Inflation vs consumption

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. Apple beat expectations, but its stock dipped in after-hours trading. Amazon beat expectations and rose in late trading. The Mag 7 do not follow a single playbook. Email us: [email protected] and [email protected].

Weak inflation, strong consumption

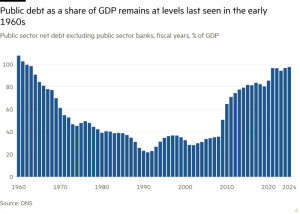

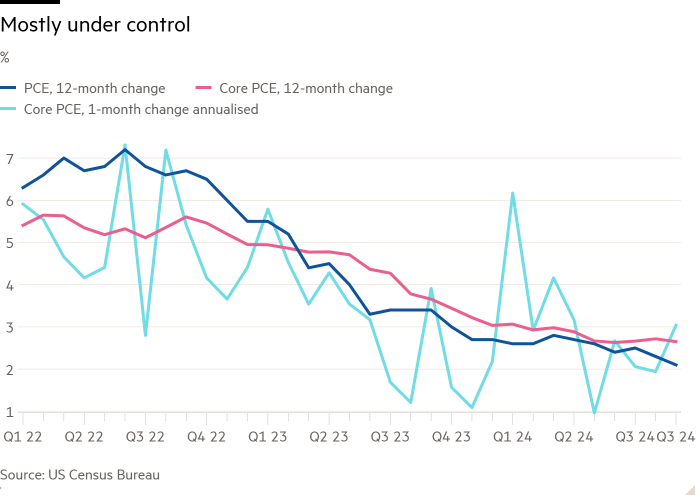

Personal consumption expenditures inflation, the Fed’s preferred measure, rose 2.1 per cent in September from the year before. That’s the best news yet on inflation and makes the Fed’s jumbo rate cut look smarter than its detractors have recently suggested.

The news was not uniformly great, however. Core PCE, which strips out volatile oil and food, was only slightly down, at 2.65 per cent. Annualising the one-month change in the core, it was up for the second month in a row. Inflation is mostly under control, but cheap energy is doing a lot of the work.

At the same time, remarkably, the US consumer shows no signs of slowing. The PCE report showed that disposable personal income continued to grow above trend, and the average personal savings rate was still below the long-run average. Americans have more money in their pockets and they are spending it:

This fits neatly with last week’s GDP numbers, where, again, the story was consumption. Final sales to domestic private purchasers (which strips out trade, inventories and government spending) were up 3.2 per cent, faster than last quarter.

Can slowing inflation and very strong consumer demand coexist? They have so far, but it is going to be a delicate balance. Any exogenous shock could upset the equilibrium.

(Reiter)

Imports

Imports rose unusually quickly in the GDP report. There are several theories about why.

“I suspect that was people getting stuff before dock workers went on strike [in October],” said David Kelly, chief global strategist at JPMorgan Asset Management. In other words, importers pulled demand ahead. Indeed, business inventories rose in July and August. If this is what is going on, imports should normalise next quarter.

But high demand could be playing a role, too. “Consumer spending numbers are really strong, which makes sense as a flow through to imports,” said Claudia Sahm of New Century Advisors. “[Consumption indicators] are a better predictor [of the strength of the economy] than net exports or government spending, which tend to move around from month to month.” Again: normalisation ahead.

Finally, higher imports may be a product of the AI and diet drug booms. Stephen Brown of Capital Economics pointed out to us that “most of [the recent surge in imports] has been driven by computing equipment and pharmaceuticals”, rising to nearly 15 per cent of total imports in July and August. Nvidia chips and Novo Nordisk injections may now be so big that they meaningfully change the shape of US GDP.

(Reiter)

Vistra

On the list of the top 20 stocks in the S&P 500 this year, as measured by total shareholder return, the Magnificent Seven has only one representative. It is Nvidia, the company selling the silicon shovels in the AI gold rush.

But the Mag 7 have, indirectly, elevated three other companies into the top 10: the utilities Vistra, Constellation and NRG. As Big Tech has lit up new data centres to run AI applications, utilities in the right places and with the right business models have fed the centres’ bottomless appetite for power.

Vistra, the top performer in the S&P, is the best positioned of all. It is a merchant power provider, meaning that it sells most of its energy on the open market, so its earnings respond quickly to changing electricity prices. And Vistra is connected to the PJM regional transmission system, a power network covering the area stretching from the mid-Atlantic coast inland to Ohio and western Kentucky. Crucially, PJM covers Virginia, which for a variety of reasons hosts the densest population of data centres in the country (yes, more than California). What this means for Vistra is best expressed in the PJM chart below, showing the results of the system’s last 11 annual power auctions. This year, price per megawatt hour rose as much as tenfold from the year before (LDA stands for local delivery area):

The tricky question is whether Vistra, after its epic year, has gotten ahead of itself as a stock. Wall Street expects free cash flow at the company to rise steadily from 2024 through 2027. If that’s true, then the stock is still very reasonably priced. But that will require power prices to stay high. This seems like a solid bet, given the current pace of data centre construction. But it is not a certainty, for two reasons. One: the AI revolution could fizzle, to a greater or lesser degree. Two: even in the capital-intensive, hyper-regulated world of utilities, supply is elastic. New supply will find a way.

Utilities stocks with tech stock upside have tech stock risks, too.

One good read

Chinese cars.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

#Inflation #consumption