Why the broken telecoms sector could be upwardly mobile

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It takes a brave soul to call a recovery in European telecoms. Yet there are a few, tentative signs that the struggling sector may be ringing in the changes.

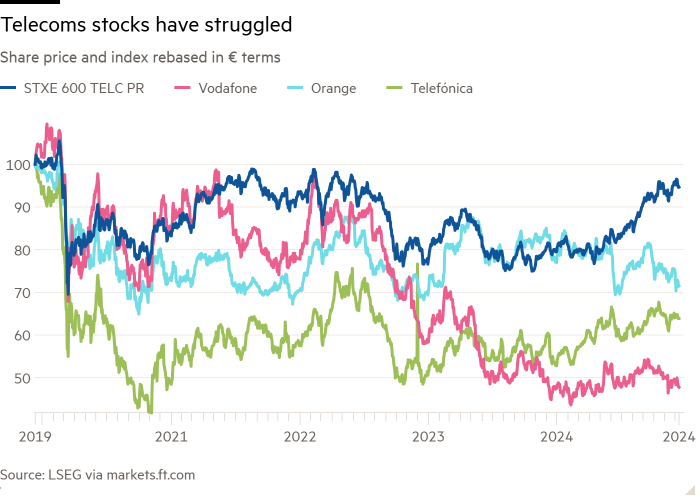

Providers of mobile telecoms services have long been stuck in a value trap. Vodafone and its ilk need to keep investing in networks as the technology progresses. But intense competition has squashed revenues and prevented many of them from making a decent return. Attempts to solve this problem by merging have not helped, mainly because antitrust authorities have imposed onerous remedies designed to favour new entrants. As a result, despite the rise in 2024, the European Telecoms Stoxx 600 index is down 6 per cent over the past five years.

Recently, however, there have been a few positive signals. The UK’s Competition and Markets Authority approved Vodafone’s merger with Three UK without imposing the feared “structural” remedies — aka major asset sales. That’s good news for Vodafone itself. It expects to cut £700mn between costs and investments, which will allow the combined group’s return on capital to rise from the ashes to something approaching its cost, thinks Karen Egan at Enders Analysis.

More broadly, the CMA’s decision suggests something may have shifted in the minds of competition authorities. The regulator, for instance, is going to monitor Vodafone/Three’s commitment to invest £11bn in the network. Encouraging the rollout of 5G may have crept up in the list of priorities. That chimes with some of the language in Mario Draghi’s hefty report on EU competitiveness, which calls on regulators to “focus remedies on commitments to invest . . . rather than partial de-consolidations or the transfer of physical assets”. Operators in markets suffering cut-throat competition — see Italy — will have pricked up their ears at this.

Of course, it is by no means a given that, even where consolidation does not facilitate the arrival of a new entrant, it will actually translate into more benign conditions for telecoms operators.

In the UK, for example, a big chunk of the competitive pressure comes from mobile virtual network operators (MVNOs) such as Sky, whose customer base piggybacks on others’ networks. Spreading revenues from MVNO agreements on essentially a fixed cost base makes a huge difference to operators of physical networks, which fall over themselves to offer low-cost deals. Without market discipline, merger benefits could be partly competed back to consumers.

Yet European telecoms are lowly valued things. Vodafone itself trades at less than 10 times forward earnings, Orange below 9. This reflects a broken market structure. Investors should be on the lookout for signs of repair.

#broken #telecoms #sector #upwardly #mobile