It’s high time to make Russia pay

This article is an on-site version of Free Lunch newsletter. Premium subscribers can sign up here to get the newsletter delivered every Thursday and Sunday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Kaja Kallas, the EU’s new foreign policy chief, has called for the west to seize Russian central bank reserves for Ukraine’s benefit. That is something her own bloc and its allies have so far resisted. Instead, these days G7 countries are pushing their “extraordinary revenue acceleration” loans for Ukraine over the line, with the US Treasury announcing on Tuesday that it had disbursed its share. This will make good on the G7 promise in June to provide Kyiv with $50bn of financing on the back of future profits from blocked Russian foreign exchange reserves.

In the summer, I warned that we should not be impressed by this deal — and now that the details are known, I remain unimpressed. It is high time to follow Kallas’s lead and make use of the reserves themselves.

The UK parliament has a concise explanation of the scheme in the briefing paper that comes with the legislation needed for the UK’s participation. It has been presented as finally making use of Russia’s blocked foreign exchange reserves for Ukraine’s benefit — the loan is designed to be serviced by profits arising at European securities clearing houses where Moscow’s reserves are parked, principally Belgium’s Euroclear — and as another show of united support by western countries. But now that the scheme is ready, it is important to bust some myths that the politicians behind the scheme have been all too happy to allow to take hold.

First, it does not make Russia pay. On the contrary, the entire scheme is designed to maximise the amounts that can be provided to Ukraine without actually touching Moscow’s immobilised central bank reserves themselves — only the profits Euroclear makes by storing them. So this came about as a way to avoid making Russia pay. For a while, it looked like the US would require at least a commitment from the EU to keep those reserves under lock and key for longer than the current six-monthly sanctions renewals, but Washington gave up on that demand in return for a higher interest rate on its portion. Russia is in no worse position concerning its reserves than it was before June, in other words.

Second, the arrangement also avoids making western taxpayers sacrifice anything. While Ukraine’s G7 backers are borrowing money in the market, they are passing that on to Kyiv as another loan. The European Commission makes perfectly clear in its guide to the credit “waterfall structure” in the arrangement that the Ukrainian state is on the hook for. If sanctions are lifted and Moscow regains access to its reserves, or Russia fails to pay sufficient reparations, Kyiv would stand to be bankrupted by this supposed generosity.

In fact, the arrangement finances Ukraine with money it was going to get anyway. The EU had already imposed a levy on Euroclear’s Russia-related profits, which would pay for Ukrainian weapons and budget support on a continuing basis as the profits arose. The ERA loan essentially front-loads that money, leaving future profits already spent.

Given Ukraine’s desperate need for more resources, that may be better than the alternative but it is hardly an act of altruism. But the money will not last very long and soon Ukraine’s remaining friends (presumably without the US under a returned President Donald Trump) will have to go through the same process of finding money all over again. The Kiel Institute’s Ukraine Support tracker shows that external aid for Ukraine since the full-scale invasion amounts to more than €230bn, or about €80bn per year. So the newly committed $50bn will at best cover Ukraine’s needs for seven months.

Even that will only involve the drip-drip rate of funding that has done little more than keep the country from financially drowning. A recent policy note by Olga Pindyuk, at the Vienna Institute for International Economic Studies, demonstrates the inadequacy of the current rate of external financing and shows the strong case for front-loading even more funding: it would improve both Ukraine’s military prospects and its economic growth and ability to fund more of its needs itself. This should be of great interest to the leaders now trying to put Ukraine and Europe in a good position ahead of the anticipated turn in international diplomacy once Trump is back in the White House. Trump himself advocates “peace through strength” — of which financial strength is a big part.

We should add that Ukraine’s defeat would be much more expensive to its friends than it would be to bankroll a better chance at victory. Another piece of research from the Kiel Institute estimates that Germany would lose 10 to 20 times more money from not supporting Ukraine than it at present spends to help the country. In other words, it is cheaper to front-load greater investments in Ukraine’s prospects now.

All this is why I think the debate over seizing the Russian reserves outright will return sooner or later. I had expected European leaders, in the event of a Trump election victory, to fast-track their thinking about other sources of aid for Ukraine when the US is likely to withdraw its support and European countries themselves are facing growing demands on their public purses. So far that hasn’t happened. But there are stirrings of a willingness to cut into frozen assets to compensate for Euroclear-managed assets being confiscated in or by Russia.

So this debate is clearly not dead. My assessment is that the legal part of it has largely played itself out: there are arguments to serve whatever political decision is made. A good overview is provided by Professor Philippa Webb’s report for the European parliament in February, which analyses options for seizing Russia’s foreign exchange reserves and assesses the risk of breaking with international law. Its clear conclusion is that there are ample routes with low legal risk.

Conversely, my impression is that the thinking inside councils of state is more centred on the political, economic and financial repercussions.

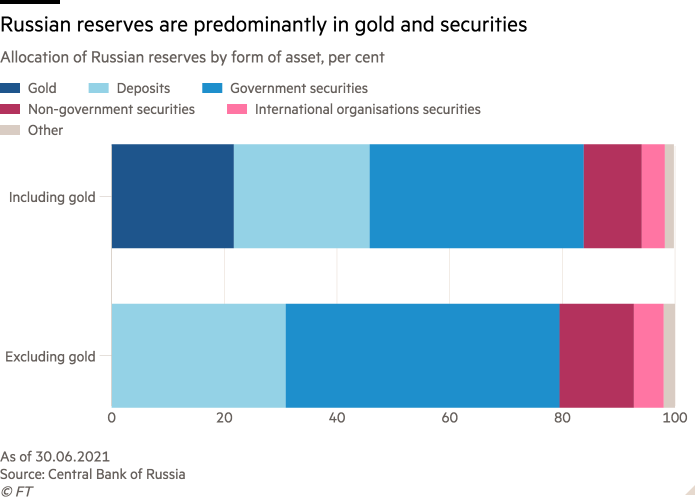

On the economic side of things, an important evolution has been taking place without receiving due attention. When the west blocked access to Moscow’s foreign exchange reserves, these were largely in the form of securities (about two-thirds according to the Russian central bank itself; the rest is in bank deposits), mostly highly creditworthy government bonds.

Over time, most of these securities have matured: at Euroclear, this is the case for €176bn of a reported initial total of €191bn. This has three important implications. First, the nature of Moscow’s assets has changed. What used to be claims on top-rated advanced economy governments (ie sovereign bonds) are now claims on the AA-rated Belgian bank Euroclear Bank (ie a gargantuan uninsured bank deposit).

Second, Euroclear Bank now holds a huge pile of cash on its balance sheets, a good €60bn worth in other currencies than euros (mostly sterling and Canadian and US dollars), exposing it to the home jurisdictions of those currencies should they decide to treat this cash as tainted.

And, third, the regulatory and contractual rules governing these assets have changed: from the bond contract and securities laws under which they were written to Belgian and EU bank regulations.

This opens up new possibilities for transferring Russia’s reserves to Ukraine. These have not been contemplated but could be. One is if Washington, Ottawa or London decided to break with EU recalcitrance, and treated the relevant amounts of Euroclear deposits in their jurisdictions as Moscow’s money and moved to confiscate it. Another is if European authorities used prudential banking regulation to split out the Russia-related part of Euroclear Bank’s balance sheet into a separate banking entity, which could then be bought out and directed to invest its assets in Ukraine, as I have described before. That would in effect make Russia pay for its destruction without ever changing its title to its reserves (which was not possible with securities holdings).

Why would western authorities not do this? The most powerful voice against making Russia pay in any of these ways is the European Central Bank, which fears the financial repercussions. This is not an arbitrary fear. Saudi Arabia and China have reportedly told the French government they would dump its bonds should Paris move towards central bank reserves confiscation. And by far the most thorough analysis of the economic effects of seizing central bank assets is a working paper by four ECB researchers. While theirs is not an official ECB view, no doubt the underlying research has helped inform the central bank’s opposition to seizure.

That paper is well worth reading, including for its list of historical not-quite precedents. It estimates that confiscating another country’s central bank reserves would significantly raise the funding cost of the confiscating government, a warning that should be taken seriously. But I think it makes three mistakes along the way. One is that it does not consider the route that has opened up, now that Moscow’s reserves consist of bank deposits, of making Russia make good on its debts to Ukraine without forcibly stripping it of title (ie confiscating).

Another is that it erroneously draws a difference between the blocking or immobilisation that has already happened, and an outright seizure, since “a seizure is modelled as a permanent loss, unlike a freeze which is modelled as a temporary loss”. But all the calls for seizing Moscow’s blocked reserves propose that these should be set off against its future compensation payments to Kyiv. The paper’s distinction only makes sense on the premise that Russia will somehow be allowed to wriggle out of paying for the destruction it has wrought.

Finally — back to the real-world threats that have been issued — the central bank itself is in a position to remedy some of these possible repercussions. If Paris is worried about an attack on its sovereign debt for political reasons — this echoes the scary days in 2011 when it looked for a few days like French government bonds might go the way of Spain’s or Italy’s — the ECB now has instruments designed to address precisely a spike in bond yields for non-economic reasons. It would behove the ECB to make clear that it stands ready to counter a politically motivated speculative attack on any Eurozone country’s sovereign’s debt. If the EU is to be a strategic actor on the world stage, not being intimidated is the way to proceed.

Other readables

Recommended newsletters for you

Chris Giles on Central Banks — Your essential guide to money, interest rates, inflation and what central banks are thinking. Sign up here

India Business Briefing — The Indian professional’s must-read on business and policy in the world’s fastest-growing large economy. Sign up here

#high #time #Russia #pay