Farmer uproar a consequence of Labour’s high-risk tax pledges

This article is an on-site version of our Inside Politics newsletter. Subscribers can sign up here to get the newsletter delivered every weekday. If you’re not a subscriber, you can still receive the newsletter free for 30 days

Good morning. Farmers descended on Westminster yesterday to protest the government’s changes to inheritance tax. They were addressed by Kemi Badenoch, Ed Davey, Nigel Farage and Jeremy Clarkson.

The reforms mean farmers and agricultural landowners previously exempt from paying inheritance tax will, from April 2026, be subject to a 20 per cent levy on assets above £1mn. How much trouble is the Labour government in?

Inside Politics is edited by Georgina Quach. Read the previous edition of the newsletter here. Please send gossip, thoughts and feedback to [email protected]

Fielding discontent

Given how much I get wrong, you’ll forgive me, I hope, for noting something I got right, which is saying on the day of the Budget that its changes to inheritance tax rules for farms had the potential to become a running sore.

In policy terms, this is a dispute between two figures: that of the government, which argues that in practice, any farmer whose farm is worth less than £3mn will not be hit by the changes, and the National Farmers’ Union, which insists that many more farms will be.

My hunch — and it is no more than that — is that the government’s figures probably underestimate the number of farms that are going to be hit by the changes, but that the NFU is probably overestimating the number. A regular complaint I hear from working farmers (including readers of this newsletter) is that the NFU is, in practice, a union for the richest farmers. But government projections, in my experience, tend to be shaped by the fact that the people with whom it comes into contact the most are often the very poorest and in crisis.

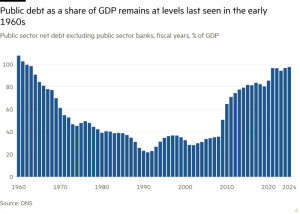

So a lot depends on who is less wrong: the government or the NFU. But in policy terms, the government’s increase in employers’ national insurance is a bigger deal for farms than these changes. The original sin here — at risk of sounding like a stuck record — is the Labour party’s promise not to touch income tax, value added tax or national insurance. That means it has forced itself to increase taxes in ways that come with a heavy risk of unintended consequences.

The Conservative commentator John Oxley, in the last parliament, talked about “rubbish state Tories” (or, at least, he used a word not wholly unlike “rubbish”). When the Tories cut spending, they ended up with a state that did essentially all of the things it did in 2010, but badly. This is because they never wanted to face up to the politically difficult task of working out what the state would do less of.

Labour risks ending up with “slow growth social democracy”, in which the tax rises it chooses are a drag on growth and economic performance. This would be because it was unwilling to confront the politically difficult task of telling people that improvements in public services needed to be funded by broad-based taxes on everybody, rather than selected tax rises on employers, the rich and other groups outside the Labour tent.

Now try this

I was at the Baillie Gifford’s prize for non-fiction last night. (I was a judge in 2018, which means we get invited back until they have to clear us out to make space for more important people: we gave it to Serhii Plokhy’s marvellous book Chernobyl. Polina Ivanova interviewed Plokhy for the Lunch with the FT here.) This year Richard Flanagan, one of my favourite novelists, won for Question 7, essentially a non-fiction treatment of the same subject as his excellent novel The Narrow Road to the Deep North. I would read the novel and then Question 7, personally.

Top stories today

-

Jump in inflation | UK inflation accelerated sharply to 2.3 per cent in October, as higher energy costs pushed price growth above the Bank of England’s target. It’s up from 1.7 per cent in September.

-

‘Misrepresented’ | The UK labour market is in a better state than official data suggests, according to new analysis that finds there has been no surge in the rate of economic inactivity since the pandemic.

-

Swinging by the Gulf | Keir Starmer will travel to Saudi Arabia and the United Arab Emirates next month in a bid to drum up fresh investment for the UK from the oil-rich Gulf, according to people familiar with his plans.

-

‘We want that closer economic partnership’ | The prime minister has refused to publicly condemn the sentencing of 45 pro-democracy activists in Hong Kong for up to a decade in prison. Starmer’s allies say he has made a strategic decision that Britain cannot afford to have a fractious relationship with one of its biggest trading partners.

-

Nice work if you can get it | A quarter of the members of the UK’s House of Lords do two-thirds of the work, and 24 do nothing, Tortoise has found. Its analysis also reveals the taxpayer has covered more than £1.5mn in air travel costs for peers over the last parliament, half of which was claimed by just 14 people.

Recommended newsletters for you

White House Watch — Your essential guide to what the 2024 election means for Washington and the world. Sign up here

One Must-Read — Remarkable journalism you won’t want to miss. Sign up here

#Farmer #uproar #consequence #Labours #highrisk #tax #pledges