The reunion of BP and Transocean is sending a signal to the oil market

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

There is a feeling of déjà vu about BP’s big new oil project. Not just because the company is returning to the Gulf of Mexico, 15 years after the Deepwater Horizon accident killed 11 people, spilled 5mn barrels of oil and cost the company more than $60bn.

It is also because it is drilling its new Kaskida field, where oil sits about six miles below the surface of the sea at an incredibly high pressure, with the same company that owned Deepwater Horizon: Transocean.

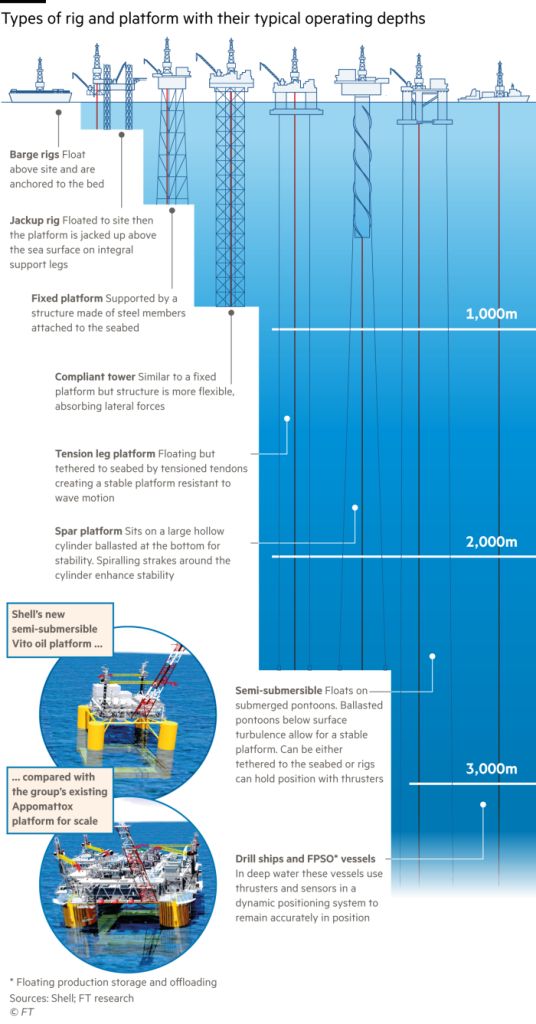

This time around, the drillship is called the Deepwater Atlas. Before you raise your eyebrows at the reunion, BP had little choice; Transocean was the only company with an available drillship capable of handling the high pressure of the oil reservoir.

Indeed BP was forced to pay a high price, roughly $635,000 a day, to secure the Deepwater Atlas, since Transocean’s fleet is almost fully booked. Its chief executive said last month that its rigs are 97 per cent booked for next year and 86 per cent for the first half of 2026. He boasted that the company had a backlog of work worth $9.3bn.

Since the start of 2022, the average day rate for floating oil rigs has risen by more than 40 per cent according to analysts tracking the industry at Rystad, an energy consultancy. Since renting a rig accounts for between 20 per cent and 40 per cent of the cost of developing an oilfield, the rise in prices, combined with rig availability, has implications for how much oil is going to come on to the market over the next few years.

The number of future rig contracts is already falling as companies, fretting over a possible oversupply of oil, exercise restraint in starting new projects. The worries have seen the share prices of some leading rig operators fall nearly 30 per cent in the last year, despite the current boom.

The story of the Deepwater Atlas illustrates the boom and bust of the market. The ship was commissioned from a yard in Singapore in 2014, back when the price of oil was more than $115 a barrel and companies were falling over themselves to find and develop more offshore oil. But almost as soon as work started on the $1bn vessel, the oil market collapsed as Saudi Arabia fought a price war against oil from the US shale patch and Russia.

Contractors quickly learnt how vicious the cycle can be; plenty of oil companies simply walked away from their contracts. How much oil the world would need in the future was increasingly unclear as oil companies diverted some spending to low-carbon projects and the Covid-19 pandemic hit demand and introduced the idea that gas-guzzling commuters might prefer to work from home. Transocean put the Deepwater Atlas deal on ice for years, only taking delivery in 2022.

The supply-demand balance now looks better for the oil rig companies. There has been significant consolidation in the offshore supply chain, plenty of older rigs have been scrapped and few companies are brave enough to place new orders.

And offshore oil is back, particularly in the US, Brazil and Guyana, but also in Africa and Asia. This year, oil companies will spend more than $100bn on offshore projects, rising to nearly $140bn in 2027, according to Rystad. With more deepwater oil being extracted, some analysts are now even expecting a glut of oil to hit the market in the next few years. By the end of the decade, the International Energy Agency thinks there may be as much as 8mn barrels a day of spare capacity, an amount never seen outside of the Covid pandemic.

Much depends on how quickly the demand for oil fades, especially in China, where consumers are switching rapidly to electric cars. But the tightness of the rig market may also point to constraints on supply. Offshore projects take years to develop and often over a decade to break even. If oil prices wane, they get put on ice while oil companies focus on cheaper and easier prospects.

Since April, despite wars in Europe and the Middle East, the price of crude has fallen more than 15 per cent, as traders fret over the Chinese economy. Rystad believes that three-quarters of the offshore projects looked at by oil majors will be approved at a $60 price for crude. Rig owners are also bullish. Transocean says some of its customers have boasted they can make a 20 per cent return even at $40 oil.

But for rig operators to invest in new capacity, and to brave their shareholders’ reticence about capital spending, it will take several years of stable oil prices, as well as an expectation that the world’s oil needs can only be met from offshore drilling. That still looks like a tough call at the moment.

#reunion #Transocean #sending #signal #oil #market