The worsening tit-for-tat trade war between the US and China

This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. The newsletter is taking a short break over the next couple days, but I’ll be back in your inbox on Thursday. Enjoy the holidays!

In today’s newsletter:

-

Washington’s investigates China’s semiconductor sector

-

The best city in the world for mental healthcare

-

US banks’ report bumper profits in 2024

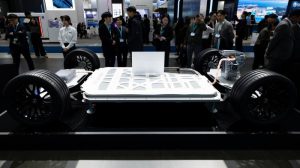

The US has launched an investigation into alleged anti-competitive measures by China to support its semiconductor industry, just weeks before the Biden administration hands over to president-elect Donald Trump.

Washington accused China of using “extensive anti-competitive and non-market means, including setting and pursuing market share targets, to achieve indigenisation and self-sufficiency”.

The probe will be conducted under Section 301 of the US Trade Act, targeting what the US Trade Representative called “foundational” semiconductors — including those used by the automotive, healthcare, infrastructure, aerospace and defence industries.

It marks the latest in a worsening tit-for-tat trade war over semiconductors, sparking fears of serious disruptions to international supply chains. The investigation could result in import restrictions or new tariffs on shipments from China of the kinds of chips used in cars, household appliances and consumer devices. That decision, though, would fall to the Trump administration.

Here’s what officials in Beijing said in response to the announcement.

Here’s what else we’re keeping tabs on today:

-

Reserve Bank of Australia: Minutes from the most recent rate-setting meeting are expected to shed light on how policymakers are weighing geopolitical risk.

-

Japanese outlook: Japan’s central bank will also release its forecast today in minutes from its latest meeting.

-

Moldova’s presidential inauguration: Pro-EU president-elect Maia Sandu will be sworn in. Her narrow victory, despite alleged Russian interference, puts the country on a path to EU membership.

Five more top stories

1. Honda and Nissan have agreed to begin talks that could lead to the biggest domestic merger in Japanese automotive history and create the world’s third-biggest carmaker by sales. Read the details of the agreement.

2. Bangladesh’s interim government has asked India to return exiled former prime minister Sheikh Hasina to face legal proceedings. The diplomatic request will fuel tensions between the two neighbours after a criminal tribunal accused Sheikh Hasina of orchestrating massacres and “crimes against humanity” during August protests that lead to her ousting. Sheikh Hasina has denied the allegations.

3. France’s new prime minister François Bayrou has selected Eric Lombard as finance minister. Lombard, head of state-backed financial group Caisse des Dépôts, will be asked to come up with a tax and spending plan for 2025 that can be approved by France’s raucous hung parliament, while also starting to repair’s the country’s degraded public finances.

4. The UK economy failed to grow in the third quarter. It’s the latest blow to a Labour government already under fire from businesses for its tax-raising Budget. Here’s more on the factors that are constraining the UK economy.

5. Russia is building more than 10 nuclear units abroad as it looks to tap into rising energy demand driven by artificial intelligence and developing markets, according to an envoy of President Vladimir Putin. The plans come as Moscow seeks to boost its global influence by expanding its nuclear fleet. Here are the countries where Russia is constructing new plants.

The Big Read

In the Italian city of Trieste, a community-based approach to mental illness has produced startling results at a relatively low cost. The model contrasts starkly with others that make much greater use of psychiatric institutionalisation. The final instalment of the FT’s series on mental health takes a look at the decades-long debate about the best way to care for people living with mental illness.

We’re also reading . . .

-

FT Investigation: Terra Firma founder Guy Hands has been accused of raging at staff and making sexually inappropriate comments.

-

BlackRock’s $12bn deal: HPS Investment Partners could hardly be more different than its suitor. But BlackRock, the world’s biggest fund manager, was willing to shell out to break into what could be finance’s next battleground.

-

Eye spy: Meta is accelerating its plans to build lightweight headsets in its push for smart glasses to overtake the smartphone.

-

Year in a word: Memecoins are two fingers up to the financial establishment, and not for the cautious or faint of heart, writes markets columnist Katie Martin.

Chart of the day

The four biggest US banks are on course to capture their largest share of the industry’s profits in almost a decade, a sign of how they are consolidating their dominant market position. JPMorgan Chase, Bank of America, Citigroup and Wells Fargo collectively reported about $88bn in profits in the first nine months of 2024, according to an FT review.

Take a break from the news

It’s been a bumpy year for the world’s biggest luxury players, as financial results largely brought bad news. But looking to 2025, analysts are more hopeful. Acting fashion editor Kati Chitrakorn reports on what to expect in luxury in the year ahead, and why we may rediscover the joy of dressing.

#worsening #titfortat #trade #war #China