Singapore Post must move swiftly to rebuild credibility

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

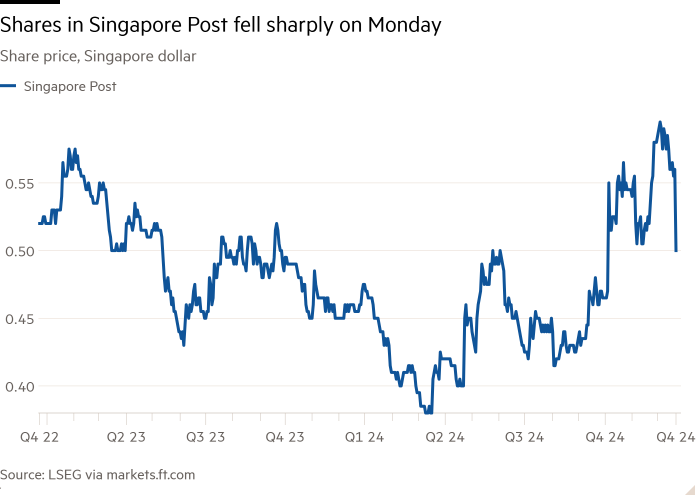

A whistleblowing report has rocked one of Singapore’s oldest companies. Shares of Singapore Post, founded in 1819, fell 11 per cent on Monday after its chief executive and several other senior leaders were fired over a scandal linked to parcel deliveries. The reputational hit comes at difficult time for one of the oldest postal groups in the world.

The whistleblowing report alleged that some employees had either approved or manually updated a “delivery failure” status code for parcels, even though no delivery was made. The alleged intention was to avoid contractual penalties with one of Singapore Post’s largest customers. Singapore Post began investigations after receiving the report. The senior leaders were fired over their handling of the report. Several have already said they will contest the termination of their employment.

The timing is unfortunate. Shares of Singapore Post had already been on a downward trend, losing nearly two-thirds since early 2018. Operating margins have more than halved over the past five years, from nearly 14 per cent in the year to March 2019 to just 5 per cent in its last fiscal year, reflecting growing competition in the local market.

Singapore Post, which offers a wide range of services, from domestic and international postal delivery to ecommerce logistics, has long faced stiff competition from established global logistics groups such as DHL, UPS and FedEx as well as regional competitors such as Lalamove, Grab Express, J&T Express and Ninja Van.

More recently, Singapore’s logistics sector has been undergoing significant transformation, driven by tech start-ups leveraging the latest innovations. Tech-enabled courier services are offering same-day delivery at lower prices by adjusting delivery prices based on demand. Robots are being used for automated picking, packing, and sorting. Start-ups have also been testing drones and autonomous vehicles for deliveries.

Meanwhile, the broader sector outlook remains subdued. Singapore’s mature logistics sector means opportunities for growth are limited compared with regional peers, with annualised growth expected to remain at about 3 per cent in the next five years.

Neighbouring countries, such as Malaysia and Indonesia, have been investing heavily in logistics infrastructure, attracting business away from Singapore. These neighbours also have larger domestic markets — Indonesia’s population, for example, is about 47 times larger than that of Singapore.

All of that means trust and a reputation for reliability are emerging as critical differentiators for logistics companies in the competitive market. Even after Monday’s plunge, shares of Singapore Post trade at 19 times forward earnings, a significant premium to global peers. Maintaining that premium will depend on its ability to rebuild credibility with both its customers and investors.

#Singapore #Post #move #swiftly #rebuild #credibility