What to expect in luxury in 2025

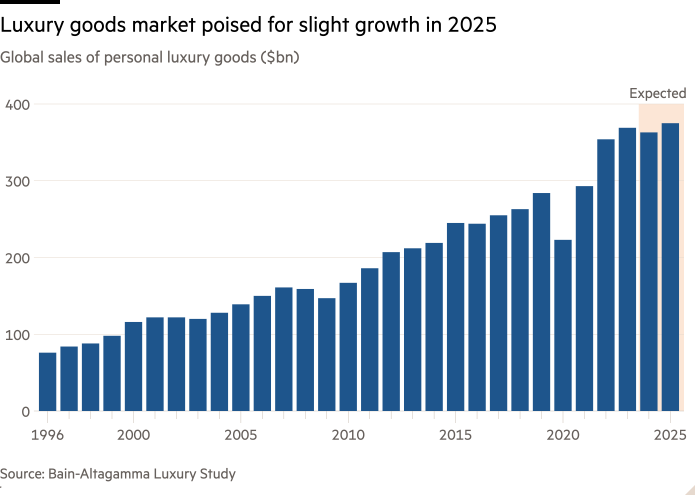

This year the financial results from the world’s biggest luxury players have largely brought bad news, their shine dimmed by a sector-wide slowdown following a multiyear sales boom during Covid-19. For the first time since 2008, excluding the year of the pandemic, global sales of personal luxury goods are poised to fall by 2 per cent, to €363bn, according to Bain & Company.

“As wealthy customers showed more resilience, brands focused their efforts on marketing activity and dedicated experiences for this [demographic],” observes Claudia D’Arpizio, a partner at Bain & Company, who leads its luxury goods vertical. “It created some growth at the top of the pyramid but there was a strong decline across the rest of the customer base, with 50mn pulling back.”

Geopolitical risks posed by elections (more than 60 countries headed to the polls in 2024) and conflicts also had an impact on consumer confidence. Online retailers shut up shop (Matchesfashion) or restructured under new owners (Farfetch and Coupang; Yoox Net-a-Porter and Mytheresa), while companies with lagging profits sought to consolidate (Saks Fifth Avenue’s owner HBC acquired Neiman Marcus in a $2.65bn deal; Tapestry and Capri’s merger fell apart after months battling antitrust regulators in court).

Looking to 2025, luxury analysts are hopeful that the sector will see slight improvements, even if sales growth remains low. Achim Berg, an independent luxury adviser and former senior partner and leader of McKinsey & Company’s luxury practice, where he worked for 24 years, believes that recovery could be driven by macro-environmental shifts, such as regulatory changes under new governments or certain conflicts coming to an end. He notes that a degree of optimism is necessary, and any prospect of a further decline in luxury would be “uncomfortable”.

“Stability always helps consumption,” agrees D’Arpizio.

Luxury prices will get a reality check

Luxury goods in Europe have seen significant post-pandemic price increases of at least 52 per cent since 2019, according to HSBC, as brands sought to maintain margins amid rising production and material costs, while also citing inflation and the balancing out of regional price disparities.

That’s proved to be a cautionary tale for brands including Burberry and Mulberry, which are now charting a new course under new bosses, having both been marred by profit warnings and dwindling sales following ill-timed moves upmarket. Hermès, on the other hand, is one of the few big players that has weathered the storm. Its solid growth demonstrates that the rich are still willing to spend if they see value in what is being offered.

Unlike previous years where some luxury sales growth has been driven by price inflation, there is a sobering expectation that from 2025 they will be driven by sales volume. “The industry got pricing wrong in the last couple of seasons and will have to do some corrections on that,” notes Berg.

Brands will be held accountable

For many people, prices for luxury goods have always been absurdly high. And while companies will continue to find ways to maximise profit, one area they won’t be able to compromise on is the environmental, social and governance aspects, as supply chains come under increased scrutiny.

Recent investigations into the alleged exploitation of workers in the supply chains of luxury brands including Dior, Armani and Loro Piana are damaging for the image-conscious sector, which is able to maintain its cachet by promoting the idea that its products, typically crafted by artisans in France or Italy, are inherently of the highest standards — in contrast to fast fashion.

Many groups such as Chanel and Only The Brave, owner of Maison Margiela and Diesel, have invested in buying their suppliers and bringing them in-house. Ethical and social responsibility cannot be overlooked, says D’Arpizio. “The reputational impact of mistakes in the supply chain is too high and can create boycotting and big revenue loss.”

A jolt of creativity is needed

One recurring complaint among editors is that fashion, of late, has felt a bit “blah”. As brands seek to mitigate risk, many have taken a conservative path, focusing on their iconic pieces or offering commercially viable and subtle styles (in a bid to reach shoppers looking to invest in more classic, timeless products). Yet, while it is natural to find comfort in the familiar, clinging to old ways can hinder innovation and creativity.

Re-editions and remakes of popular products have contributed, in part, to growth in the second-hand market (which is no bad thing); D’Arpizio observes that “the same bags, shoes and clothes” can be found in both new and secondary channels. Meanwhile, younger generations are also consuming in ways that feel “more respectful to the environment”.

Big changes in luxury’s creative leadership could help to renew excitement. Chanel, Bottega Veneta, Givenchy, Tom Ford, Celine, Lanvin and Calvin Klein are among the labels with new designers set to make debuts. Fendi, Margiela, Helmut Lang and Carven, which are without a creative director, will need to fill those slots. And there are still question marks around whether Dior, Loewe and Gucci will make new appointments or continue forward with their current designers.

People will rediscover the joy of dressing

After a period of “stealth wealth” dressing, in which people adopted a more classic, pared-back (borderline basic) look, and following the unavoidable influence of algorithms on social media platforms such as TikTok, which meant that the same trends were adopted on a global scale, Net-a-Porter and Mr Porter’s fashion director Kay Barron is hopeful for a return to personal style in which “character and individuality comes to the forefront”.

For Barron, the rise of “quiet luxury” offered people an opportunity to reset and form the building blocks of their wardrobe — “our customers are always looking for items that have longevity,” she says — but the re-emergence of romanticism in fashion, seen via Chloé, Margiela and Valentino, will give way to “subtle statement dressing”, which involves “tailoring an outfit and making it more personal”. In short, getting dressed will be fun once again.

Middle-market brands — and customers — have new appeal

A finite number of ultra wealthy individuals will require brands to fine-tune their strategies. In September, Valentino’s CEO Jacopo Venturini shared that he was focused on expanding product categories to “complete the wardrobe of our clients”. Elevation, however, remains top of mind; Venturini terminated the sub-label Red Valentino at the start of the year.

For brands, the big question is whether they want to serve customers from the middle class, which is growing in some countries at a fast clip; more than 300mn potential new customers from this segment will emerge over the next 10 years from regions including India, Mexico, south-east Asia and Africa, Bain predicts.

Contemporary brands with a strong value proposition will also regain appeal with shoppers who appreciate unique, innovative designs at a fair price point. This is demonstrated by brands with engaged communities, such as Toteme, Aimé Leon Dore and Studio Nicholson, which have been expanding internationally (and giving overseas competitors a run for their money).

No quick fixes in China

As China’s economic slowdown and a crackdown on displays of wealth takes its toll, Japan has emerged as a bright spot for high-end spending due to a weak currency combined with a resurgent wave of Chinese tourists. (LVMH, the world’s largest luxury group, is among those riding that wave.)

Whether the good times will last remains to be seen, as brands will probably adjust their prices to avoid regional disparity, warns D’Arpizio. But China (where luxury consumption has not yet recovered to pre-pandemic levels) will remain key because of its growing middle class: 150mn new aspirational shoppers are expected to emerge from China over the next decade, she says.

It’s why Moncler’s chief executive Remo Ruffini has been keeping his foot on the gas: in October, the Italian skiwear brand took its Genius project to Shanghai, marking the first time the annual blockbuster spectacle-event took place outside of its home market, Europe. To succeed in China, a sophisticated strategy is required for a market that has evolved and matured.

More consolidation, fewer exits

As the luxury sector hits an inflection point, there will be no easy way out. “We’ve seen exceptional growth for 15 years,” says Berg. “Valuations for companies have come down a bit, but they’re still high. Margins and profits are also high.” But for companies looking to safely steer forward, it may require structural changes, such as the offloading of underperforming assets.

Despite recent lower interest rates and the pick-up of private equity activity in other sectors, there have not been significant deals in luxury and fashion — and these are unlikely in the following year, says Berg. “The IPO markets haven’t recovered,” he adds, though he does predict more consolidation and a much-needed overcorrection across the industry in the months ahead. What’s for certain, he says, is that “2025 is not going to be a boring year.”

Follow us on Instagram and sign up for Fashion Matters, your weekly newsletter about the fashion industry

#expect #luxury