UK urged to tax ‘unhealthy’ food companies to boost national health

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The UK should increase tax on tobacco, alcohol and “unhealthy food companies” to raise £10bn a year by the end of the decade to boost the nation’s health, a leading think-tank has said.

The centre-left Institute for Public Policy Research’s commission on health and prosperity also recommended tighter regulation in areas such as food packaging and gambling advertising, as it proposed enlisting employers, communities, businesses and investors in the effort to improve wellbeing.

Health secretary Wes Streeting said he had engaged closely with the commission’s work and wanted to make the Department of Health and Social Care “a department for economic growth because we won’t build a healthy economy without a healthy society”.

Established three years ago, the commission has been chaired by England’s former chief medical officer, Dame Sally Davies, and surgeon and former Labour peer Lord Ara Darzi, whose report into the state of the NHS last week declared it to be in critical but salvageable condition.

As the government begins to focus on delivering its “health mission”, the commission had provided “a ready made policy vision for a new approach to public health”, Darzi said.

Linking the UK’s health and economic challenges, the commission’s report released on Tuesday found about 900,000 people of working age were missing from the workforce due to sickness, costing the exchequer an estimated £5bn in lost tax receipts a year.

New levies on unhealthy food, tobacco, vapes, gambling and alcohol could raise more than £10bn per year by the end of the decade, “while serving as a powerful incentive for reformulation”, it added.

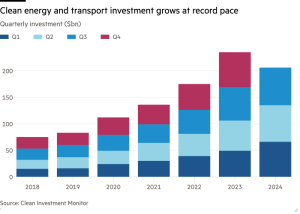

Just as economies are seeking to transition from the use of fossil fuels, industrial policy should support “health vital” industries such as healthy food and agriculture, active transport and the life sciences, the report said.

The number of people with a health condition is expected to rise sharply between 2010 and 2040. The report, published on Tuesday, suggested that improved health could save the NHS £18bn per year by the mid-2030s.

After nearly two decades of stagnant real wage growth, avoiding a preventable long-term condition was “worth up to £2,200 in annual earned income”, it added.

Last week, Prime Minister Sir Keir Starmer made clear that reform would be a precondition for further investment in the NHS.

Calling for an end to the service’s traditional “feast and famine funding model”, the commission said the government should top-load investment “with the firm expectation that NHS spending . . . stops rising as a proportion of total government expenditure”.

Resources would need to shift from hospitals to prevention yet the proportion of the NHS’s budget spent on hospitals had reached the highest level in at least a decade in 2022, accounting for more than half of all UK NHS spending, the report noted.

It argued that the government should enshrine in legislation a goal of adding 10 years to healthy life expectancy over the next 30 years.

The commission also proposed including a “right to try” for anyone on sickness, disability or incapacity benefits, guaranteeing a right to return to the same level of benefit within six months of entering work or training.

It recommend the establishment of health and prosperity improvement (Hapi) zones, with new powers and national investment to rebuild local health infrastructure, such as swimming pools and green spaces, in the most health-deprived areas.

The government should also introduce a wellbeing premium, providing a time limited tax incentive to employers who offer high quality jobs in a supportive work environment, the commission proposed.

#urged #tax #unhealthy #food #companies #boost #national #health