Corporate Britain cools on Labour

When she arrived in the City of London on Thursday evening, chancellor Rachel Reeves was on a rescue mission.

Labour’s relations with business, carefully nurtured over years of breakfast meetings in the run-up to July’s election, had soured after last month’s tax-raising Budget.

Mingling in the champagne reception ahead of the Mansion House address, one executive who supported the party publicly before the election complained they had been “shit” since taking office.

The government needed to do a much better job of explaining its policies, another industry leader added.

The mood was in stark contrast with a drinks reception in the Downing Street rose garden held shortly after Labour’s election victory, where executives toasted an era of political stability and the party’s pledge to “partner” with the corporate world.

That optimism has been tested by workers’ rights reforms that will cost businesses up to £5bn a year and a Budget that raised the minimum wage and increased employers’ national insurance payments — though smaller businesses were partly protected.

“I’m not sure they understand business at all,” bemoaned one City grandee, who said ministers no longer seem to be listening to them.

“There’s . . . a strong feeling amongst the business leaders I speak with that policy is being done to business rather than designed with them,” said CBI boss Rain Newton-Smith.

In her speech to City executives on Thursday, Reeves insisted that restoring “stability” to the public finances had been a necessary first step to underpin growth and investment.

Her backing of deregulation in areas such as bankers’ pay and the oversight of senior managers were well received in the room.

Similarly, the speech’s flagship policy of consolidating small pension schemes into “megafunds” to try to turbo-charge investment was welcomed by financial services companies.

It followed a decision in the Budget not to impose a full 45p tax rate on private equity bosses’ bonuses as previously threatened, another move cheered in the City.

But these City-friendly measures have not convinced businesses in other sectors that the government has shown it can fulfil its “mission” of kick-starting economic growth.

“The narrative around growth was somewhat missing”, analysts at Boston Consulting Group wrote to clients after the Budget, adding the measures amounted to fiscal tinkering rather than “economic strategy”.

Meanwhile, many businesses have been left nursing what the CBI calls a “triple whammy” of higher costs.

“The cumulative effect of all these changes is too much for industry to bear in the sense of them being able to get on and invest and grow,” said Andrew Higginson, the chair of retailer JD Sports, in a BBC interview this week.

Higginson’s intervention was notable because he was the only current chair or chief executive of a FTSE 100 company to sign a public letter supporting Labour before the election.

“The firms we represent have been left scratching their heads to see how growth will be possible if their costs are rising,” said Alex Veitch, director of policy at the British Chambers of Commerce.

The BCC’s relations with the government “remain good . . . but our discussions are increasingly dominated by frustration from our membership about the spiralling costs businesses are now facing”, he said.

The chair of one of the UK’s biggest employers said “you have to have a lot of faith” to believe the government’s plans will deliver the growth it has promised.

Official growth forecasts do not include the potential effect of planned reforms, such as the streamlining of the planning system, which ministers hope will speed up investment and spur growth. The government has also promised a full industrial strategy in the new year.

Disquiet has been building since Labour took power.

In September, the chair of one of the FTSE’s most valuable companies told the Financial Times the party’s strategy seemed to be “to prioritise growth and at the same time undermine all the levers of growth”.

Many meetings since the election have lacked substance, businesses say, with ministers “broadcasting” at them during the party’s annual conference in Liverpool in September and at its international investment summit in London in October.

Starmer’s pledge at the summit to “rip up” bureaucracy to boost investment by businesses was well received. But several executives said there was a lack of detail.

A UK executive at one multinational said his company’s boss had flown to the summit but left unimpressed: nobody from government spoke to him all day and officials’ only focus seemed to be fishing for planned company investments they could announce at the end of the event. Some £63bn of projects were unveiled at the summit.

At a private lunch in the City on the eve of the Budget, more than a dozen company directors lamented the party’s failure to prepare for government, the long wait between the election and the Budget and what they saw as ministers’ failure to truly take on board businesses’ views.

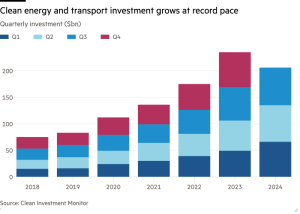

After its first four months in office, the warmest reception for the party’s policies have come from sectors set to benefit directly, such as energy or infrastructure groups.

Claudio Descalzi, chief executive Italian energy producer Eni, which has invested in a carbon capture and storage project in the UK, praised the government. He said its £22bn commitment for carbon capture and hydrogen projects and “its swiftness in defining regulatory frameworks and in authorising projects” were “clear evidence of how governments and industry can work together”.

A person close to the business secretary Jonathan Reynolds insisted the government was listening to companies. “Parts of the Budget that could have been worse for business were softened to take into account concerns they had raised,” the person said.

“Ministers worked hard to build up goodwill with business with extensive engagement before the election. They may be using up some of that capital now but that goodwill at least means the door is still open.”

The government said Reeves and Reynolds have held “constructive meetings with hundreds of business leaders representing companies of all sizes and sectors across the UK”, and that the government “has worked in partnership with business from day one to deliver its number one mission of growing the economy”.

Some business groups have avoided being overly critical of the government but have warned officials privately that they will only do so for so long if they believe they are not being heeded, said one lobbyist.

Kate Nicholls, chief executive of industry group UKHospitality, said business engagement with Labour had not broken down but that the relationship was different now that the party was in power.

The industry is one of the hardest hit by employment cost rises in the Budget.

“You’ve got the promise of sunlit uplands in a year or 18 months’ time, when reform kicks in, when the economy starts to improve,” Nicholls said. “But in the meantime, you’ve got a world of pain to navigate.”

Additional reporting by Malcolm Moore and Peter Foster

#Corporate #Britain #cools #Labour