BP has only scratched the surface in solving its identity crisis

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Companies often make statements they later wish they could erase. Take BP. Four years ago it declared that the “attractive” returns from offshore wind power would endure “for decades to come”. Now it seems the European oil major cannot eat its words fast enough.

On Monday, BP said it was putting its offshore wind assets into a jointly-owned business with Japan’s biggest power generation company Jera. Its British rival Shell has also said it will not initiate any new offshore wind schemes, as the sector struggles to recover from a crisis that has ravaged returns.

Embarrassing as the retreat may be, for BP the move is a good first step in tackling an identity crisis that has been building since 2020, when former chief executive Bernard Looney set out a grand energy transition plan.

First and foremost, the move eases concerns about how much capital expenditure BP will have to commit to offshore wind during the remainder of the decade.

Investors had been braced for that number to reach one-third of BP’s $30bn renewables and hydrogen capex budget over that time. But BP will contribute a maximum of $3.25bn in capex to the joint business. Given its spend in 2023 and 2024 on offshore wind has been under $2bn, its overall outlay will be some $5bn lighter than investors had feared.

Another attraction is that the joint business — which will own a more appealing mix of assets than BP did alone — would be in effect pre-packaged for a sale if and when the renewables market improves. Italy’s Eni has already had some success in selling stakes in its energy transition “satellite businesses” at attractive valuations.

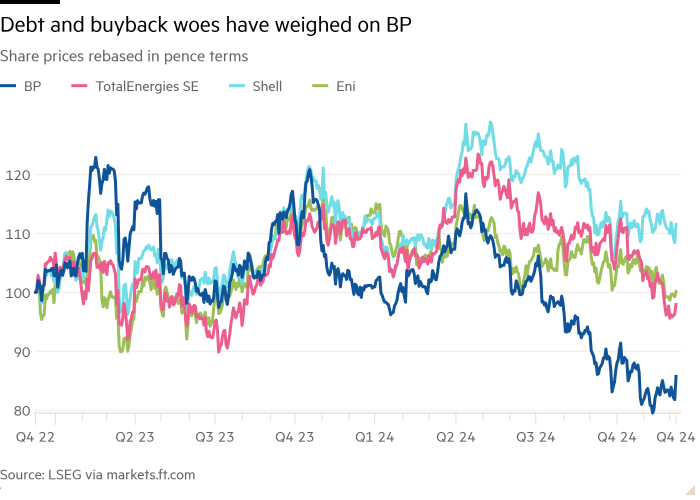

But for BP’s current CEO Murray Auchincloss, this only scratches the surface. Investors remain fixated on BP’s borrowings — unsurprisingly, since it is expected to end the year as the most highly indebted European oil major — and the extent to which it can sustain share buybacks.

In February, BP promised share repurchases of “at least” $14bn across 2024 and 2025. But Brent crude has fallen in price by 8.5 per cent year-to-date, casting severe doubt over whether the remaining $7bn of buybacks are possible next year. Bank of America analyst Christopher Kuplent expects Auchincloss to unveil a “comprehensive re-set” at BP’s annual results in February, with share buybacks even dropping to zero.

Four years ago, BP might have hoped its strategy would go down in corporate history as a blueprint for navigating the energy transition. Instead, it’ll be lucky if in years to come no one can remember it.

#scratched #surface #solving #identity #crisis