The global green transition will survive Trump

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Whatever Donald Trump’s victory might be good for, the planet’s atmosphere is not it. True, his economics team is still being selected, and more or less anything could emerge from the maelstrom of personalities and ideologies. Joe Biden’s Inflation Reduction Act, by concentrating spending in Republican states, was designed to be politically sacrosanct. Still, the incoming president has said he will kill at least the subsidy for electric vehicles, if not more of Biden’s green spending.

Howard Lutnick, announced on Tuesday as the nominee for commerce secretary with additional control over the US trade representative’s office, has described climate change as a concern of the elitist rich, a category in which the Wall Street chief executive oddly seems not to include himself.

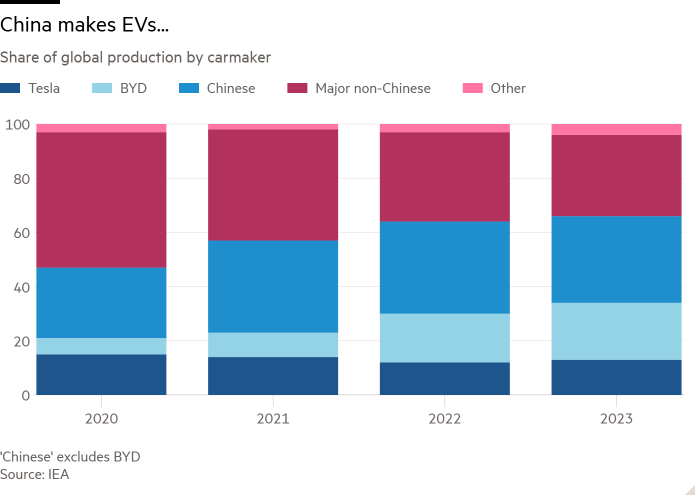

The US turning its back on a technology would once have dealt its global adoption and prominence in world trade a serious blow. This time it’s different. Thanks to the persistent strain of climate change denial in American politics and the short-sightedness of some of its industries, the US is well behind China as the biggest global producer (and consumer) of green tech.

Instead, the Trump administration’s biggest blow to green investment outside the US might well be the collateral damage from a high interest rate environment.

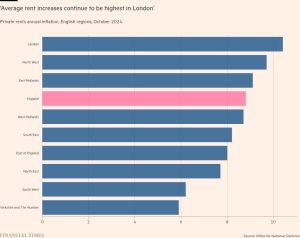

The disappearance of the US as a buyer and producer of EVs, for example, will not kill the global market. America has been a slow adopter: EVs were only 10 per cent of the US car market in 2023 compared with nearly 40 per cent in China. Under Biden’s policy of building up domestic production behind high tariff walls while excluding Chinese software, America was already heading towards becoming an isolated high-price low-tech island.

China’s dominance, often in consumption as well as production, and aided by massive state support, was established in earlier generations of green technology: solar, wind power, batteries. The International Energy Agency says China has more than 80 per cent share in all stages of the solar power supply chain. Even for advanced economies which want to compete with China, the choice is often between becoming a mass adopter with cheap Chinese kit or protecting (or heavily subsidising) more expensive local producers.

For solar panels, for example, China won the battle for dominance of the European market a decade or so ago as the EU soft-pedalled anti-dumping duties to protect its industry. The US, by contrast, made a determined effort to drive Chinese solar panels out of its market. It succeeded, though mainly for the benefit of Vietnamese and other south-east Asian producers, and with lower adoption. The think-tank Bruegel and the consultancy the Rhodium Group estimate that the US is currently investing more than 10 times as much in domestic solar manufacturing as the EU ($2.1bn in the second quarter of 2024 as opposed to $141mn) but still has only around half the installed capacity.

Certainly, for countries wishing to retain some manufacturing capacity, the prospect of Chinese or other low-cost exports being diverted from the US market elsewhere will intensify their competitiveness problem. There will certainly be plenty of cheap kit washing round the world trading system: China’s slowing domestic demand means it is switching back more generally to an export-oriented model.

Climate denialism is on the rise in some parts of the European political right. But it’s nonetheless hard to imagine cheaper Chinese EVs, for example, stopping the green transition rather than encouraging EU governments to capture more of the value-added for their own economies. Viktor Orbán, Hungary’s climate sceptic prime minister, has welcomed BYD building a Hungarian EV plant. In an extraordinary, and some would say humiliating, reversal of traditional practice, the EU is planning to require Chinese battery companies to transfer their technology to European counterparts in return for accepting EU subsidies.

Perhaps more worrying is the effect on already disappointing green investment in low and middle-income countries. Private capital has been slow to fund what look like obvious business opportunities.

Responding to criticism that the World Bank has traditionally been too optimistic about private investors financing green infrastructure in the developing world, Ajay Banga, the bank president, told the FT in an interview recently he fully accepted that past projections of trillions of dollars of spending had been overblown.

But he said there were some countries and sectors where the under-investment was puzzling. “The question is, if solar and wind per unit of electricity are today cheaper than fossil fuel, then why is it that the billions of dollars standing outside the doorways of the middle-income countries not rushing in?” Banga said. The bank is working on a variety of ways to encourage private capital.

In the meantime, high global bond yields over the past two years have deterred renewable energy companies, which had previously experienced benign low interest rate environments, from investing. This, like all of Trump’s potential policies, is in the realm of speculation, but green investment will suffer even more if Trump imposes broad import tariffs and makes big tax cuts and the Federal Reserve responds with higher borrowing costs.

For most governments and companies in the world, green transition issues will mainly remain unchanged: the availability of technology, calculations of costs and benefits, the trade-off between adoption via imports and domestic production. The financing conditions for that investment may not. The US government may not be anchoring the spread of carbon-saving technology, but the dominance of dollar markets will make its influence powerfully felt.

#global #green #transition #survive #Trump