Going private will not cure Walgreens’ ailments

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Walgreens Boots Alliance is in sore need of a remedy for its slumping business. Rival retailers, from Amazon at one end and dollar stores at the other, have chipped away at front-of-the-store sales of household and beauty items.

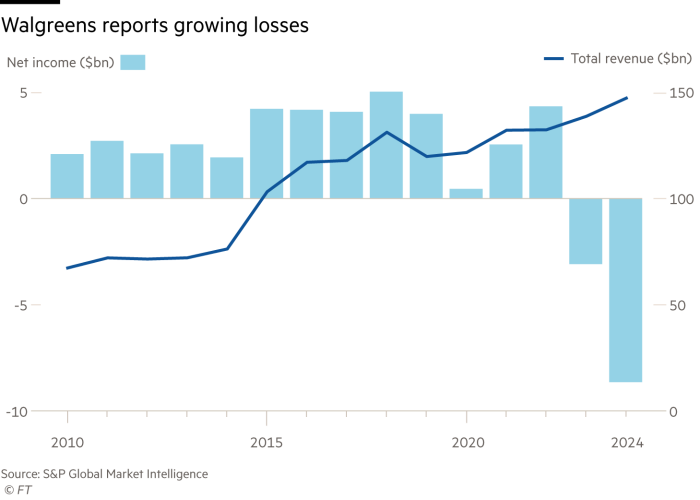

At the same time, prescription drug margins are being squeezed by falling reimbursement rates and cheaper generics. Add to this billions of dollars of opioid liabilities and a pricey attempt to move into primary care that backfired spectacularly, the result was a near $9bn in net loss for the 2024 fiscal year.

All that explains why the company is in talks to sell itself to private equity firm Sycamore Partners. Yet private ownership may not be the panacea for all of Walgreens’ corporate ills.

On paper, Walgreens, which also owns the Boots chain in the UK, makes for a tempting target. The last time the company was in take-private talks was in 2019. Back then it had a market value of about $55bn. These days it is worth just $10bn — even after accounting for Tuesday’s 18 per cent share price jump. Assume another 20-30 per cent premium on top of this and that would still value the equity at less than $13bn.

That said, any deal would not be plain sailing. For starters, given Walgreen’s debt pile and depressed cash flow, levering the company’s balance sheet to fund the acquisition could present a challenge. The company has $6.4bn of net debt. This does not include the $27.6bn of operating lease obligations. The current lease-adjusted net debt ratio to adjusted Ebitdar ratio is around 3.6 times, according to Morgan Stanley. That is against the $363mn in negative free cash flows Walgreens reported in fiscal 2024. S&P reckons Walgreens has about $4.6bn of debt due to mature over the next two years.

Giving Boots the boot would be one obvious way to raise cash. Walgreens tried to offload the UK drugstore chain back in 2022. But the sale process was abandoned after the upheaval in credit markets resulted in bids that were below its initial expectations. There is no guarantee buyers will be lining up this time around either.

Stefano Pessina, Walgreens’ chairman and its largest shareholder, is the wildcard. The Italian businessman is no stranger to private equity, having teamed up with KKR in 2007 to take Alliance Boots private. However, it is not clear if Pessina is working with Sycamore this time around or another rival take private offer.

While going private would enable Walgreens to be restructured away from the glare of quarterly earnings, the same conditions that have decimated Walgreens’ market cap persist. Across the US, pharmacies large and small are fighting for survival. Walgreens needs to stem the losses at its nascent healthcare ventures and find a way to grow its retail drugstore business again. There are no miracle cures for its ailments.

#private #cure #Walgreens #ailments