UniCredit’s Orcel is just working the angles on European bank mergers

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

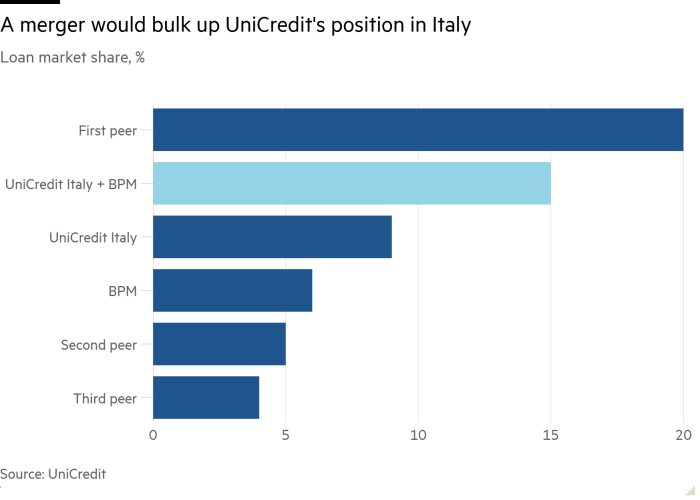

Savvy chess players do not commit to a specific game plan from the get-go. They create options and adjust their strategy as they go along. UniCredit’s chief executive Andrea Orcel shows a similar approach to European bank consolidation. The Italian lender’s €10.1bn offer for domestic rival Banco BPM, closely following its acquisition of a stake in Germany’s Commerzbank, is a lowball approach, unlikely to succeed. But it does give Orcel room for manoeuvre.

Prior to this move, the Italian executive was at risk of getting hemmed in. He parked his tanks on Commerzbank’s lawn by building a stake, but securing all the overt and implicit approvals required to increase that holding has turned into a lengthy business, not least because Orcel will need to sit tight until a new German government is in place.

UniCredit’s approach to BPM suggests Orcel does not want to miss out on opportunities closer to home in the meantime. Earlier this month, the northern Italian lender bought 5 per cent of Monte dei Paschi di Siena from the Italian government. BPM is also in talks to buy asset manager Anima, which itself owns shares in Italy’s oldest bank. Combined, a potential stake of 9 per cent prompted rumours that the two mid-sized banks were headed for a tie-up.

Monte dei Paschi is not BPM’s only option, either. Crédit Agricole bought 9.2 per cent of the bank in 2022. Given UniCredit’s move on Commerzbank, it is entirely possible that the continent’s major lenders are blowing cobwebs off their own cross-border M&A plans.

UniCredit’s bid for BPM puts a useful spanner in everyone’s works. It will make it harder for the smaller lender to buy or be bought. It also indicates that UniCredit is not wedded to the idea of buying Commerzbank, sending a message to the German bank’s recalcitrant board and stakeholders.

The snag is that UniCredit will need to improve its bid if it wants to secure BPM. The current all-share offer is broadly in line with Friday’s closing price. True, BPM’s shares have run up of late on the Anima deal and MPS deal speculation. But this just highlights that it has alternative ways to create value.

In theory at least, UniCredit has room to do better. Inclusive of Anima, BPM is forecast to make €1.6bn of net income by 2026 according to Andrea Lisi at Equita. That, plus €800mn of post-tax annual cost savings and revenue enhancements would provide UniCredit with an extra €2.4bn of net income by 2026, for a 20 per cent return on its outlay.

That sort of maths only holds if UniCredit’s shareholders support Orcel’s strategy. Given the uncertainty around his plans, that is by no means a given. UniCredit’s 5 per cent stock decline on Monday points to the work he needs to do to keep them onside.

#UniCredits #Orcel #working #angles #European #bank #mergers