A guide to 2025 investment outlooks by someone who hasn’t read them

What is investment research for? Here are a few possible answers.

-

It generates investment ideas

-

It sets or contributes to the setting of consensus expectations

-

It gives employees of a bank or asset manager something to talk to clients about, and vice versa

-

It is an introductory calling card for analysts and strategists

-

It offers investment advisers something to talk about with their clients

-

It disseminates the same trading idea among groups of investors, so works a little like a pump-and-dump

-

It gives investors a scapegoat for when trades go wrong

-

It is marketing

Year-ahead previews don’t fit well in any of these categories. Their themes are by necessity approximate and sweepy. The forecasts they contain are informational rather than instructive, focusing on things like global GDP. Predictions are clipped into a calendar year, which adds difficulty not value. Final drafts tend to be sent to the editors in October, so any recommendations are even more stale and backward-looking than regular sellside. What little actionable advice they offer is out of date by January 2.

That leaves marketing, but yearly outlooks are not even good for promotion. Far too many reports drop in the fourth quarter for any message to cut through. Content is too samey for broker-client matchmaking. Any idea they might encourage in a reader will probably be one they already have. Confirmation bias makes them more similar to horoscopes than conventional investment research.

The good news is that whichever year-ahead bias a reader wants confirmed, they’re sure to find it somewhere. Goldman Sachs has published 46 outlook notes for 2025, alongside ten summary presentations and a half-hour podcast. Bank of America has 50 individual reports. Morgan Stanley’s 2025 outlook landing page has 76 reports, nine summary presentations and a video explainer.

Have we read all of these? Absolutely not. Have we read enough to provide an overview of their contents? Again, no.

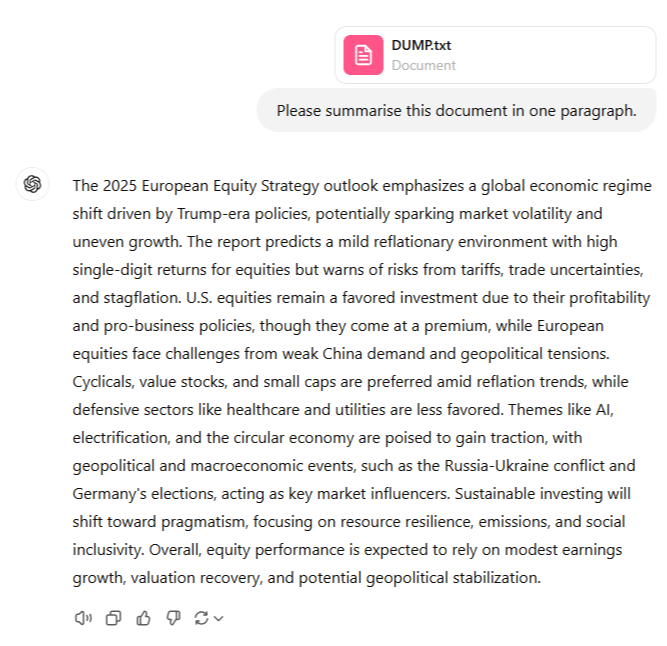

Have we put some reports into a big file and fed it to ChatGPT? Yes. That’s exactly what we’ve done.

Did ChatGPT approximate a decent summary while making a mess of the specifics? Yes.

You know immediately that these forecasts are wrong because they’re interesting. US hyperinflation and a 70 per cent drop for the S&P 500 are not consensus expectations. Here (based on a non-scientific scrape of available outlook notes) are what are:

(Click through for the detailed forecast tables from JPMorgan, Morgan Stanley, UBS, Deutsche Bank, BofA and Goldman. Barclays, SocGen and BNP Paribas are also in the sample but didn’t provide neat tables.)

Quite a few of those forecasts owe something to mean reversion, though an 8.4 per cent gain for the S&P 500 from its current level is a bit below the average annual performance:

Caution is no surprise after back-to-back 20 per cent-plus annual gains for US stocks. US equity valuations look stretched by any measure. But common logic dictates that stock markets only fall in response to rate hikes or a recession, and neither is considered likely in the next 12 months. Whatever problems are being stored up, they’re for the next guy.

That means . . . say the line, Bart!

The best time for stock pickers in 25 years.

(SocGen)

We expect a more ample opportunity set for stock pickers next year as the Fed eases policy amidst still resilient growth, tight labor markets, and record household wealth. This, coupled with the policy agenda uncertainty, should help broaden equity leadership with high dispersion across the market.

(JPMorgan)

Sector return dispersion is elevated, even more so than it was after Trump’s first Presidential election win. Dispersion could stay high if equities follow Trump 1.0’s road map as a reaction to policy shifts from the outgoing administration, making it more of a stock (and sector) picker’s market.

(Barclays)

Europe is a stock picker’s market: Since our recent downgrade of European equities to neutral, a question we have been getting from some investors is ‘why spend time on the region considering the likely continued underperformance vs the US?’ Our answer, backed with a high degree of conviction, is the material scope for alpha generation under the surface of EU equities’ headline performance.

(Morgan Stanley)

To find out why next year will be another for the stock pickers, we’d need to read the research, which we’d rather not. Presumably, it’s all to do with thematics (meaning AI), US exceptionalism (meaning tax cuts). and pockets of secular earnings growth (meaning AI and tax cuts). Trump’s mandate of reflation and deregulation holds promise for certain sectors, so long as investors can accept the volatility that comes with government by brainfart. And while tariffs complicate everything, the consensus expectation for dollar strength and steady or falling oil prices can help keep inflation in check.

We can guess all this without looking at the notes because strategists have been writing it for months.

Add in the detail that US equities have been unusually uncorrelated of late. Presuming it’ll continue that way, SocGen is keen on the S&P Equal Weight, along with America-first domestics, small caps and deregulation plays like financials and crypto exchanges:

Europe? Bad but cheap. “We see a tactical opportunity in Europe”, says Exane BNP Paribas, which is just another way of saying it’ll be a stockpicker’s market. Its suggested picks include European exporters that price in tariff tape bombs and technology stocks that have lagged the Nasdaq.

Japan? Stockpicker’s market. Here’s Goldman:

We expect TOPIX to deliver a third consecutive year of positive returns in 2025. Moreover, for fundamental stock-pickers, a focus on compelling top-down investment themes in sectors where there is clear bottom-up dispersion in terms of growth outlook, valuations, and/or shareholder engagement momentum should continue to create solid alpha opportunities.

As we said at the top, this kind of stuff makes most sense as marketing. The problem is that it’s badly targeted marketing. Reams of reports end up in the wrong places, such as the author’s inbox, while being kept from anyone with an appetite for top-down portfolio strategy.

That’s why we put a selection of 2025 outlooks in a shared Google Drive. (Access is by request only, so it’s a bit like The Long Room. Just tell us you’re an investment professional and we’ll probably let you in.)

FTAV usually does a free-to-air round-up of year-ahead reports in early January. In the meantime, please let us know if you spot anything interesting in the reports provided above, since it saves us the bother of reading them.

Further reading

— All those 2023 economics and markets outlooks, distilled (FTAV)

— No one knows anything (Rupak Ghose)

#guide #investment #outlooks #hasnt #read