UK government borrowing for October exceeds forecasts at £17.4bn

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The UK government borrowed more than expected in October, according to official data that highlights the challenges facing chancellor Rachel Reeves in her efforts to stabilise the public finances.

Borrowing — the difference between public sector spending and income — was £17.4bn last month. That was £1.6bn more than in October 2023, and the second-highest October level since monthly records began in 1993, data from the Office for National Statistics showed on Thursday.

The figure was also higher than the £12.3bn forecast by economists polled by Reuters.

In the first seven months of the fiscal year, borrowing was £96.6bn. That was £1.1bn more than the same period the previous year and the third-highest since monthly records began.

Alex Kerr, economist at Capital Economics, said that October’s “disappointing” public finances figures “underline the fiscal challenge that the chancellor still faces, despite the big increases in spending and taxes announced in the Budget”.

“And while the chancellor has downplayed the chances of further tax-raising measures, if she wants to increase day-to-day spending in future years, she may need to raise taxes to pay for it,” he added.

These are the first figures published since the autumn Budget in which Reeves delivered large increases in spending, tax and borrowing with a pledge to “begin a decade of national renewal” and “fix the foundations” of the UK economy.

Darren Jones, chief secretary to the Treasury, said the recent Budget aimed to put “public finances on a sustainable footing to rebuild the country”.

He added: “This government will never play fast and loose with the public finances. Our new robust fiscal rules will deliver stability by getting debt down while prioritising investment to deliver growth.”

Since the Budget, the chancellor has indicated that she has no plans to raise taxes further or borrow more than she announced in October, even if tax revenues fall short of current projections.

Jessica Barnaby, ONS deputy director for public sector finances, said: “Despite the cut in the main rates of national insurance earlier in 2024, total receipts rose on last year. However, with spending on public services, benefits and debt interest costs all up on last year, expenditure rose faster than revenue overall.”

Public sector receipts, largely taxes, were up £3.3bn from last year, boosted by the strength of wage growth.

However, public sector spending was up by £4.8bn following an increase in payments for public services, benefits and debt interest. Government debt interest payments hit £9.1bn, £0.5bn more than in October 2023 and the highest October figure since monthly records began in January 1997.

In the Budget, the chancellor pledged to bring the current budget into surplus in three years.

However, the ONS reported that the current budget deficit — borrowing to fund day-to-day public sector activities — was £12.7bn in October, £0.4bn more than in October 2023.

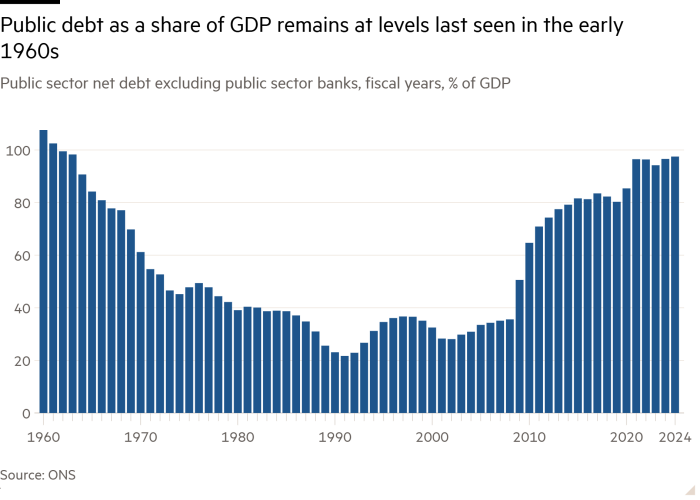

Public debt, or borrowing accumulated over time, was 97.5 per cent of GDP, remaining at levels last seen in the early 1960s.

#government #borrowing #October #exceeds #forecasts #17.4bn