Prepare for extra traffic at US ports

Stay informed with free updates

Simply sign up to the US trade myFT Digest — delivered directly to your inbox.

It could be a good year to order your Christmas presents early, especially if they’re manufactured overseas.

Government Goldman Sachs says it expects a pick-up in US imports this year, as companies respond to the prospect of tariffs next year:

Anecdotes suggest that companies are already front-loading imports . . . and port traffic in China has increased since the US election.

Such stockpiling should have a negligible effect on GDP, however, since the import boost should be offset by inventory increases.

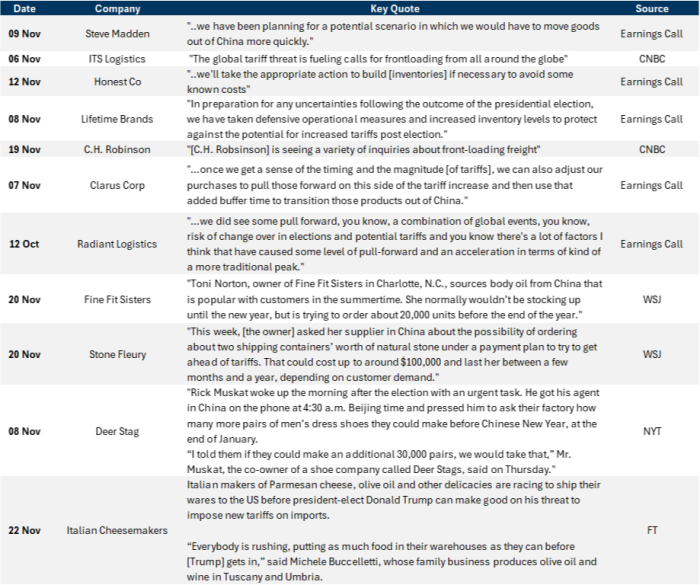

The word “anecdote” is usually a reason for scepticism, but the bank lists public comments from corporate management teams, which usually count as company disclosures:

And GS’s economists found that companies did front-load their imports during the last US-waged trade war, based on an analysis of product-level data:

These anecdotes of import front-loading align with empirical evidence from the last trade war. Using product-level data on US imports from China, we estimate that each 1pp increase in the effective tariff rate boosted US imports by 1.7% in the month prior to implementation . . .

More evidence in chart form:

This means that ports could be, uh . . . busy between now and the inauguration, or whenever the incoming Trump Administration imposes tariffs. Last time the administration exempted goods that were already in transit from tariffs, which could further encourage front-loading. With our emphasis:

Under our baseline assumptions for a 3.4pp increase in the overall tariff rate, these estimates imply a 5-6% boost to US imports in the next few months.

Furthermore, we see risks that the stockpiling boost to imports could be a bit larger and/or more prolonged given the sizeable lead time between now and inauguration, particularly if the Trump administration follows precedent and exempts goods already in transit.

Early evidence from China also points to a boost to US imports, as port traffic increased sharply since the US election.

GS also has a “Trade Policy Uncertainty” index, which it calls TPU, based on the number of Bloomberg articles (¯\_(ツ)_/¯) with “trade-related words like ‘tariff’ and uncertainty-related words like ‘risk’”.

The economists found that capex fell after an increase in trade policy uncertainty, but that most of the response happened within a quarter:

It could be a stretch to compare the last US-waged trade war — one that genuinely came as a surprise — to today, when it’s widely expected.

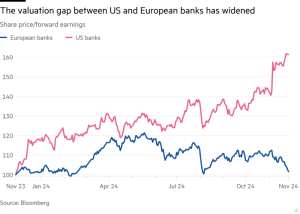

The most important issue is whether it affects capex and investment. GS expects Europe to bear the brunt of any capex slowdown from trade-policy uncertainty:

Our updated statistical estimates of the timing of the drag from trade policy uncertainty combined with the rise in TPU indices thus far suggests a sizeable drag on Euro area growth in 2025H1 but only a modest drag on US activity, with the larger drag in Europe reflecting both a larger rise in TPU and greater investment sensitivity (itself reflecting a large export-focused manufacturing GDP share). These patterns are consistent with our country teams’ forecasts that trade uncertainty (in addition to ongoing structural headwinds) will drive below-consensus Euro area growth in 2025 (0.8% GS vs. 1.2% Bloomberg consensus) but provide only a small headwind to US activity.

Trade uncertainty, structural headwinds, TPUs, etc . . . None of these bodes particularly well for the Euro area.

#Prepare #extra #traffic #ports