms are worth less than £1mn. To this, the government counters that most farmers looking to pass on their estate are married, so the relief can be claimed by two spouses on top of their personal allowance, bringing the threshold to nearer £3mn.

Additional reporting Jim Pickard

#transformation #British #farming