The UK’s trustbuster sounds a serious retreat on deal remedies

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Britain’s competition watchdog developed a reputation for ferocity after Brexit gave it a bigger say over large international mergers. That could be set to change. Sarah Cardell, boss of the Competition and Markets Authority (CMA), has promised to consider approving more mergers on the basis of behavioural, rather than structural, remedies — a shift that could amount to a considerable retreat for the regulator.

Dealmakers will be delighted. Despite the CMA’s insistence to the contrary, this looks like a defanging of the watchdog after criticism from politicians and business. Prime Minister Sir Keir Starmer recently told the regulator to prioritise growth, investment and innovation as he vowed to rip out growth-blocking bureaucracy.

That followed last year’s fracas over Microsoft’s $75bn acquisition of video game maker Activision Blizzard. The CMA ended up securing a significant structural change to the deal but only after it came under sustained fire from the companies involved. Call of Duty developer Activision Blizzard accused the UK of being “closed for business” and talked of the UK becoming “Death Valley” for global tech.

The UK watchdog was also awkwardly isolated among its peers in opposing it. That could become a more common predicament if it retains its hard-edged approach. With the US antitrust authorities expected to revise their aggressive approach to trustbusting when president-elect Donald Trump enters the White House next year, a sceptical UK regulator could find itself alone more often.

Still, the British authority has historically been loath to accept behavioural undertakings, such as price caps or investment commitments, in return for merger approval. Its provisional approval of Vodafone’s mobile tie-up with Three if the companies commit to delivering on their £11bn network upgrade plans is an exception. In general, it has preferred structural remedies, such as divestitures, as a clear-cut way of protecting market structure.

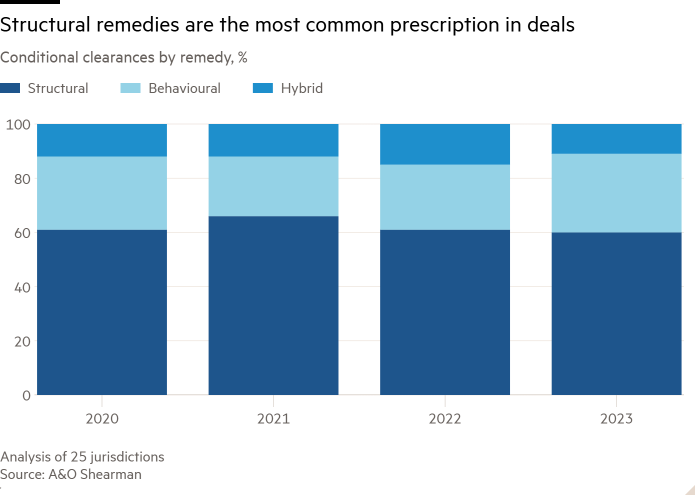

Structural interventions are still the most common remedy that regulators reach for. Yet they are making growing use of behavioural commitments, particularly in vertical transactions. The proportion of conditional clearances involving them increased by six percentage points to 40 per cent of clearances over two years to 2023, according to law firm A & O Shearman.

The CMA insists its commitment to strong antitrust enforcement is unwavering. Perhaps. But behavioural measures were previously dismissed as inadequate sticking plasters for deals that hurt competition and should not have been approved in the first place. Such remedies can draw authorities into a frustrating game of whack-a-mole. They are hard to police, can distort the market and are often time-limited. A change of approach, however welcome to business, may not be in the interests of consumers in the long run.

#UKs #trustbuster #sounds #retreat #deal #remedies