US clean energy thrown into uncertainty ahead of Trump 2.0

This article is an on-site version of our Energy Source newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday and Thursday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning, and welcome back to Energy Source, coming to you from New York, where Indian billionaire Gautam Adani has been charged by federal prosecutors on charges of allegedly bribing Indian officials to secure favourable solar power contracts.

Down in Washington, Marc Rowan has emerged as a top contender to lead Donald Trump’s Treasury department, meeting with the president-elect yesterday in Florida to make his pitch.

Who Trump selects to be his Treasury secretary will have ramifications for the US energy transition and the future of the Inflation Reduction Act, President Joe Biden’s landmark climate law. Because the US funds its renewable energy projects through its tax code, the Treasury plays an outsized role in decarbonising the economy and has been tasked with the implementation of the IRA.

The oil and gas industry have so far been jubilant about Trump’s “wildcatter” approach to picking leaders on energy. The president-elect has named North Dakota governor Doug Burgum as his interior secretary and “energy tsar” and shale executive Chris Wright to lead the energy department.

Today’s Energy Source breaks down the latest figures on how the clean energy economy in the US is shaping up and what their future might look like under a Trump administration.

Thanks for reading,

Amanda

The clean energy landscape ahead of Trump 2.0

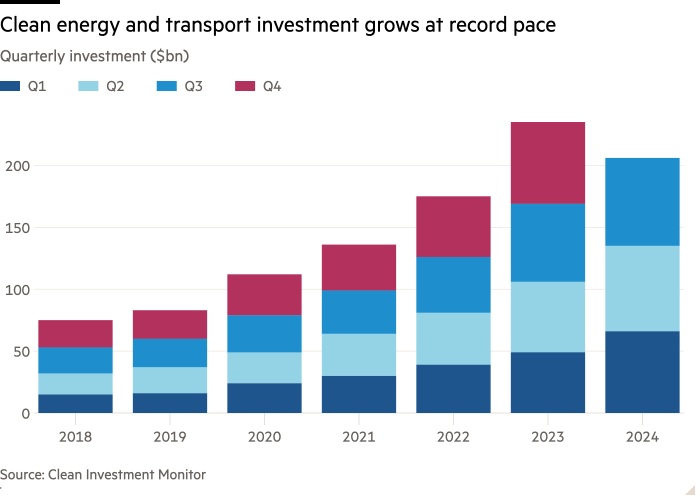

Clean energy and transportation investment across the US is growing at a record pace despite policy uncertainty and tough macroeconomic conditions.

Investors ploughed $71bn into clean energy and transport sectors in the third quarter, a 12 per cent increase year over year, and the highest quarterly investment on record, according to a new update from the Clean Investment Monitor, a partnership between Rhodium Group and the Massachusetts Institute of Technology.

Cumulative clean investment has surpassed $1tn and has nearly doubled since the Inflation Reduction Act, President Joe Biden’s landmark climate law, was enacted in August 2022. The IRA included about $370bn in federal incentives to turbocharge the country’s energy transition and reduce reliance on clean technologies from China.

Suvi Sharma, co-founder of Solarcycle, a US solar panel recycler, told Energy Source that the IRA’s support was a “huge” factor in its decision to build a recycling facility and glass manufacturing project in Georgia, worth $406mn. “I don’t see how we would be building this project without the IRA.”

The latest figures on clean investment arrive as the future of the IRA is up in the air with an incoming Republican government that will control both chambers of Congress and the White House. The IRA passed with no Republican support, and the party has tried 54 times to repeal it, according to Climate Power. Trump vowed to “terminate” the law on the campaign trail.

The loss of the IRA would result in a 17 per cent drop in renewable capacity additions from 2025 to 2035, estimates BloombergNEF. Offshore wind would be the hardest hit in their forecasts, falling 45 per cent. Uncertainty over policy next year has forced developers to hit pause and burn cash on projects.

“The market pipeline is not robust enough . . . it’s just not moving quickly enough to justify a US base quite yet. Under Trump it will push things even further out to the horizon,” said Chelsea Moss, a US representative for Seasight Davits, a Danish offshore wind supplier.

A full repeal of the IRA is unlikely. Republican states have arguably benefited the most from clean investment, with Texas, Georgia and Tennessee among the top five securing dollars since the IRA, according to the Clean Investment Monitor. Since the IRA passed, 78 per cent of all investment, about $190bn, has been funneled to Republican districts.

In August, 18 Republican members of Congress wrote a letter to Republican House Speaker Mike Johnson, urging him to preserve the tax credits, warning a full repeal would be “a worst-case scenario”.

“It’s really easy to be an extremist when you’re not in power. It’s a lot harder when the actions you’re taking are going to affect people’s jobs,” said Jon Powers, co-founder of CleanCapital, a clean energy developer. Uncertainty over policy under the next administration has made it difficult for the company to plan for projects beyond 2026, Powers said.

Clean energy developers and analysts also point to forecasts of surging US electricity demand as evidence that support for clean energy will continue. The push to bring back manufacturing and the proliferation of data centres for artificial intelligence are leading to a historic rise in power demand, with Bain estimating utilities may need to boost annual generation by as much as 26 per cent from 2023 levels.

“One objective that I think everyone shares across the aisles is we want to be the leader in AI, and we’re going to have to work together to do that and try to bring as many resources in the best way possible, in the quickest way possible,” Jim Murphy, president of Invenergy, the largest US private renewables developer, told Energy Source. While Murphy didn’t know if Invenergy’s offshore wind projects would receive final permits under Trump, he said a wholesale repeal of the IRA “is not something we think is practical”.

Solar and wind installations grew during Trump’s first term, increasing 32 per cent and 69 per cent respectively, according to a Raymond James analysis. While Trump rolled back regulations on fossil fuel production, he renewed tax credits for renewable projects and electric vehicles.

The US can’t afford any green energy slowdown. Clean Investment Monitor’s researchers anticipate the US will see only 30 per cent of emissions reductions below 2005 levels by 2030, short of the 40 per cent federal target as cheap gas, high interest rates and permitting challenges make it harder for renewables to compete.

“We are off course,” said Hannah Hess, co-author of the report. (Amanda Chu)

Job moves

-

Northvolt has hired restructuring expert Paul O’Donnell to oversee its Swedish battery plant as the European battery maker descends into crisis, according to Reuters.

-

Adam Schmelzer has joined law firm Stinson as counsel of its energy, environmental, mining and transportation practice division.

-

Houston American Energy has appointed board chair Stephen Hartzell as acting chief financial officer.

-

Pablo Di Si has stepped down as head of Volkswagen’s North America division after only two years in the post. He will be succeeded by Kjell Gruner, a former executive at EV start-up Rivian.

Power Points

Energy Source is written and edited by Jamie Smyth, Myles McCormick, Amanda Chu, Tom Wilson and Malcolm Moore, with support from the FT’s global team of reporters. Reach us at [email protected] and follow us on X at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

#clean #energy #thrown #uncertainty #ahead #Trump