South Korean stocks and currency slide after impeachment failure leaves power vacuum

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

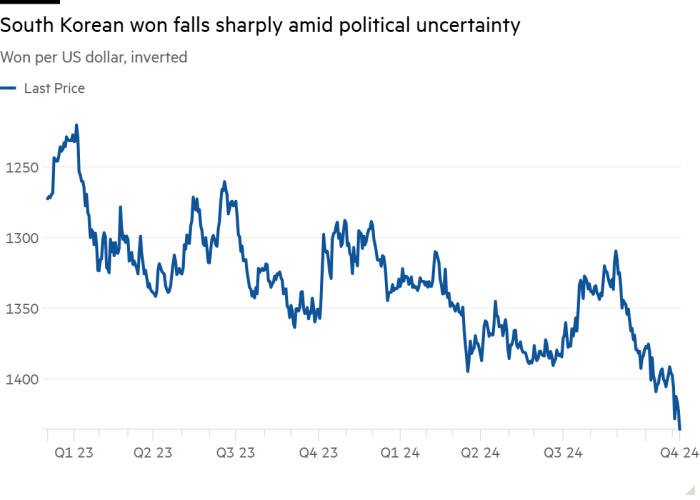

South Korean stocks sank and the currency approached a 15-year low against the dollar on Monday amid fears of a power vacuum at the top of government following President Yoon Suk Yeol’s failed bid to impose martial law last week.

The won weakened 0.8 per cent against the dollar to Won1,435.6, its worst since October 2022, before making a modest recovery. South Korea’s Kospi stock benchmark fell 2.3 per cent to its lowest in more than a year.

Investors and Korean companies are worried about a long period of uncertainty over the position of Yoon, who survived an impeachment bid at the weekend but whose allies say they are seeking his “orderly exit” from the presidency.

“Nobody is clearly in charge,” said Andrew Gilholm, director of analysis for China and Korea at Control Risks, a geopolitical risk consultancy.

Prime Minister Han Duck-soo, a Yoon appointee and career technocrat, announced on Sunday that the president would step back from managing affairs of state, including the conduct of diplomacy, but would remain in his post.

The prime minister and Han Dong-hoon, the leader of Yoon’s conservative People Power party, said they would co-operate on operational matters related to “national governance”. But they have not spelt out how this would work in practice or given any timeline for Yoon’s departure.

Opposition leaders and many analysts argue there is no constitutional basis for the arrangement.

Yoon has accepted the resignation of interior minister Lee Sang-min, suggesting he was continuing to perform at least some of his constitutional duties.

South Korea’s national police agency confirmed on Monday that it was considering imposing a travel ban on the president, who is under investigation on charges of treason and abuse of power over his attempt to impose military rule.

In a note to investors on Monday, analysts at Goldman Sachs said “the most likely scenario appears to be an orderly transition to an early presidential election”. But “more clarity is needed on duration, scope and details of such transitional arrangements”, they said.

In the immediate aftermath of Yoon’s apparent coup attempt, Bank of Korea governor Rhee Chang-yong pledged to provide as much liquidity as necessary to prevent the episode from triggering severe disruption to markets in Asia’s fourth-largest economy.

Park Chong-hoon, head of Korea research at Standard Chartered in Seoul, said investors were “worried but not panicking” and that sell-offs had been driven principally by local retail investors concerned about the country’s political turmoil.

He noted that many foreign institutional investors had already reduced their positions in South Korea following the election of Donald Trump, amid expectations that the president-elect’s protectionist trade policies would harm the east Asian country’s export-oriented economy.

“With Korean stocks already heavily discounted, many investors will be reluctant to sell further given the determination of the Korean financial authorities to weather this event as they did in the case of Covid-19 and impeachment crises in the past,” said Park.

#South #Korean #stocks #currency #slide #impeachment #failure #leaves #power #vacuum