Estée Lauder is in need of a makeover

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Estée Lauder needs a new look. For decades, the maker of MAC cosmetics and La Mer skin care has been a dominant force in the $500bn-a-year global beauty industry. Revenue more than tripled between 2000 and 2022 as shoppers loaded up on its pricey lipsticks, face creams and fragrances.

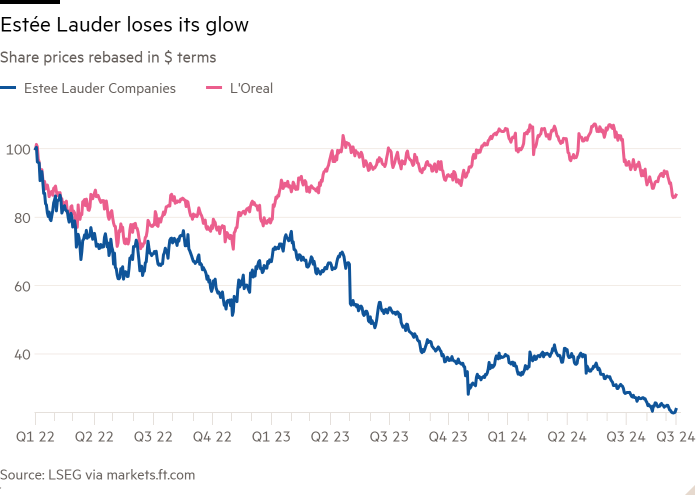

But the company has lost its glow. Sales and profit have fallen in the last two fiscal years. Shares in the US beauty giant are down 76 per cent since the start of 2022. By contrast, French rival L’Oréal has only lost 14 per cent of its value and the S&P 500 has gained 18 per cent during the same period.

The retirement of chief executive Fabrizio Freda, announced last month, offers an opportunity for a reset. Whoever ends up succeeding him will have to turn around key China and North American businesses, revitalise the company’s namesake beauty brand and boost its appeal among younger shoppers — all while navigating the dynamics of the founding Lauder family, which has voting control of the company and occupies four board seats.

Like its middle-aged consumer, Estee Lauder’s earnings need some anti-ageing protection. Sales fell 2 per cent in the fiscal year to June, led by skincare, the biggest division. Net income tumbled 61 per cent to $390mn for the year.

Conditions remain tough. Estee Lauder expects sales growth for the fiscal year to June 2025 to be between a 1 per cent decrease and a 2 per cent increase. As recently as May, the consensus forecast was for a 9 per cent rise, according to S&P Global Market Intelligence.

Estée Lauder is not the only US company struggling to manage the challenge of faltering Chinese consumer spending. But it stands out for its exposure to the country and its reliance on airport boutiques to sell its wares. About 20 per cent of its 2023 sales came from China and another 20 per cent was from travel retail, says Jefferies.

In North America, there is another problem: a good chunk of the company’s sales (around 40 per cent in 2022) still come from department stores. Many of these are struggling with falling foot traffic or are closing down. Selling its wares directly online and via retailers such as Sephora and Ulta helps. But the company also needs to be more savvy in marketing through social media and TikTok influencers.

Its operating margin of 6.2 per cent is less than a third of what L’Oréal made in 2023. Estée Lauder’s new chief executive faces a challenge to pretty the company up.

#Estée #Lauder #makeover